Which appeals are covered under Direct Tax Vivad Se Vishwas Scheme, 2024 ?

Please refer to section 89 of the Direct Tax Vivad Se Vishwas Scheme, 2024 (‘the DTVSV Scheme, 2024’ or ‘the Scheme’) [contained in Chapter IV of the Finance (No.2) Act, 20241. Section 89 of the Scheme provides for the definition of “appellant” which is –

(i) a person in whose case an appeal or a writ petition (WP) or special leave petition (SI.P) has been filed either by him or by the income-tax authority or by both, before an appellate forum and such appeal or petition is pending as on the specified date i.e. 22.7.2024; or

(ii) a person who has filed his objections before the Dispute Resolution Panel (DRP) under section 144C of the Income-tax Act, 1961 (‘the Act’) and the DR? has not issued any direction on or before 22.7.2024; or

(iii) a person in whose case the DRP has issued direction under section 144C(5) of the Act and the AO has not completed the assessment under section 144C(I3) on or before 22.07.2024, or

(iv) a person who has filed an application for revision under section 264 of the Act and such application is pending as on 22.7.2024.

Which cases are 1101 covered under DTVSV Scheme 2024?

As per section 96 of the Scheme, the Scheme shall not, inter-alia, apply in respect of tax arrear,-

(i) relating to an assessment year in respect of which an assessment has been made under section 143(3) / 144/ 147/ 153A/ 153C of the Act on the basis of search initiated under section 132/ 132A of the Act;

(ii) relating to an assessment year in respect of which prosecution has been instituted on or before the date of filing of declaration;

(iii) relating to any undisclosed income from a source located outside India or undisclosed asset located outside India:

(iv) relating to an assessment or reassessment made on the basis of information received under an agreement referred to in section 90 or section 90A of the Act, if it relates to any tax arrear.

There are certain other cases where provisions of COFEPOSA Act, 1974: UAPA Act, 1967; NDPS Act 1985; PBPT Act,1988: PC Act, 1988: PMLA 2002 etc. may apply. Such cases are also not covered in the Scheme.

For further details, refer section 96 of the Scheme.

Kindly provide the amount payable on the tax arrears as per the DTVSV Scheme, 2024?

What are the various Forms specified in the Scheme?

Four separate Forms have been notified for the purposes of the said Scheme. These are as under:

- Form-1: Form for filing declaration and undertaking by the declarant

- Form-2: Form for Certificate to be issued by Designated Authority

- Form-3: Form for Intimation of payment by the declarant

- Form-4: Order for Full and Final Settlement of lax arrears by Designated Authority

The Scheme also provides that Form-1 shall be filed separately for each dispute, provided that where appellant and the income-tax authority, both have filed an appeal in respect of the same order, single Form-1 shall be filed in such a case.

The intimation of payment is to be made in Form-3 and is to be furnished to the Designated Authority along with proof of withdrawal of appeal, objection, application, writ petition, special leave petition, or claim.

What are the various timelines specified in the Scheme?

Various timelines specified in the Scheme are as follows:

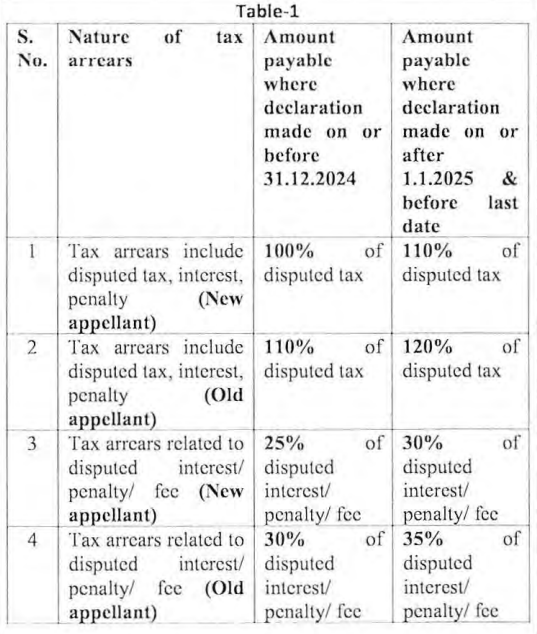

(i) Declaration and Undertaking shall be filed by tax payer in Form-1 on or before 31.12.2024 to keep the amount payable on the lower threshold. In case of filing the declaration and undertaking beyond 31.12.2024, amount payable will increase as specified in rates Table-1 above.

