Gold is purchased for a variety of reason such as for auspicious occasions or for daughter/son’s marriage in future.

It includes not only jewellery but also includes gold coins, bars and other forms.

Why Is It Important To Buy Gold With A Proper Tax Invoice?

Always buy gold with a proper tax invoice and keep it for future requirements.

CBDT in its press release dated 1 Dec 2016 clarified that there is no limit on gold holding if the investment source is explainable.

It is essential that the income of assessee is in line with the quantity of gold held.

Providing proof for such possession will help in avoiding scrutiny from the IT department.

What Happens When There Is No Proper Tax Invoice?

Apart from the tax invoices, you may provide evidence in case of inheritance and gift.

You can also submit a family settlement deed, will or a gift deed stating the transfer of such a commodity to you.

If there is no such documents then the officer will analyze family’s social status, customs and traditions to come a conclusion on whether your statement is valid or not.

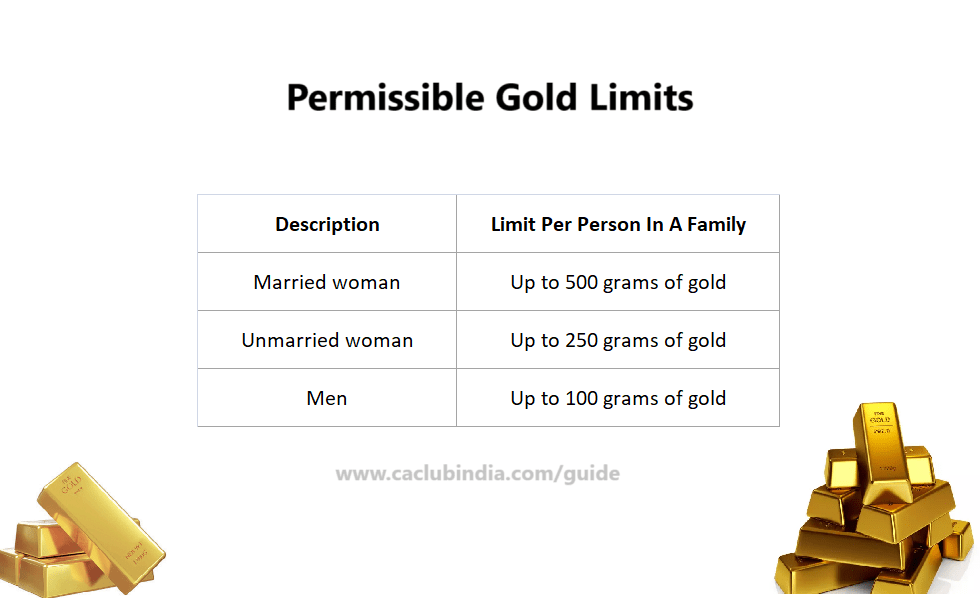

Permissible Gold Limits During Tax Search Operations

Gold within permissible limits is safe during tax searches.

CBDT has clarified the prescribed quantity of gold considered as allowable. Specified limit will not be seized even at the time of search at the assessee premises.

Power of IT Department u/s 132

Power to Search u/s 132 of the Act

Section 132 of the IT Act allows the IT department to search and seize undisclosed money, bullion, or valuables linked to unreported income.

The power of the authorised officer to seize jewellery during the course of search is derived from clause (iii) of section 132(1) which reads that the authorized officer should seize any such books of accounts, other documents, money, bullion, jewelery or other valuable articles or things found as a result of such search.

Jewellery Seizure

As per the proviso to the said clause, any bullion, jewellery or other valuable articles or thing, being stock in trade of the business, found as a result of such search shall not be seized but the authorized officer shall make a note or inventory of such stock in trade of the business.

Conditions for Seizure

Jewellery seizure depends on whether it is declared or unexplained at the time of search. It is pertinent to note that the seizure of jewellery mainly depends upon two situation:

- when an assessee has disclosed such jewellery in a wealth tax return.

- when the assessee has not disclosed such jewellery in a wealth tax return.