GST on Clothes – An Overview

The clothing and textile sector, being a major part of the Indian economy, is covered under GST with specific rates depending on their type and value. The GST regime classifies garments based on their retail sale price, and whether they are branded or unbranded, finished or unfinished. Clothing items are taxed to balance affordability for consumers and revenue for the government.

In this article, we focus on the latest GST rates for FY 2025-26 which will be applicable from 22nd September 2025.

GST Rates on Clothes until 21st September 2025

GST on clothes is applied based on the retail price of the garment. As of FY 2025-26 until 21st September, the key rates are:

- 5% GST: On garments and apparels priced up to INR 1,000 per piece.

- 12% GST: On garments priced above INR 1,000 per piece.

These rates apply to both branded and unbranded clothing. The distinction helps ensure essential and affordable wear is taxed at a lower rate, while premium apparel attracts a higher rate.

GST Rates Based on Value of Clothing w.e.f. 22nd September 2025

The GST structure for clothing is primarily value-based. Here’s how it works:

| Category | Clothing Value | Applicable GST Rate | Purpose/Remarks |

| Low-value clothing | Up to ₹2,500 per piece | 5% | To keep basic and essential wear affordable |

| High-value clothing | Above ₹2,500 per piece | 18% | Applies to mid-range and premium garments |

This classification ensures a fair tax burden and maintains accessibility to essential clothing items while generating higher revenue from luxury apparel.

GST on Different Types of Clothing (Fabric-wise & Use-wise)

GST rates can also vary slightly based on the type of fabric or intended use, as follows:

| Item | HSN | Condition | Old Rates | New Rates |

| Articles of apparel & clothing accessories, knitted/crocheted | 61 | Sale value ≤ ₹2,500 per piece | 5% | 5% (no rate change; only value definition clarified) |

| Articles of apparel & clothing accessories, not knitted/crocheted | 62 | Sale value ≤ ₹2,500 per piece | 5% | 5% (no rate change; only value definition clarified) |

| Other made-up textile articles (excl. 63053200, 63053300, 6309) | 63 | Sale value ≤ ₹2,500 per piece | 5% | 5% (no rate change; only value definition clarified) |

| Cotton quilts | 9404 | Sale value ≤ ₹2,500 per piece | 5% | 5% (no rate change; only value definition clarified) |

| Articles of apparel & clothing accessories, knitted/crocheted | 61 | Sale value > ₹2,500 per piece | 12% | 18% |

| Articles of apparel & clothing accessories, not knitted/crocheted | 62 | Sale value > ₹2,500 per piece | 12% | 18% |

| Other made-up textile articles (excluding 6309; worn clothing/rags excluded) | 63 | Sale value > ₹2,500 per piece | 12% | 18% |

| Cotton quilts | 9404 | Sale value > ₹2,500 per piece | 12% | 18% |

| Products wholly made of quilted textile material | 9404 | Sale value > ₹2,500 per piece | 12% | 18% |