(ii) The Designated Authority shall issue Form-2 within a period of fifteen days from the date of receipt of the declaration to determine the amount payable by the taxpayer.

(iii) The tax-payer shall pay the amount as determined in Form-2 within a period of fifteen days from the date of receipt of the certificate, and shall intimate the details of such payment in Form-3.

(iv) Upon receipt of Form-3, Designated Authority shall pass an order in Form-4 stating that the tax- payer has paid the full and final amount.

Kindly clarify which assessments shall be considered to have been made on the basis of search initiated under section 132/132A of the Act?

Assessments framed under section 153A or 153C are clearly made on the basis of search initiated u/s 132/132A. Therefore, such cases shall not be eligible for the DTVSV Scheme, 2024.

For other cases where assessments have been made u/s 143(3)/144/147, following three sets of cases shall be considered as cases where assessments have been made on the basis of search initiated u/s 132/ 132A.

These cases are:-

(i) Where a search is initiated Under section 132 or books of account, other documents or any assets are requisitioned under section 132A, on or after the 1st day of April, 2021, in the case of the assessee and assessments have been made consequently; or

(ii) Where the Assessing Officer has drawn satisfaction, with the prior approval of the Principal Commissioner or Commissioner, that any money, bullion, jewellery or other valuable article or thing, seized or requisitioned under section 132 or section 132A in case of any other person on or after the 1st day of April, 2021, belongs to the assessee and assessments have been made consequently; or

(iii) Where the Assessing Officer has drawn satisfaction, with the prior approval of Principal Commissioner or Commissioner, that any books of account or documents, seized or requisitioned under section 132 or section 132A in case of any other person on or after the 1st day of April, 2021, pertains or pertain to, or any information contained therein, relate to, the assessee and assessments have been made consequently.

A taxpayer is evaluating to close few years in DTVSV Scheme, 2024 out of 4 rollback years. Whether Advance Pricing Agreement can be pursued for remaining years of the 4 rollback years?

As per CBDT Circular 15/2015 dt. 10.6.2015-

“The applicant does not have the option to choose the years for which it wants to apply for rollback. The applicant has to either apply for all the four years or not apply at all. However, if the covered international transaction(s) did not exist in a rollback year or there is some disqualification in a rollback year, then the applicant can apply for rollback for less than four years. “

Thus, in certain exceptions, the rollback period could be less than 4 years also. On the same analogy, if few years are settled in the Scheme, the rollback can be applied for the remaining years.

Suppose a taxpayer is eligible to apply for DTVSV Scheme, 2024 as his appeal is pending as on 22.7.2024. But subsequently, before the taxpayer could file declaration under the DTVSV Scheme, 2024, his appeal has been disposed off, Can such a taxpayer still file declaration under the Scheme?

The DTVSV Scheme, 2024 is a Scheme for settlement of tax disputes. Where a decision has been given prior to the taxpayer filing a declaration, there is no dispute pending unless the taxpayer or the Department again prefers an appeal. Therefore, where an appeal is pending as 011 22.7.2024 but is not pending as on the date of making declaration under the Scheme, such cases shall not be eligible for the Scheme.

However, in cases where a taxpayer files declaration under section 90 of the Scheme and intimates the same to the appellate authority, the concerned appellate authority may consider not disposing the appeal of the taxpayer.

Extant provisions of DTVSV Scheme, 2024 does not cover cases where Taxpayer would have received orders but the lime limit to file an appeal / special leave petition had no expired as on 22 July 2024. Is there any possibility that such cases can be covered in the Scheme?

As per section 89(1) of the Scheme, it is clear that the appeal has to be pending as on the specified date i.e. 22.07.2024 for an appellant to be eligible for the Scheme. The definition of appellant also covers cases where the DRP has issued directions u/s 144C(5) but the AO has not completed the assessment u/s 144C(13).

Therefore, the Scheme does not provide for eligibility of those cases where an appeal is not pending as on 22.7.2024 except for DRP cases referred above.

Where disputed tax contains qualifying tax arrears along-with non-qualifying tax arrears (such as, tax arrears mentioned in section 96(a) for eg. tax arrear in respect of undisclosed foreign income), whether the taxpayer can apply for the Scheme in such a case?

