Aadhaar Authentication for GST registration is introduced by the government to verify the identity of individuals or businesses applying for GST registration.

Important update from 53rd GST Council Meeting

On 22nd June 2024 in the 53rd GST Council Meeting, Finance Minister Nirmala Sitharaman announced the nationwide implementation of biometric-based Aadhaar authentication for GST registration. The key points include:

- Biometric Aadhaar authentication will be introduced in across India.

- New GST registrations will require Aadhaar biometric authentication.

- FM Sitharaman said that this measure will help to address issues related to fraudulent input tax credit claims.

What is biometric-based Aadhaar authentication for GST registration?

Biometric-based Aadhaar authentication for GST registration means verifying an applicant’s identity using their Aadhaar-linked fingerprints or iris scan to ensure authenticity and prevent fraud in the GST registration process.

Rule on Aadhaar Authentication for GST Registration

Opt-in for Aadhaar Authentication

When an applicant apply for GST registration can choose Aadhaar authentication, except for those exempted by the Central government or those mandated to authenticate under Section 25(6C) of the CGST Act.

Mandatory Authentication Period

- From April 1, 2020, to August 20, 2020, Aadhaar authentication was mandatory for all registration applications.

- From August 21, 2020, onwards, opting for Aadhaar authentication became a choice.

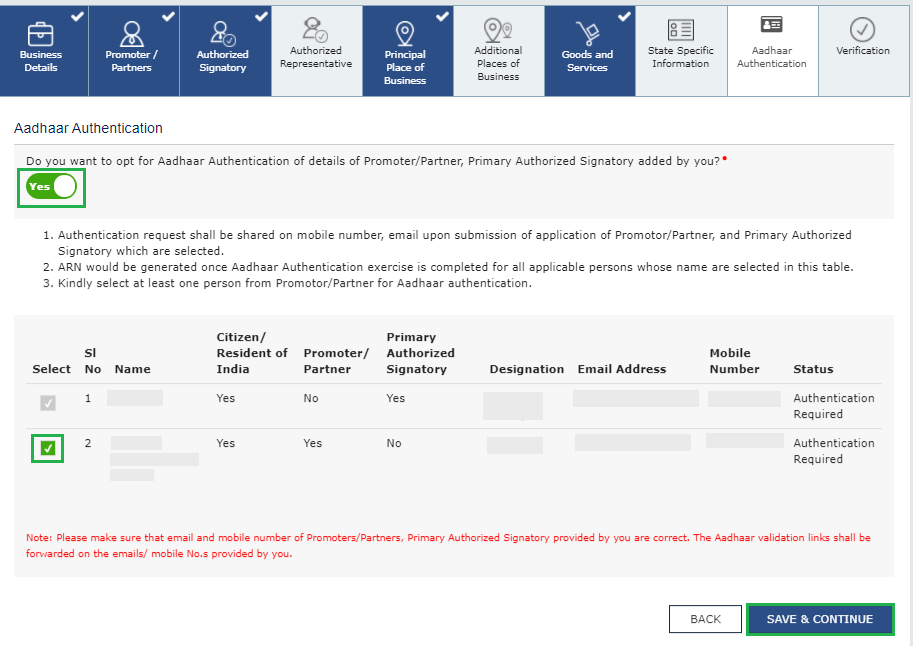

Authentication Process in GST Registration

- Submit Aadhaar number with the GST registration application.

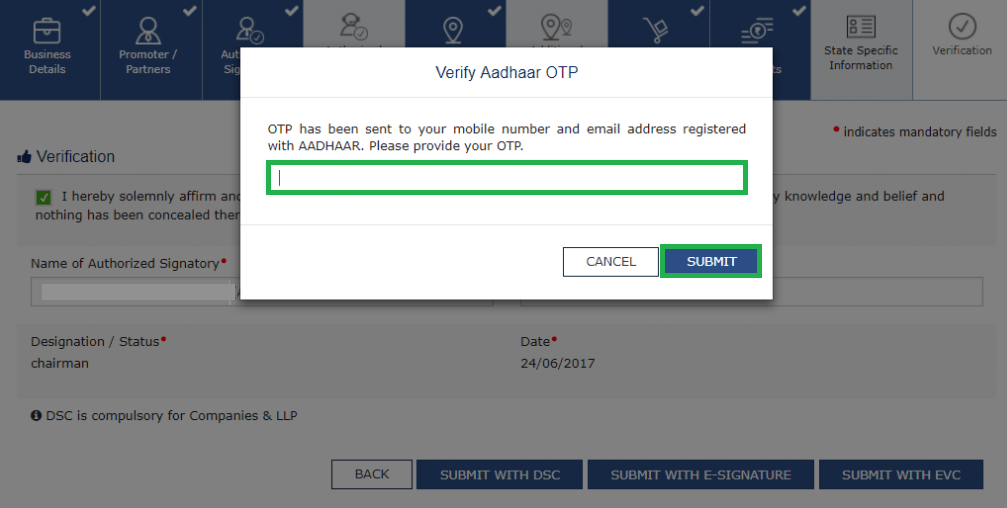

- E-verify using an OTP sent to the Aadhaar-linked mobile number and email.

- Aadhaar authentication is required for the primary authorized signatory and at least one promoter or partner.

- For entities like companies, LLPs, foreign companies, AOPs, societies, trusts, or clubs, only the primary authorized signatory needs to be authenticated.

Post-Authentication

After successful authentication, an OTP will be required for future filings on the GST portal.

