Direct Tax Code is a proposed legislation set to modernize, simplify and align India’s tax law into a single code by taking in a new era of efficient and transparent taxation.

On 21st August 2024, Finance Minister Nirmala Sitharaman during the 165th year of Income Tax in India introduced the forthcoming Direct Tax Code (DTC).

Its goal is to replace the existing Income Tax Act, 1961, with a more straightforward and transparent system.

The New Income Tax Bill is likely to be tabled in the Lok Sabha on Thursday as announced by FM Nirmala Sitharaman during her Budget speech on February 1.

Important Update

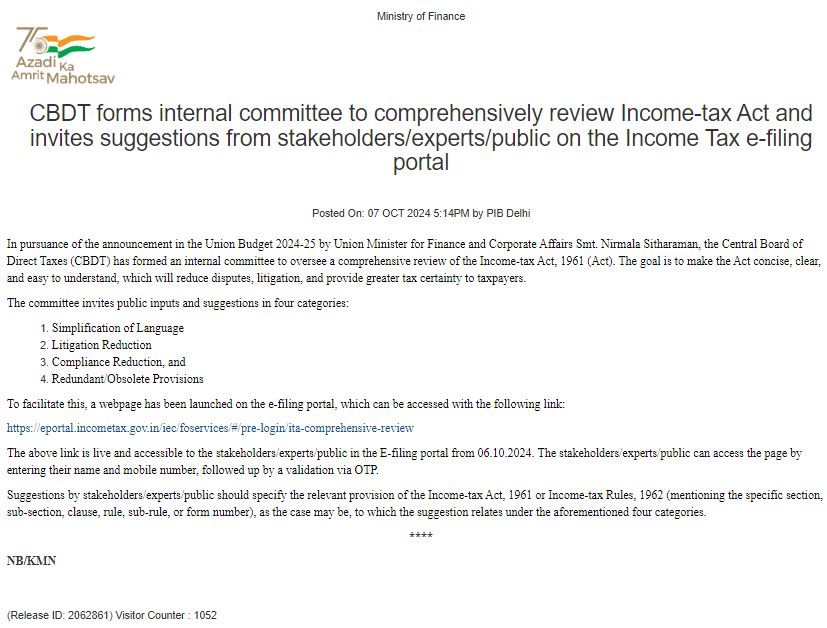

CBDT Seeks Public Feedback to Revamp Income-tax Act

The Central Board of Direct Taxes has set up a committee to review the Income-tax Act to simplify the Act, reduce disputes, and enhance tax certainty.

Public suggestions are invited and a dedicated webpage has been launched on the e-filing portal for submitting inputs.

Major Changes in Direct Tax Code

- The DTC 2025 eliminates the concepts of assessment Year and Previous Year. From now, taxpayer will only consider the Financial Year, streamlining tax filing.

- It will provide a simplified Residential Status. DTC removes terms like Resident but Not Ordinarily Resident (RNOR). The new system classifies taxpayers solely as resident or non residents.

- It includes capital gains as part of normal income, which means taxpayers may face higher tax rates on capital gain.

- The five heads of income remain but some categories get renamed. Example – “Income from Salary” becomes “Employment Income” and “Income from Other Sources” becomes “Income from Residuary Sources”.

- A common tax rate for both domestic and foreign companies to simply compliance for multinational business.

- The DTC 2025 eliminates most current deductions and exemptions, making tax filling easier and reducing loopholes.

Evolution of DTC

The concept of DTC has been in development for over a decade:

Year 2009

The First draft of the DTC was proposed to replace the Income Tax Act.

2010

A revised discussion paper was released, followed by the introduction of the Direct Tax Code Bill, 2010 in the Lok Sabha.

2013

The DTC was revised after considering feedback from stakeholders

2017

Six member task force was established to draft new Direct Tax Law.

2024

The announcement of DTC’s forthcoming introduction by Finance Minister Nirmala Sitharaman.

2025

The DTC is expected to be introduced with Budget 2025.

Purpose

- New tax law is believed to bring relief for individuals paying income tax as the slabs will be increased.

- Simpler language will be used for the tax laws by making it easier.

- This law aims to simplify the tax system by gradually removing multiple exemptions and deductions, making it more straightforward and transparent.

- Minimize the use of content and make it shorter, which will be easier to understand.

- A separate litigation unit is also recommended for processing the litigation cases.

- The proposed direct tax code should have fewer sections than income tax to simplify it.

- Easy Compliance by reducing the complexity of tax laws.

Difference between Income Tax Act and Direct Tax Code

| Nature | Income Tax Act | Direct Tax Code |

| Financial Year and Assessment Year | Both are applicable | Only Tax Year |

| Residential Status | Resident, Non Resident, Non Ordinarily Resident | Resident, Non Resident |

| Simplification | Proviso and explanation in very sections | No proviso and explanation |

| Tax Audit | Conducted by only Chartered Accountants | Can be conducted CA as defined in Section2(1)(b). |

| Tax on Distributed Income | Income from like LIC, mutual Fund etc are exempted | Taxable @ 5% |

| Tax Rate for Income above 10 Cr | 30% + Surcharge @ 15% | Taxable @ 35% |

| Taxation on Dividends | Subject to Dividend Distribution Tax @ 15% | Taxed @ 15% without DDT |

Tax Year Meaning As Per Income Tax Act 2025

Income Tax Act 2025 Proposed Clauses w.e.f 1st April 2026

Angel Tax

Domicile Certificate

Unified Pension Scheme (UPS)