As per section 91 (2) of the Scheme, after filing of declaration, appeals before ITAT /CIT(A)/ JCIT(A) are deemed to be withdrawn from the date of issue of certificate by the Designated Authority. Further as per section 91(3) of the Scheme, the taxpayer is required to withdraw appeals and furnish proof thereof along with intimation of payment u/s 92(2) of the Scheme.

Therefore, the Scheme docs not envisage settling issue in part. The dispute has to be settled in full as per the Scheme.

Thus, where there are non-qualifying tax arrears, such disputes are not eligible to be covered under the Scheme.

Can a taxpayer settle penalty appeal while continuing to litigate the associated quantum appeal?

Reference may be made to section 89(1)(i) of the Scheme, which provides the definition of ‘disputed penalty ‘. It provides that the disputed penalty is such penalty which is not levied or leviable in respect of disputed income or disputed tax.

Thus, it would not be possible for the appellant to apply for settlement of penalty appeal only, when the appeal on disputed tax related to such penalty is still pending.

If both quantum appeal covering disputed tax and appeal against penalty levied on such disputed tax for an assessment year are pending, the declarant is required to file a declaration form giving details of both disputed tax appeal and penalty appeal. However, he would be required to pay relevant percentage of disputed tax only.

If there is substantive addition as well as protective addition in the case of same assessee for different assessment year, how will that be covered? Similarly, if there is substantive addition in case of one assessee and protective addition on same issue In the case of another assessee, how will that be covered under DTVSV Scheme, 2024?

Where substantive as well as protective additions have been made whether In the case of same taxpayer for different assessment years or in the hands of different taxpayers, then either of the two additions i.e. substantive or protective can be, settled if the substantive addition eligible for settlement under the Scheme.

On settlement of dispute related to substantive or the protective addition, AO shall pass rectification order deleting the protective or the substantive addition, as the case may be, relating to the same issue in the case of the same taxpayer or in the case of another taxpayer.

Are disputes relating to wealth tax, security transaction tax, commodity transaction tax and equalisation levy covered?

No. Only disputes relating to income-tax are covered.

If a taxpayer has requested for withdrawal of appeal under section 91 (3) of the Scheme and the appeal is not yet allowed to be withdrawn, how will the taxpayer furnish proof of withdrawal in such cases?

Where assessee has made request for withdrawal and such request is under process, proof of request made shall be enclosed.

With respect to interest under section 234A, 234B or 234C, there is no appeal but the assessee has filed waiver application before the competent authority which is pending as on 22.7.2024? Will such cases be covered under the Scheme?

A taxpayer who has filed a waiver application is not an appellant u/s 89(1)(a) of the Scheme. Therefore, such cases are not covered.

If JCIT(Appeals)/ CIT(Appeals) has given an enhancement notice, can the appellant avail the DTVSV Scheme, 2024 after including proposed enhanced income in the total assessed income?

Yes. Where an appeal is pending before the JCIT(A)/ CIT(A), the disputed tax is the amount that is payable by appellant if such appeal was to be decided against the appellant. This is as per the definition of ‘disputed tax’ in s. 89(1)(j) of the DTVSV Scheme, 2024. Hence, where JCIT(A)/ CIT(A) has given enhancement notice, the taxpayer can avail the Scheme after including proposed enhanced income in the total assessed income. Appropriate calculation of disputed tax is accordingly provided in the relevant Schedules of Form- 1.

Whether taxpayers can settle appeals under DTVSV Scheme, 2024 using the refunds which they are expecting from the department?

As per section 92(2) of the Scheme, the declarant shall pay the amount determined under section 92(1) of the Scheme within a period of fifteen days of the date of receipt of the certificate and intimate the details of such payment to the Designated Authority in the prescribed form and thereupon the Designated Authority shall pass an order stating that the declarant has paid the amount.

There is no provision in the Scheme allowing payment of the amount determined u/s 92(1) of the Scheme through adjustment or any refund expected from the Department.

If taxes are paid after availing the benefits of the DTVSV Scheme, 2024 and later the taxpayer decides to take refund of these taxes paid, would it be possible?

No. Any amount paid in pursuance of a declaration made under the Scheme shall not be refundable under any circumstances as per provisions of section 94(1) of the Scheme.

Will delay in deposit of TDS/TCS be also covered under the Scheme?

The disputed lax includes tax related to tax deducted at source (TDS) and tax collection at source (TCS) which are disputed and pending in appeal. However, if there is no dispute related to TDS or TCS and there is delay in depositing such TDS/TCS, then the dispute pending in appeal related to interest levied due to such delay will be covered under the Scheme,

Where assesses settles TDS appeal (against order u/s 201 of the Act) as deductor of TDS, will credit of such tax be allowed to deductee?