Failure to Authenticate

If Aadhaar authentication is not completed:

- The application can proceed without it.

- Registration will be granted after physical verification of the business premises by a GST officer or e-KYC verification with approval from a higher-ranking officer.

Notification and Response

- A notice (Form GST REG-3) is issued within 21 days if authentication fails.

- The applicant must respond within 7 working days (Form GST REG-4).

- The officer has 7 days to approve or reject the application.

Physical Verification

If Aadhaar is not available, physical verification of the business premises will be conducted within 60 days from the application date.

Mandatory Aadhaar Authentication

Under Section 25(6C) of the CGST Act, the Aadhaar authentication is essential for the following class of individuals as per Rule 8 of the CGST Act in order to become eligible for for the GST enrollment:

- Authorized signatories of all types.

- Managing/authorized partners of a partnership firm.

- Karta of a Hindu Undivided Family (HUF).

Exceptions

Non-citizens of India or individuals other than those listed (e.g., authorized signatories, partners, Karta) are exempt from mandatory Aadhaar authentication.

Cases and timelines for deemed approval of a GST registration application

| Case | Timeline | Deemed Approval |

| Successful Aadhaar Authentication or Exemption | 3 working days from the date of submitting the application. | If the officer fails to take action within 3 working days, the application is deemed approved. |

| Opted but Failed to Complete Aadhaar Authentication | 21 working days from the date of submitting the application to issue a notice in Form REG-3. | If the officer fails to to take action within 21 working days, the application is deemed approved. |

| Did Not Opt for Aadhaar Authentication | 21 working days from the date of submitting the application. | If the officer fails to take action within 21 working days, the application is deemed approved. |

| Opted but Failed to Complete Aadhaar Authentication | 7 working days from the date of receipt of the response, information, or required documents (after issuing notice in Form GST REG-3 and receiving a reply in REG-4). | If the officer fails to take action within 7 working days after receiving the response, the application is deemed approved. |

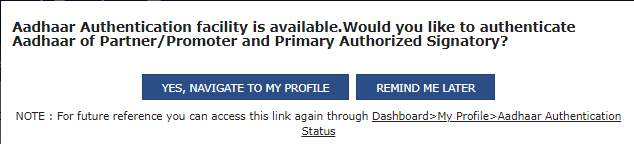

Aadhaar Authentication for Existing Taxpayers

- Login to the GST Portal with valid credentials i.e. your user id and password.

- After logging in a pop-up message window is displayed with the question “Aadhaar Authentication facility is available. Would you like to authenticate Aadhaar of Partner/ Promoter and Primary Authorized Signatory?”.

- Two options are displayed: YES, NAVIGATE TO MY PROFILE and REMIND ME LATER.

- Selects the option “YES, NAVIGATE TO MY PROFILE” for Aadhaar Authentication.

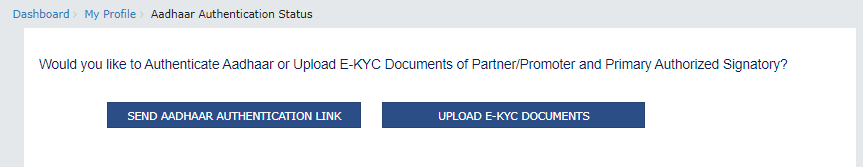

- Select ‘SEND AADHAAR AUTHENTICATION LINK’ from the two options – Send Aadhaar authentication link or upload e-KYC documents.

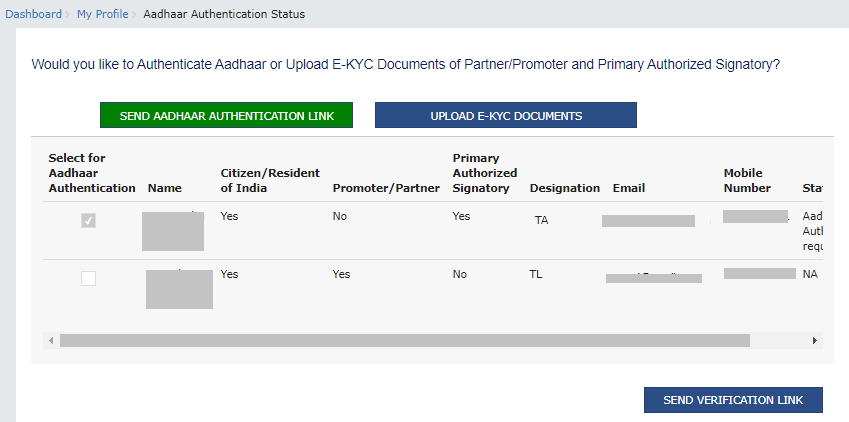

- In case, the column of Promoter/ Partner displays more than one name, the taxpayer needs to select only one name out of them.

- Then, Click the SEND VERIFICATION LINK to send link to the selected promoter/ partner.

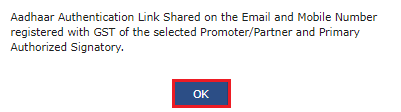

- A pop-up message will be displayed stating the link has been shared on the GST registered Email and mobile number. Click OK to close the window.

FAQs

Yes, it is mandatory for the following class of individuals as per Rule 8 of the CGST Act.

The key steps in biometric Aadhaar authentication for GST registration:

1. Submit GST registration application with Aadhaar number. 2. Get an email with OTP or appointment link. 3. Enter OTP for online verification or schedule a biometric visit to a GST Suvidha Kendra.

The complete GST registration procedure takes 7 to 10 working days.