Direct Tax Vivad Se Vishwas Scheme making it more beneficial for those who join the scheme late as it offers less settlement amounts for “new appellants” compared to “old appellants”.

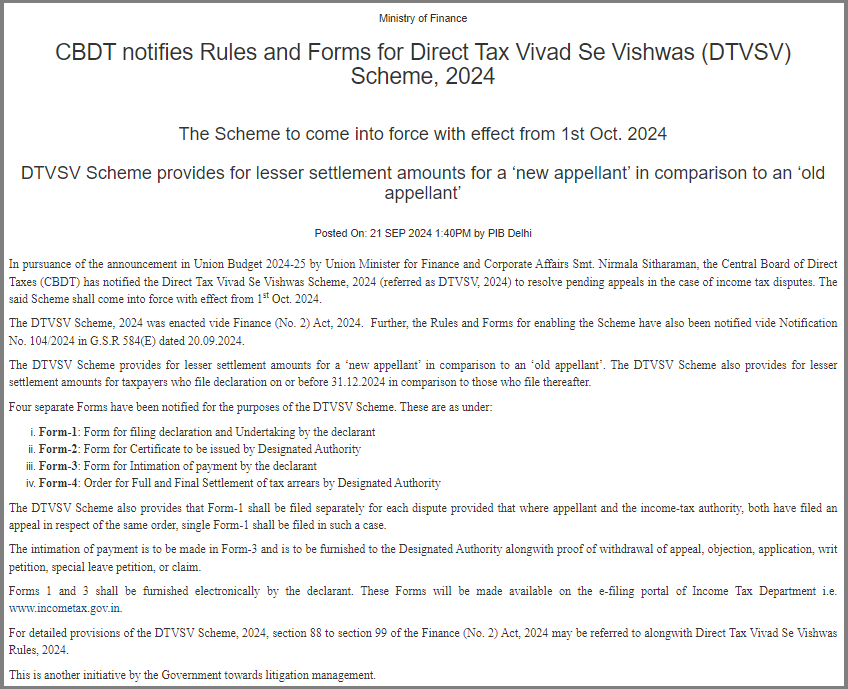

The Union Government has announced the second edition of Vivad Se Vishwas Scheme (VSV 2.0 or Direct Tax Vivad Se Vishwas Scheme, 2024) which will become operational from 1st October 2024.

The rules and forms for the scheme have been notified in Notification No. 104/2024 in G.S.R 584(E) dated 20.09.2024. For detailed provisions of the scheme section 88 to 99 of Finance Act, 2024 may be referred.

Key Highlights

- Vivad Se Vishwas Scheme 1.0 which was launched in 2020, gained a massive response from taxpayers at resolving tax disputes.

- Around 4,83,000 direct tax appeals were pending across various forums before the VSV scheme wasintroduced.

- This scheme (Direct Tax Vivad Se Vishwas Scheme 2024) would allow to settle tax related disputes for cases which are pending before appellate authorities, High Court, Supreme Court, Dispute Resolution Panel and revised applications filed before Income Tax Comissioner.

- This new edition will also help taxpayers to settle their tax disputes and appeals efficiently within the limited time window.

- No prosecution will be initiated under this scheme for the cases resolved.

Why this Matters

- Reduce pending litigation cases

- Generation of Revenue

- Relief from pending demands

Eligible applicants

- Tax payers with pending appeals before the Supreme Court, High Courts, Income Tax Appellate Tribunal (ITAT), Commissioner (Appeals) and Joint Commissioner (Appeals).

- Taxpayers who have their writ petitions and special leave petitions (SLP) pending.

- Assessee who have filed appeals but not paid taxes or interest.

- Taxpayers who have disputes related to Income Tax, Wealth Tax, Minimum Alternate Tax (MAT), Alternate Minimum Tax (AMT), Tax on distributed income of Domestic Company under section 115-O, Tax on distributed income of Mutual Fund under section 115-R.

- Objections have been filed before the Dispute Resolution Panel (DRP) and directions have not been issued on or before 22nd July 2024.

- Dispute Resolution Panel (DRP) has issued directions under section 114C(5) and the Assessing Officer (AO) has not completed the assessment under section 144C(13) on or before 22nd July 2024.

- Assessees who have filed an application for revision under section 264 of the Income Tax Act and such application is pending as on the specified date.

Ineligible applicants

- Taxpayers with pending

- searches or seizures

- prosecution proceedings

- Cases o fundisclosed foreign income or assets

- Cases related to Goods and Services Tax (GST)

- Cases related to Tax deducted at source or Tax collected at source (TCS)

- Cases related to assessment/reassessment made on the basis of tax exchange information agreement

- Cases related to Benami Property transaction

- Cases related to Money Laundering

Forms to be filed to avail the scheme

Form- 1:

Declaration and undertaking, seperately for each dispute by the declarant.

Form-2:

Certificate issued by the Designated Authority.

Form-3:

Intimation of payment by the declarant.

Form-4:

Order for full and final settlement of tax arrears by the Designated Authority.

Last date to avail the scheme: December 31, 2024

New Appellants

Lower settlement amounts for those filing after July 22, 2024.

Old Appellants

Standard settlement amounts for those with pending appeals as of July 22, 2024.

This is another initiative by the Government towards tax administration, regulatory compliance and litigation management.