Yes. However, the credit will be allowed as on the date of settlement of dispute by the deductor and hence the interest as applicable to deductee shall apply.

When assessee settles his own appeal under DTVSV Scheme, 2024, will consequential relief be available to the deductor in default from liability determined under TDS order u/s 201 of the Act?

Yes. In such a ease, the deductor in default would not be required to pay the corresponding TDS amount. However, he would be required to pay the interest under sub-section (1A) of section 201 of the Act. If such levy of interest under sub-section (1A) of section 201 of the Act qualifies for DTVSV Scheme, 2024. the deductor in default can settle this disputed interest by filing up the relevant schedule of disputed interest,

Where assessee settles TDS liability as deductor of TDS under DTVSV Scheme, 2024 (i.e. against order u/s 201), when will he get consequential relief of expenditure allowance under proviso to section 40(a)(i)/(ia) of the Act?

In such eases, the deductor shall be entitled to gel consequential relief of allowable expenditure under proviso to section 40(a)(i)/(ia) of the Act in the year in which the lax was required to be deducted, if the disallowance under section 40(a)(i)/(ia) of the Act is with respect to same issue on which order under section 201 has been issued.

However, if the assessee has already claimed deduction of the same amount under section 40(a)(i)/(ia) of the Act in subsequent year on account of recovery of IDS in such subsequent year, he shall not be entitled to consequential relief under section 40(a)(i)/(ia) of the Act on the basis of the settlement under DTVSV Scheme, 2024.

In ease, in the order under section 143(3) there are other issues as well, and the appellant wants to settle the dispute with respect to order under section 143(3) of the Act as well, then the disallowance under section 40(a)(i)/(ia) of the Act relating to the issue on which he has already settled liability under section 201 of the Act would be ignored for calculating disputed tax.

A trust has been denied registration u/s 12AA of the Act. Whether appeal against such order is eligible For DTVSV Scheme, 2024?

No

An order has been set aside, fully or partially, to the AO. Can the taxpayer avail the DTVSV Scheme, 2024 if the set-aside matter is pending as on 22.7.2024?

According to the Scheme, an appeal which is pending as on 22.7,2024 shall be eligible for settlement. A set-aside matter to the AO is not an appeal pending as such. Therefore, set-aside matters to the AO, whether fully set-aside or partially set-aside are not covered under the Scheme,

Where there are two appeals filed for an assessment year in respect of the same order – one by the appellant and one by the lax department, whether the appellant can opt for only one appeal? How would the disputed tax be computed in such a eases?

Yes. The appellant has an option to opt for settling appeal filed by him or appeal filed by the department or both. This has to be specified in the declaration to be made in Form-1. Also refer to the proviso to Rule 4 of the Direct Tax Vivad se Visit was Rules, 2024 which is reproduced as under- “where the appellant and the income-tax authority have both filed an appeal or writ petition or special leave petition in respect of the same order, single Form-1 shall be filed by the appellant. “

Accordingly, relevant Schedules in Form-1 have to be filled out by the appellant and the disputed tax would be worked out.

If a writ has been filed against a notice issued under section 148/ 148A of the Act and no assessment order has been passed consequent to that notice, whether such eases are eligible under the Scheme?

The income in such cases is yet to be determined. Therefore, the disputed tax is not ascertainable. Thus, the taxpayer would not be eligible for the Scheme in such cases.

If appeal is filed before High Court or Supreme Court and is pending for admission as on 22.7.2024, whether the case is eligible for DTVSV Scheme, 2024?

Yes.

Whether cross objections filed and pending as on 22.7.2024 will also he covered by the Scheme?

Yes.

Whether Miscellaneous Application (MA) pending as on 22.7.2024 will also be covered by the Scheme?

No, MA is not an appeal. Therefore, there is no pending appeal as on 22.7.2024.

Whether the DTVSV Scheme, 2024 can be availed in a case where the enforceability of an assessment order passed by AO has been stayed by the High Court or Supreme Court?

No. A quantum appeal pending on 22.7.2024 can be settled under the Scheme. Where an assessment order has been stayed, it does not tantamount to an appeal pending as on 22.7,2024.

