Belated Return means the tax return which is filed after the original due date specified by the Income Tax Department.

Due Date Extended

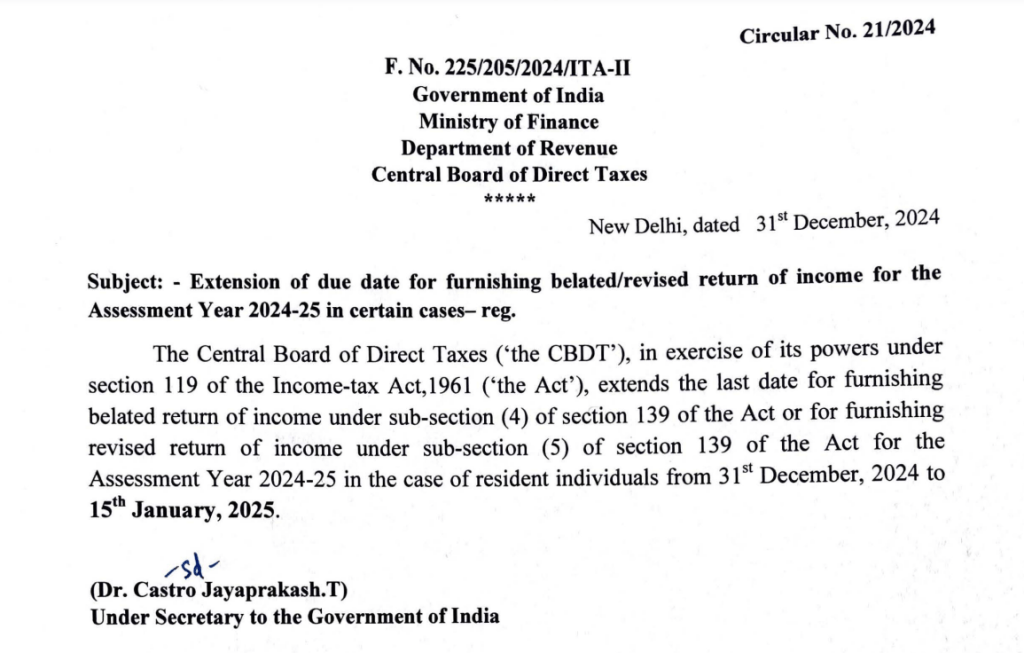

| CBDT extends the last date for furnishing Belated/ Revised return of income for AY 2024-25 in the case of Resident Individuals from 31st December, 2024 to 15th January, 2025. |

Official Notification

Extension of due date for furnishing belated/revised return of income for the Assessment Year 2024-25.

Latest Update

Bombay High Court Order on Section 87A

- The Bombay High Court has directed the CBDT to extend the due date for filing revised or belated ITR to January 15, 2025.

- This extension is to ensure that all taxpayers eligible for the rebate under Section 87A are afforded the opportunity to exercise their statutory rights without facing procedural impediments

Section 87A provides a rebate on income tax for individual taxpayers:

- Up to Rs.5 lakh taxable income (under the old regime).

- Up to Rs.7 lakh taxable income (under the new regime).

Case Details

- Issue: A PIL challenged the disabling of Section 87A rebate claims via the updated filing utility from July 5, 2024.

- Petitioner: The Chamber of Tax Consultants argued that the utility changes violated taxpayers’ rights.

Original Delayed Return Due Date

The due date to file belated return for FY 2023-24 is 31st December 2024.

Section 139(4) allows for the filling of a belated return i.e., return after the due date.

Demerits of Filling Belated Return

If taxpayer has incurred any losses under the head capital gain or any loss in your business during the financial year then you cannot carry forward these losses to the next years for set off against income in future year.

Late fees of Belated ITR

- If gross total income is less than 5 lakhs: Late filing fee amounting Rs.1,000 will be applicable to individuals whose total income is below the taxable limit.

- If gross total income is above 5 lakhs: Late filing fee amounting Rs.5,000 + Tax + Interest on tax amount will be applicable.

- If gross total income doesn’t exceed the exemption limit: No late fee is applicable.

If belated due date is over i.e., after 31st December 2024. Then you can file your return only through an updated ITR i.e., ITR-U. But there are few demerit:

- A taxpayer cannot claim TDS Refund.

- There will be no facility to file NIL Return.

- Required to pay penalty with an additional taxes ranging from 25% – 50% + Interest.

Consequences of Late ITR Filling

- You cannot file ITR in Old Tax Regime.

- Interest u/s 234A at the rate of 1% per month or a part thereof is applicable for late filling of ITR.

Click Here To Know About Revised Income Tax Return

FAQs

Yes, you can claim a refund through a belated return, but the return must be filed within the prescribed time limit.

Yes, even if you do not owe taxes, you can still file a belated ITR including late fees.

If you fail to file your ITR by the due date and don’t file a belated return within the allowed time, you may not be able to claim refunds or carry forward losses, and you may face penalties.