GST Interest and Penalty Waiver Scheme under Section 128A provides provide a big relief to the taxpayers for reducing the tax disputes.

What’s the Big Relief?

GSTN has announced a waiver scheme for interest and penalties on GST demands for certain past financial years.

Overview of This Waiver Scheme

Purpose

The GST Council in its 53rd meeting held on 22nd June, 2024 had recommended for waiver of interest and penalties in the demand notices or orders issued under Section 73 of the CGST Act, 2017

Eligibility

GST interest and penalty waiver is applicable only those cases that are not involving fraud, suppression, or willful misstatement.

Financial Years Covered under this GST Waiver Scheme

Financial years 2017-18, 2018-19, and 2019-20.

Conditions to Qualify for the Waiver

Full payment of the tax demanded must be paid by March 31, 2025.

New Forms can be used for Waiver are GST SPL-01 and SPL-02.

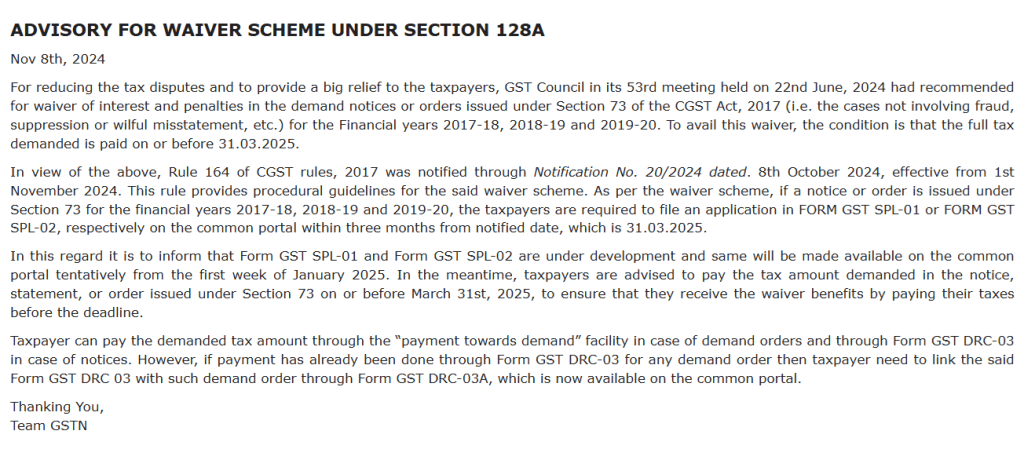

Advisory For GST Interest and Penalty Waiver

Overview of Forms GST SPL-01 and SPL-02

Taxpayers can use Forms GST SPL-01 and SPL-02 to apply for the waiver of interest and penalties under the new scheme.

Availability Of Form

Forms GST SPL-01 and SPL-02 will be available from January 2025.

Filing Deadline

Applications must be filed by March 31, 2025.

Role of Form GST DRC-03A in this waiver process

If taxpayers have already made the “payment towards demand” facility in case of demand orders and through Form GST DRC-03 in case of notices, than they need to link the payment to the corresponding demand order using Form GST DRC-03A which is now available on the portal.

How does Rule 164 help in implementing the interest and penalty waiver scheme?

Rule 164 of CGST rules, 2017 was notified through Notification No. 20/2024 dated. 8th October 2024, effective from 1st November 2024. This rule provides procedural guidelines for the said waiver scheme. As per the waiver scheme, if a notice or order is issued under Section 73 for the financial years 2017-18, 2018-19 and 2019-20, the taxpayers are required to file an application in FORM GST SPL-01 or FORM GST SPL-02, respectively on the common portal within three months from notified date, which is 31.03.2025.

Process of Filing SPL-02

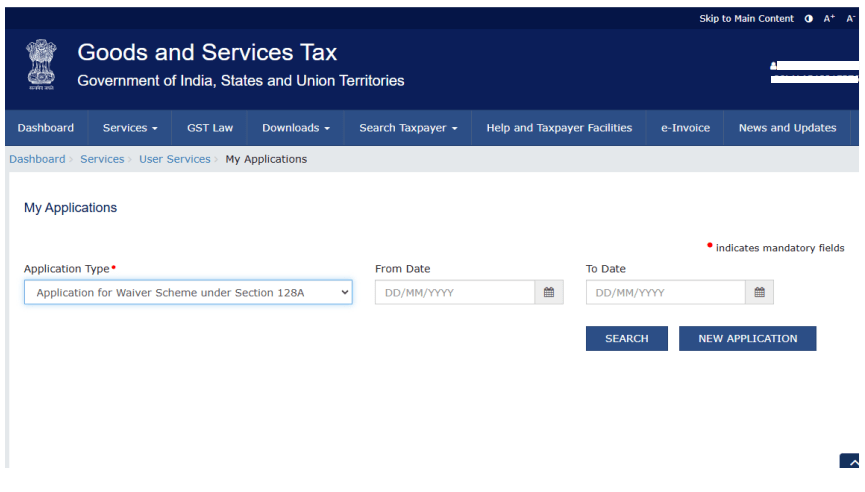

1.Login into GST portal: Navigate to > Services > User Services > My Applications.