The assessment order under section 143(3) of the Act was passed in the case of an assessee for an assessment year. The said assessment order is pending with ITAT. Subsequently another order under section 147/143(3) was passed for the same assessment year and that is pending with CIT (Appeals)? Could both or one of the orders be settled under DTVSV Scheme, 2024?

The appellant in this ease has an option to settle cither of the two appeals or both appeals for the same assessment year.

As per rule 4(1) of the Direct Tax Vivad se Vishwas Rules, 2024, the declaration shall be filed separately in respect of each order. Therefore, if a taxpayer decides to settle both appeals then he has to file separate declaration for the two orders.

There is no provision for 50% concession in appeal pending in HC on an issue where the assesses has got relief on that issue from the Supreme Court?

If the appellant has got decision in his favour from Supreme Court on an issue, there is no dispute now with regard to that issue and he need not settle that issue. If that issue is part of the multiple issues, the disputed tax may be calculated on other issues considering nil tax on this issue.

Addition was made u/s 143(3) on two issues whereas appeal is filed only for one addition, Whether interest and penalty be waived for both additions.

Under DTVSV Scheme, 2024 interest and penalty will be waived only in respect of the issue which is disputed in appeal and for which declaration is filed, lienee, for the undisputed issue, the tax, interest and penalty shall be payable.

Once declaration is filed under DTVSV Scheme, 2024, and for financial difficulties, payment is not made accordingly, will the declaration be null and void?

Yes. As per provisions of section 91(5) of the Scheme, it shall be deemed as if the declaration has not been made.

Whether the immunity from prosecution is only for the declarant or also for the Director of the company or partner of the firm with respect to the disputes settled under DTVSV Scheme, 2024?

If a dispute has been settled under the Scheme, the immunity from prosecution with respect to that dispute shall also extend to the director / partner of company / firm (being the declarant) in respect of same dispute under section 278B of the Act.

Suppose a taxpayer is eligible to apply for DTVSV Scheme, 2024 as his appeal is pending as on22.7.2024. But subsequently, before the taxpayer could file declaration under the DTVSV Scheme, 2024, his appeal has been disposed off on merits or dismissed as withdrawn for the purposes of the Scheme. Can such a taxpayer still file declaration under the Scheme?

Yes, such cases are eligible for settlement under the Scheme as appeal was pending as on 22.7.2024. Disputed tax will be calculated in the same manner as if the appeal pending on 22.7.2024 is yet to be disposed off.

Suppose a taxpayer has filed a declaration in Form-1. After the declaration, the appeal has been disposed off by the concerned authority. Whether such a case is eligible for settlement?

Yes, such a case is eligible for settlement.

Time limit for filing of appeal has expired before 22nd July 2024 but an appeal along with application for condonation of delay has been filed after 22nd July, 2024.Whether the taxpayer can opt for the Scheme in such a case?

No. Appeal has to be pending as on 22nd of July, 2024 for a taxpayer to opt for the Scheme. Thus, where an appeal along with application for condonation is filed after 22nd July, 2024, it does not tantamount to pendency of appeal as on 22nd July, 2024. Accordingly, such cases shall not be eligible.

Suppose an appeal has been filed before 22nd July, 2024 with an application for condonation of delay which is also filed before 22nd July, 2024. This appeal has been admitted by allowing condonation of delay prior to the date of filing of declaration under the Scheme. Whether such a taxpayer can opt for the Scheme?

Yes. In such cases where the appeal as well as condonation application have been filed on or before 22nd July, 2024. On admission of condonation application, such cases convert into an appeal pending on 22nd of July, 2024. Therefore, the taxpayer can opt for settlement under the Scheme in such cases.

In the case of a search action carried out before 1.4.2021, assessments of previous years other than search year, have been made under section 153A or 153C of the Income-tax Act, 1961 (`the Act’), and assessment for the year of search has been made under section 143(3) of the Act. Whether any of these assessment order can be covered under the DTVSV Scheme, 2024?

No. Such cases are specifically barred under section 96(a)(i) of the of the DTVSV Scheme, 2024.

Whether appeal filed against intimation u/s 143(1) of the Act and pending as on 22nd July, 2024 is eligible for DTVSV Scheme, 2024?

Yes. Any appeal filed against intimation u/s 143(1) of the Act and pending as on 22nd July, 2024 is eligible for settlement under the Scheme.

Section 248 of the IT Act relates to appeal by a person denying liability to deduct tax in certain cases. As per the provisions of this section, no appeal can be filed where tax is paid to the credit of the Central government on or after 1.4.2022. Whether appeal filed prior to 1.4.2022 under section 248 of the Act is eligible for DTVSV Scheme, 2024?

