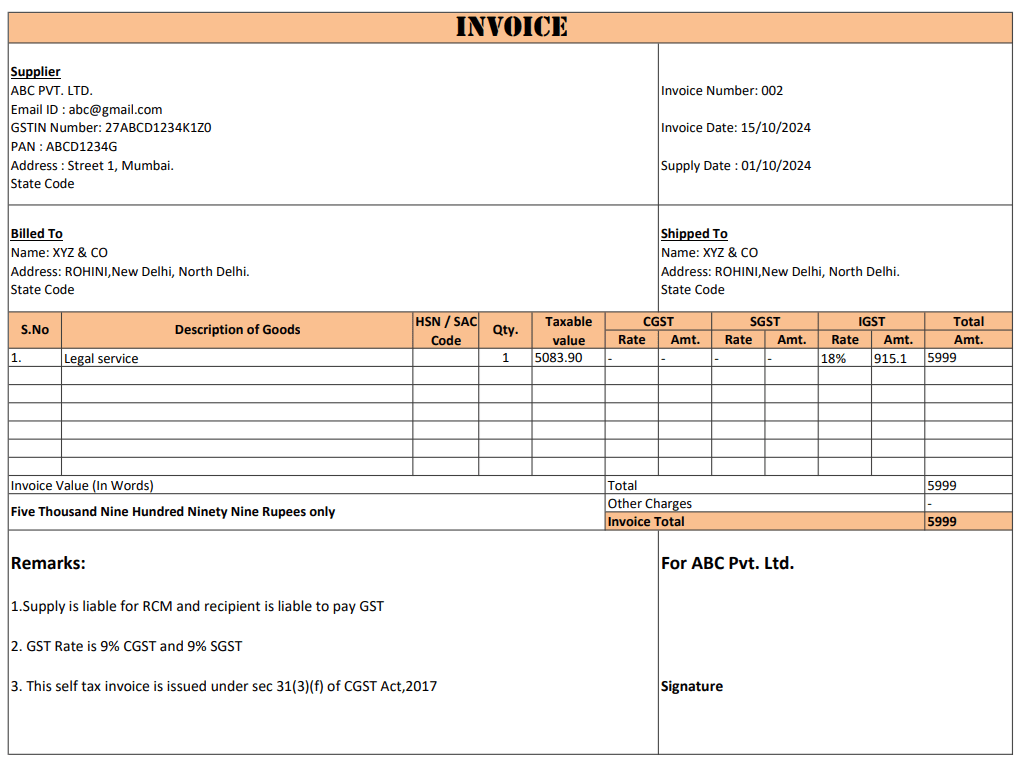

Self Invoicing under RCM must be issue by the recipient of goods or services on behalf of the supplier as it is essential for claiming Input Tax Credit (ITC) and for overall compliance with GST regulations.

Applicability

From 1st November 2024 it has become mandatory to prepare self-invoicing for all transactions liable to Reverse Charge Mechanism (RCM).

Meaning of Self Invoicing under GST

In case of forward charge or normal charge invoice is issued by supplier to recipient but in case of RCM supply, tax invoice is to be issued by recipient himself u/s 31(3)(f) such invoice is called self invoicing under GST.

Time Limit

Rule 47 – In the case of taxable supply of service, provide time limit for issuing invoice within 30 days from the date of supply.

However, it may be noted that there is no clarity provided under rule 47 with respect to the time limit to issue self-invoice under RCM. Hence, in many cases taxpayers either do not issue such self invoice or issue self invoice at the end of year.

To overcome the challenge and timely preparation of self invoicing in case of RCM, Sec 31(3)(f) amended via Finance Act, 2024 (Part2) to add the limit which may be prescribed in rules and accordingly Notification No. 20/2024 dated 8th Oct 2024 issued which specify the time limit for self invoicing in case of RCM as within 30 days of supply.

The time limit of self-invoicing is effective from 1st Nov 2024.

Invoice Format for Self Invoicing under RCM

Click Here To Download The Format.

Time of Supply for Services under RCM

Section 13(3) of the CGST Act has been amended to define the time of supply for services under RCM shall be the earlier of the following case:

- The date of payment as recorded in the recipient’s books or the date on which the payment is debited in his bank account, whichever is earlier, or

- The date immediately following sixty days from the date of issue of invoice by the supplier.

- The date of issue of invoice by the recipient, in cases where invoice is to be issued by the recipient.

Conclusion

The amendments signifies the government’s commitment to refining the GST framework for better compliance and transparency.

Businesses must adapt to these changes by updating their internal processes, ensuring timely self-invoicing, and maintaining accurate records of RCM transactions.