2.On Navigating to ‘My Applications’ page, the taxpayer has to select ‘Apply for Waiver Scheme under Section 128A’ option under ‘Application type’ dropdown. If the taxpayer wants to file a new application for availing waiver on Interest and Penalty, the taxpayer can click on ‘New Application’ button.

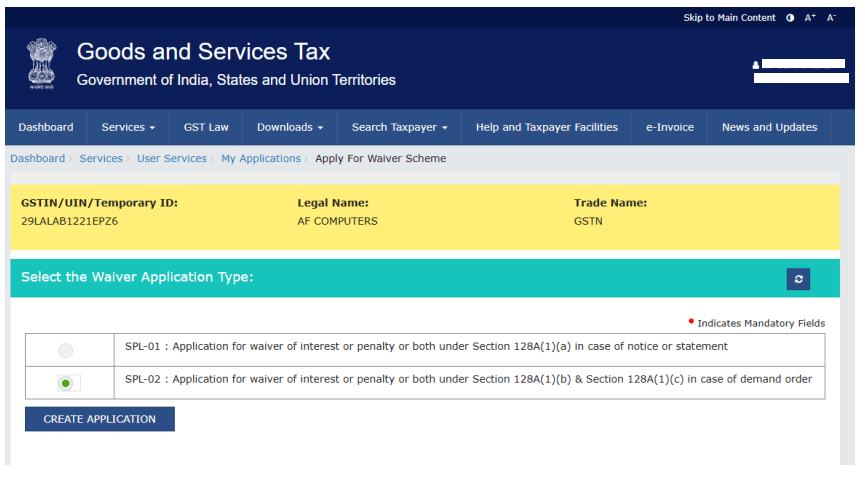

3.On click of ‘New Application’, the taxpayer will be able to see two forms, i.e.

- SPL-01: Application for waiver of interest or penalty or both under Section 128(1)(a) in case of notice or statement.

- SPL-02 : Application for waiver of interest or penalty or both under Section 128(1)(b) & Section 128(1)(c) in case of demand order.

On selection of SPL-02, the ‘CREATE APPLICATION’ button will be enabled.

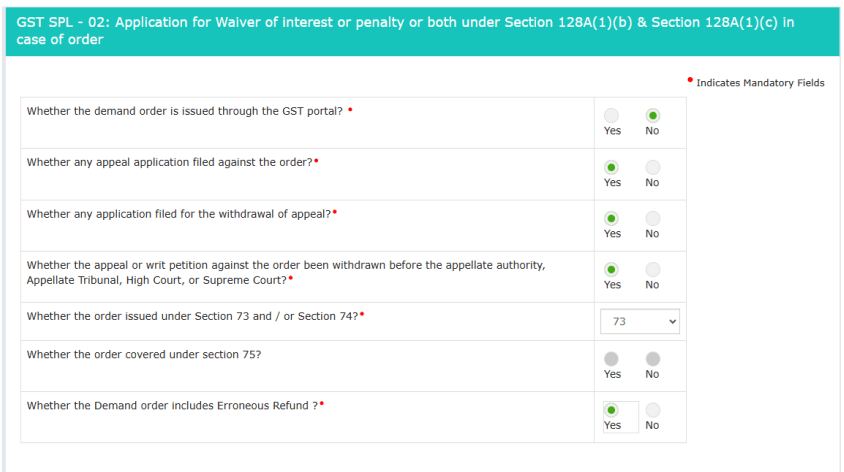

4.On click of “CREATE APPLICATION” button , a questionnaire will appear on the dashboard as shown below.

Guidelines is given below to fill the above questionnaire carefully

| Questions | Impact |

| Whether the demand order is issued through GST portal? | 1. If DRC 01/07/APL 04 is issued through GST portal, ‘Yes’ has to be selected. 2. In case the demand order is not issued through GST portal i.e. issued manually by the tax department and DRC 01/07/APL 04 is not available in GST portal, the taxpayer will be required to select ‘No’. |

| Whether any appeal application filed against the order? | If any appeal application is filed against the DRC 07/APL 04 order before the First Appellate authority or the High Court, then ‘Yes’ has to be selected. |

| Whether any appeal application filed against the order? | This question will be shown only if, ‘Yes’ is selected for Sl. No. 2 If Yes is selected for Sl. No. 2 and if the taxpayer has filed application for withdrawal of the said appeal filed against the demand order, then ‘Yes’ has to be selected. If the taxpayer has not filed any application for withdrawal of appeal, then ‘No’ has to be selected. |

| Whether the appeal or writ petition against the order been withdrawn before the appellate authority, Appellate Tribunal, High Court, or Supreme Court? | This question will be shown only if, ‘Yes’ is selected for Sl. No. 3 If any appeal filed against the DRC 07/APL 04 and the same is withdrawn, then ‘Yes’ has to be selected. |

| Whether the order issued under either Section 73 and/or Section 74? | Select Yes or No (As per the Original demand order) |

| Whether the order covered under Section 75? | Select Yes or No (As per the Original demand order) |

| Whether the Demand order includes any Erroneous Refund? | Select Yes or No (As per the Original demand order) |

5.After answering all the mandatory questions, taxpayer has to click NEXT button to proceed further.