Yes.

Where information has been received under an agreement referred to in section 90 or section 90A of the Act; however, such information has not been ‘used’ for making additions in assessment/ reassessment order.In such cases, whether the assessee can opt for DTVSV Scheme, 2024?

Yes. Section 96 of the DTVSV Scheme, 2024 clearly states that the Scheme shall not apply where tax arrears relate to assessment or reassessment made on the basis of information received under section 90 or section 90A of the Act. Accordingly, where information received u/s section 90 or section 90A has not been used for making additions in assessment/ re-assessment order, assesses can opt for the Scheme for such orders.

Where review petitions are pending before High Courts or Supreme Courts, whether those cases be eligible for settlement under DTVSV Scheme, 2024?

No. Pendency of review petition does not tantamount to pendency of an appeal. Therefore, even if a review petition is pending as on 22nd July, 2024, it will not amount to pendency of an appeal.

Whether DTVSV Scheme, 2024 can be availed in a case where proceedings are pending before Income Tax Settlement Commission (ITSC) or where writ has been filed against the order of ITSC?

No

Whether cases where the taxpayer or the Department has filed declaration/application under section 158A/158AA/158AB are eligible under DTVSV Scheme, 2024?

Yes. In such cases, where declaration/application has been filed u/s 158A/158AA/158AB of the Act on or before 22nd July, 2024, the taxpayer can opt for settlement under the Scheme provided that if there is any appeal relating to the relevant year, it is also settled.

Appeal has been set aside to ITAT/CIT(A)/DRP and was pending on 22.07.2024. Whether, in such cases the assessee can opt for the Scheme?

Refer FAQ No. 24 of Guidance Note 1/2024. It was mentioned therein that-

“According to the Scheme, an appeal which is pending as on 22.7.2024 shall be eligible for settlement. A set-aside matter to the AO is not an appeal pending as such. Therefore, set-aside matters to the AO, whether fully set-aside or partially set-aside are not covered under the Scheme.”

However, where an appeal has been set-aside fully to ITAT/CIT(A)/DRP, such appeals will be eligible for settlement.

Also, where an appeal has been partially set-aside to ITAT/CIT(A)/DRP, all the issues which have been set-aside will form a separate appeal and shall be eligible for settlement as such and disputed tax will be computed as if pending at the level to which it is set-aside.

Where the prosecution proceedings have not yet been filed before a court of law, whether the assessee is eligible for the Scheme?

Yes. Reference may be made to section 96 of the DTVSV Scheme, 2024. As per the provisions of section 96(a)(ii) of the said Scheme, the Scheme shall not apply in respect of tax arrears relating to an assessment year in respect of which prosecution has been instituted on or before the date of filing of declaration.

Accordingly, where the prosecution proceedings have not yet been filed before a court of law, the taxpayer can opt for the Scheme.

If the prosecution is for a different assessment year and the appeal for a different one, would it debar the assessee from the benefit of this scheme?

No. Section 96(a)(ii) prohibits such cases relating to an assessment year in respect of which prosecution has been instituted on or before the date of filing of declaration. Thus, prosecution in one assessment year does not debar the assessee from filing declaration for any other assessment year, if it is otherwise eligible.

The DTVSV Scheme, 2024 provides for the different rates where declaration is filed on or before 31.12.2024 and where it is filed on or after 1.1.2025. Please clarify whether payment of disputed amount is also required to be made before 31.12.2024 for applicability of the lower rate?

Reference may be made to the provisions of the Scheme read with DTVSV Rules, 2024. As per Rule 3 of the DTVSV Rules, 2024, the amount payable is linked to the date of filing of declaration. Accordingly, where declaration is filed on or before 31.12.2024, the amount payable by the declarant shall be as mentioned in column (3) of the Table specified in section 90 of the Finance (No.2) Act, 2024. However, where a declaration is filed on or after 1.1.2025, the amount payable by the declarant shall be as mentioned in column (4) of the said Table.

The payment of disputed amount is required to be made as per section 92(2) of the DTVSV Scheme i.e. within 15 days of the date of receipt of certificate in Form No. 2.

Whether any additional ground filed in relation to an appeal is to be considered while computing disputed tax?

If any additional ground has been filed on or before 22nd July, 2024, it shall be considered for the purpose of computing disputed tax.

