GST E-Invoice is an electronic invoice which is generated through the Invoice Registration Portal (IRP) and contains a unique Invoice Reference Number (IRN) along with a QR code.

Starting April 1, 2025, a new rule under the Goods and Services Tax (GST) system mandates that e-invoices must be uploaded to the Invoice Registration Portal (IRP) within 30 days from the date of invoice generation.

This rule aims to streamline GST compliance and improve the accuracy of reporting.

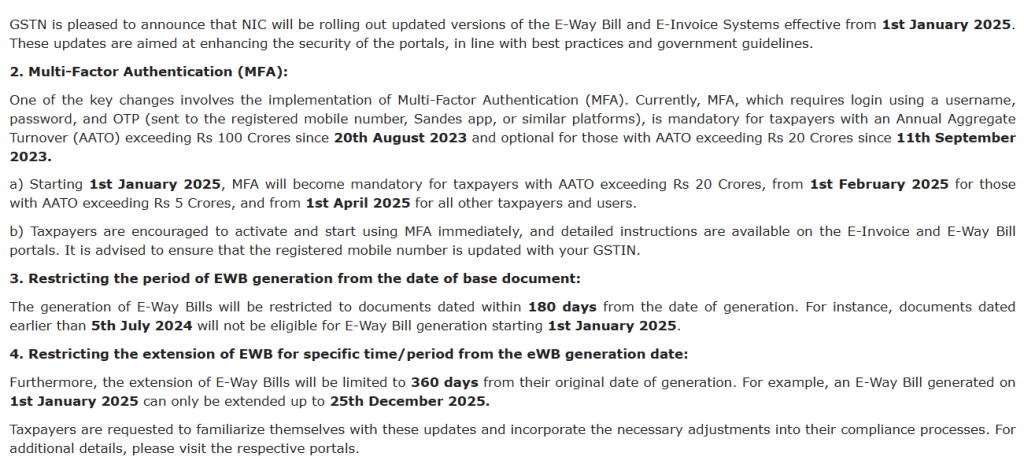

Important Update

Click Here – GSTN Issues Advisory on Updates to E-Way Bill and E-Invoice Systems

Key Points of the New Rule

Applicability

The 30-day upload rule applies to all businesses required to generate e-invoices under GST law. Currently, e-invoicing is mandatory for companies with a turnover exceeding INR 5 crore (subject to change over time).

Timeline

The 30-day period starts from the date of invoice generation, not the transaction or delivery date. This deadline is critical for claiming input tax credits and avoiding penalties.

Impact on Compliance

Businesses must adjust their invoicing practices to comply with the shorter timeframe. Late uploads could attract penalties, and input tax credits may be disallowed for non-compliance.

In-Depth Impact Analysis

Stricter Compliance

The government’s intent is to tighten compliance standards by ensuring that e-invoices are promptly reported, helping to prevent instances of delayed or backdated invoices, which can lead to tax evasion or inaccurate reporting.

This will make it easier for the authorities to monitor transactions in real time and ensure the timely collection of GST.

Penalty for Non-Compliance

Although specifics around penalties for late uploads haven’t been fully detailed, it’s expected that businesses failing to adhere to the 30-day deadline may face financial penalties.

Additionally, late invoice uploads might disqualify businesses from claiming input tax credit (ITC) on such transactions, leading to increased costs.

Implications for Input Tax Credit (ITC)

Input tax credit is a critical aspect of GST compliance, allowing businesses to reduce their tax liability by claiming the GST paid on purchases or expenses. The ITC eligibility is directly linked to timely e-invoice reporting. With the 30-day limit, businesses failing to upload invoices within the specified timeframe could lose their ITC entitlement for those transactions, impacting their working capital and profitability.

IT System Readiness

For many companies, particularly smaller businesses, this rule will necessitate upgrades to their IT infrastructure and invoicing processes.

Many businesses currently generate invoices manually or at the end of billing cycles, so adjusting to a near-real-time invoicing process may require investment in e-invoicing software or ERP systems that automatically link with the IRP.

Logistics and Operational Changes

The rule may lead to operational adjustments, especially for businesses that handle large volumes of invoices. Companies may need to train their accounting teams to process and upload e-invoices within the shortened timeframe.

Additionally, businesses with distributed operations across multiple locations may have to standardize invoicing procedures across all locations to ensure consistent compliance.

Impact on Large and Small Enterprises

While large enterprises often have established ERP systems that automate e-invoicing, smaller businesses with lower turnovers may find it challenging to adapt.

This change could increase compliance costs for small businesses, though there are GST-compliant invoicing software solutions designed for SMEs.

Transition Period and Industry Preparation

Though the rule takes effect from April 1, 2025, businesses should use the lead time to audit and enhance their invoicing processes.

Implementing a consistent workflow for e-invoice generation, verification, and IRP upload will be essential.

GST consultants and tech firms are expected to play a significant role in helping businesses transition smoothly.

This move by the GST authorities reinforces the drive towards digitization and transparency in tax administration, aiming for a more accountable and timely reporting environment across the Indian business landscape.

Click here to know about GST E-Invoicing Updates for 2025.