6.The SPL-02 form will be displayed on the dashboard. There will be following tables where the taxpayers have to enter or select the data:

Table 1: BASIC Details

Mobile No. & E-mail ID are to be selected from the drop-down list.

Table 2: Details of Demand Order

i. Order Id:

- Select Order Reference No. or Manual entry (in case of an offline/manual order which is not available in GST portal).

- The demand orders issued against the taxpayer through GST portal will be available for selection in drop down menu.

- In case, the demand order is issued offline and the demand order is not available in the GST portal, then “Manual entry” has to be selected. The taxpayer has to enter the reference number of manual order in “Order number” field.

ii. Date of Issuance of Order:

This field will be auto-populated if the selected order is online. It is user entry field, if the order is manual.

iii. Section under which the order has been issued:

User entry field. The section under which the demand notice/order is issued against need to be selected.

iv. Whether any appeal or writ petition is filed against order before AA/ appellate tribunal/ high court/ supreme court

If any appeal application is filed against the DRC 07/APL 04 order before the First Appellate authority or the High Court, then ‘Yes’ has to be selected.

v. If yes, whether the order for withdrawal of appeal or writ petition is issued or not

If the order for withdrawal of appeal or writ petition is issued by the appellate form, then ‘Yes’ has to be selected.

vi. Whether demand order involves demand of erroneous refunds

vii. Financial year From & To

As per the demand order for Sl. No. vi and vii

Table 3A. Amount demanded in the Order.

For the online orders (orders available in GST portal), the details will be auto-populated. For the offline orders, the taxpayer has to enter all the details

Table 3B. Out of demand in table 3A, ITC denied as per Section 16 (4) & subsequently eligible under Section 16(5) & Section 16(6) :

The amount pertaining to Ineligible ITC as per Section 16 (4) & subsequently made eligible under Section 16(5) & Section 16(6) which is involved in the notice/order has to be entered manually by the taxpayer. The taxpayer has to enter the amount against IGST/CGST/SGST/Cess. This amount cannot be more than demand amount entered in Table 3A.

Table 4: Amount paid through payment facility against demand order:

For the demand order (DRC 07/APL 04) issued through the GST portal and the payment is made through “Payment towards Demand” option in GST portal:

The details of payment made against the demand will be auto populated and the user is not required to make entries in the Table 4.

For the demand order (DRC 07/APL 04) issued through the GST portal and the payment is made using DRC 03 under the causes of payment as “Voluntary” and “Others”:

- The taxpayer is required to map the payment made using DRC 03 (Cause of payment is ‘Voluntary’ or ‘Others’) with the demand order using the Form GST DRC 03A. The navigation link for filing DRC 03A in GST portal is Services >> User Services >> My Applications >> FORM GST DRC-03A.

- After mapping DRC 03 with a demand order (for which SPL 02 is being filed) using DRC 03A, the details of the payment made will be auto populated in the Table 4 of SPL 02 and the user is not required to make entries in the table.

For the demand order (DRC 07/APL 04) issued offline (manually) i.e. not issued through the GST portal and the payment is made through DRC 03:

The DRC 03s filed by the taxpayer will be available in the dropdown of the field “Acknowledge Reference Number”. The applicant has to select the relevant ARN of DRC 03. Also, multiple DRC 03s can be selected.

The payment details related to the selected DRC 03 will be reflected in Table 4.

7.Upload Supporting Documents: The taxpayer is required to upload the mandatory as well as other relevant supporting documents. A maximum of five documents, each with a size limit of 5 MB, can be uploaded. Upon uploading the documents, the taxpayer must complete the Declaration & Verification section in order to proceed with saving and previewing the form. Once the form is saved and previewed, the taxpayer may click the “File” button to submit the SPL-02 form.

8.Upon clicking the ‘File’ button, a warning message will be displayed to the taxpayer: “Do you wish to proceed with filing the application?”

Select Ok to continue or Cancel to make modifications to the form. Upon selecting Ok, the application can be filed using either a Digital Signature Certificate (DSC) or an Electronic Verification Code (EVC). ARN will be generated upon the successful submission of the form

Click here to know more about Waiver of Interest & Penalties under GST

FAQs

The purpose is to provide a relief to taxpayers with demand notices u/s 73 if there is no fraud, suppression, or willful misstatement involved.

The application must be filed within three months of the form’s release, ending on March 31, 2025.

Payments can be made via the “payment towards demand” option on the portal or through Form GST DRC-03.