Suppose penalty has been levied after the taxpayer has filed a declaration for the settlement of the associated quantum appeal. In such a case, whether on settlement of tax arrears of the quantum appeal, penalty in relation to such tax arrears would be waived off?

Reference may be made to the definition of tax arrears in section 89(1)(o) of the Scheme. Interest chargeable or charged and penalty leviable or levied are included in tax arrears.

However, the settlement for quantum appeal is made as a percentage of disputed tax, where disputed tax means income-tax including surcharge and cess. Thus, penalty leviable or levied are not included in disputed tax for settlement of quantum appeal.

Accordingly, on settlement of quantum appeal, the Designated Authority will grant immunity from penalty leviable or levied in respect of tax arrears settled under the Scheme.

Suppose in a case, the additions made in assessment have reached finality. There is no quantum appeal pending as on 22nd July, 2024. However, penalty appeal is pending as on 22nd July, 2024 which relates to the additions made in the said assessment order. Can a penalty appeal be settled independent of quantum appeal?

Penalties which are unrelated to quantum additions are clearly eligible for settlement where an appeal in respect of such penalty is pending as on 22nd July, 2024. These penalties are unrelated to quantum additions and therefore can be settled independently of quantum appeals.

Further, where the additions made in an assessment have reached finality and thus there is no quantum appeal pending as on 22nd July, 2024, there is no disputed income or disputed tax as on the specified date i.e. 22nd July, 2024. Therefore, such penalty can be settled separately under the Scheme as per Si. No. (c) & (d) of the Table in section 90 of the Scheme.

Whether appeal against penalties that are not related to quantum assessment like penalty u/s 271B, 271BA, 271DA of the Act etc. are also waived upon settlement of appeal relating to disputed tax?

No, appeal against such penalty order is required to be settled separately.

In case of APA/MAP, can the Scheme be opted for settling disputes pertaining to non-APA/MAP adjustments?

The Scheme envisages settling dispute in full. The Scheme does not envisage settling issues in part.

Therefore, whatever issues are there in a pending appeal are to be settled in full whether they pertain to APA/MAP adjustments or otherwise.

Whether credit for earlier taxes paid against disputed tax will be available against the payment to be made under DTVSV Scheme, 2024?

Yes. Credit for taxes paid against the disputed tax before filing declaration shall be available to the declarant.

In such cases where Appeal is pending as on 22nd July, 2024 but disputed tax demands have been already fully paid before filing of declaration. Are such cases eligible to avail DTVSV Scheme, 2024?

Yes. Reference may be made to section 94 of the DTVSV Scheme, 2024. The situation mentioned is clearly covered in section 94(2) of the Scheme. Accordingly, such cases shall be eligible for the Scheme.

In such cases where deductee has settled his appeal, whether TDS deductor would be relieved from its liability u/s 201(1) of the Act. Further, whether TDS deductor would be allowed to claim expense deduction u/s 40(a) of the Act?

Where a deductee has settled his tax liability, the deductor is relieved from his liability other than interest payable. However, consequential relief for expense deduction u/s 40(a) of the Act shall be available to such deductor.

Whether appeals filed before the Appellate Authority against intimation passed u/s 200A of the Act (regarding intimation on processing of TDS returns) can be settled under DTVSV Scheme, 2024?

Yes, if appeal in respect of intimation u/s 200A is pending as on 22nd July, 2024.

Whether Designated Authority can amend his order to rectify any patent errors?

Yes, the Designated Authority shall be able to amend his order under section 92 to rectify any apparent errors.

Where appeal is pending in respect of primary assessee which is a foreign entity not having adequate business presence in India. Whether such foreign entity can file declaration and settle its dispute through its representative assessee having presence in India?

Yes. With proper authorisation, a representative assessee can opt for settlement under the Scheme.

Even in the case of deceased tax-payer, the legal representative may also opt for settlement under the Scheme.

If the taxpayer avails DTVSV Scheme, 2024 for Transfer Pricing adjustment, will provisions of section 92CE of the Act apply separately?

Yes, secondary adjustment under section 92CE will be applicable. However, it may be noted that the provision of secondary adjustment as contained in section 92CE of the Act is not applicable for primary adjustment made in respect of an assessment year commencing on or before the 1st day of April 2016. That means, if there is any primary adjustment for assessment year 2016-17 or earlier assessment year, it is not subjected to secondary adjustment under section 92CE of the Act.