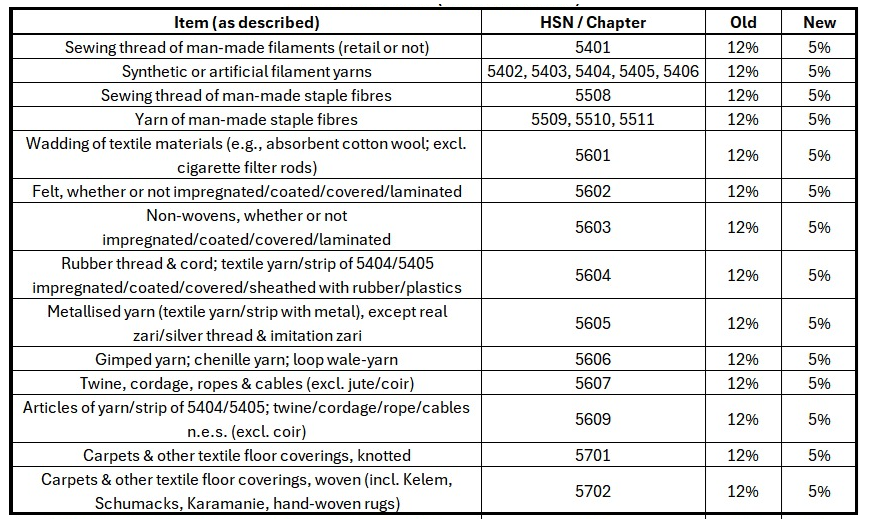

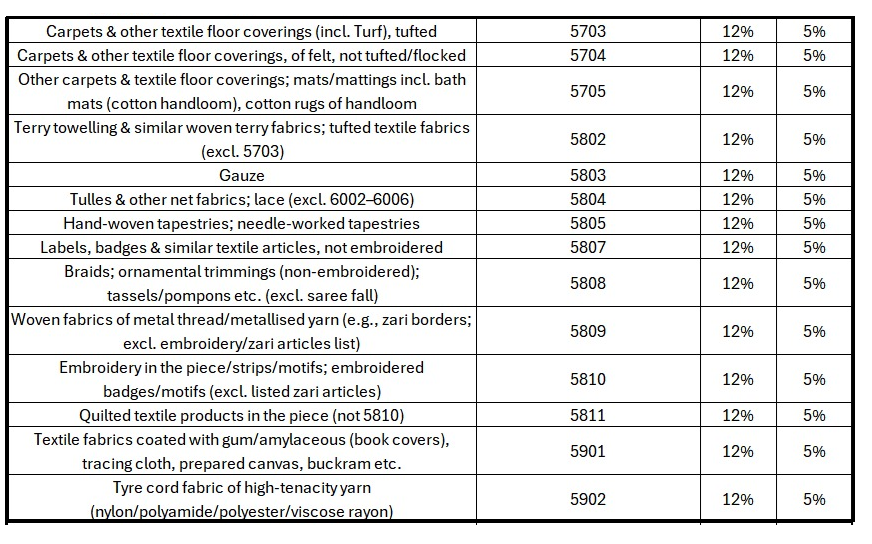

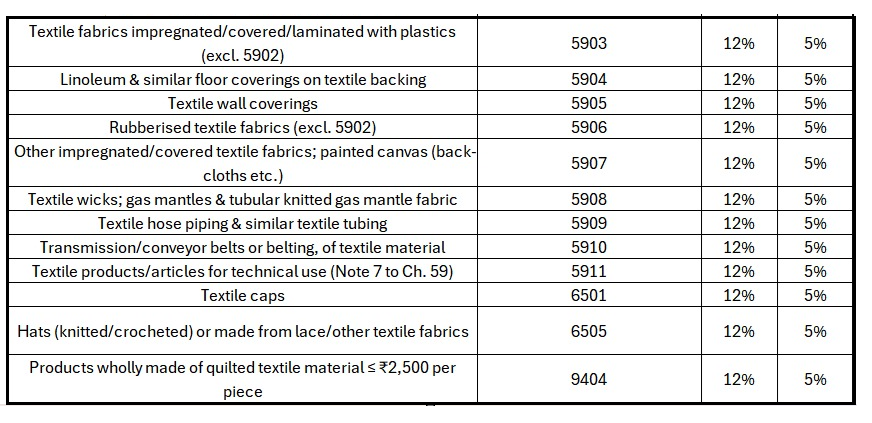

Textile Sector Items which are now 5% from 12% GST

Input Tax Credit (ITC) for Textile Industry

In the GST system, Input Tax Credit (ITC) allows businesses to offset the tax they’ve paid on inputs (like raw materials and manufacturing goods) against their output tax liabilities. This system encourages seamless credit flow and reduces the cascading effect of taxes.

For the textile industry, ITC plays a crucial role:

- Manufacturers: Can claim ITC on raw materials (like fabric, dyes and machinery) used in the production of garments.

- Retailers: Can claim ITC on goods purchased for resale, which reduces their overall tax burden.

- Exporters: Can claim a full refund of the input tax on imported goods.

The availability of ITC makes the textile industry more competitive by reducing the cost of production.

Impact of GST on Consumers vs. Manufacturers /Retailers

| Aspect | Impact on Consumers | Impact on Manufacturers/Retailers |

| Tax Rates | Lower tax rates on budget-friendly clothing (5% for < ₹2,500) | ITC reduces the cost of raw materials and production for manufacturers |

| Pricing | Slight increase in prices for premium clothes (18% for > ₹2,500) | Retailers benefit from ITC, reducing overall tax burden |

| Affordability | More affordable options for lower-income groups | Manufacturers, especially small ones, gain a competitive edge with reduced tax costs |

| Compliance | No direct impact -consumers pay final price including GST | Retailers and manufacturers need to maintain proper tax documentation |

| Market Access | More diverse product options at varied price points | Improved access to tax benefits and market expansion |

E-commerce Platforms: New guidelines were introduced for e-commerce sellers to collect and remit GST on behalf of vendors, making compliance easier for online clothing retailers.

Regarding e-commerce platforms, there have been no specific changes or notifications related to GST compliance for the textile sector in FY 2025-26. E-commerce operators are expected to continue adhering to the existing GST regulations, including registration requirements, tax collection at source (TCS), and timely filing of returns.

Conclusion

The GST framework for clothing continues to balance affordability with revenue generation by applying lower rates to budget garments and higher rates to premium apparel. With continued focus on simplification and transparency, GST is shaping a more structured and competitive textile sector in India.

FAQs

- Is GST applicable on second-hand clothes sold by small sellers?

If sold by unregistered individuals or below the threshold limit, GST is not applicable. However, registered sellers must charge GST as per standard rates.

- Can Input Tax Credit (ITC) be claimed on fabric used for in-house uniform stitching?

Yes, ITC can be claimed if the uniforms are for official business use and properly documented.

- Do online clothing sellers need to register for GST even if turnover is below ₹40 lakhs?

Yes. GST registration is mandatory for all sellers on e-commerce platforms, regardless of turnover.