RCM on Commercial Rent refers to the Reverse Charge Mechanism, where the recipient tenant is liable to pay GST on commercial rent. This occurs when the landlord is unregistered and the tenant is registered. The government clarified the RCM on commercial rent in the recent GST Council Meeting.

According to the 54th GST Council Meeting, GST will be applied to renting commercial properties owned by unregistered individuals to registered persons through the Reverse Charge Mechanism (RCM).

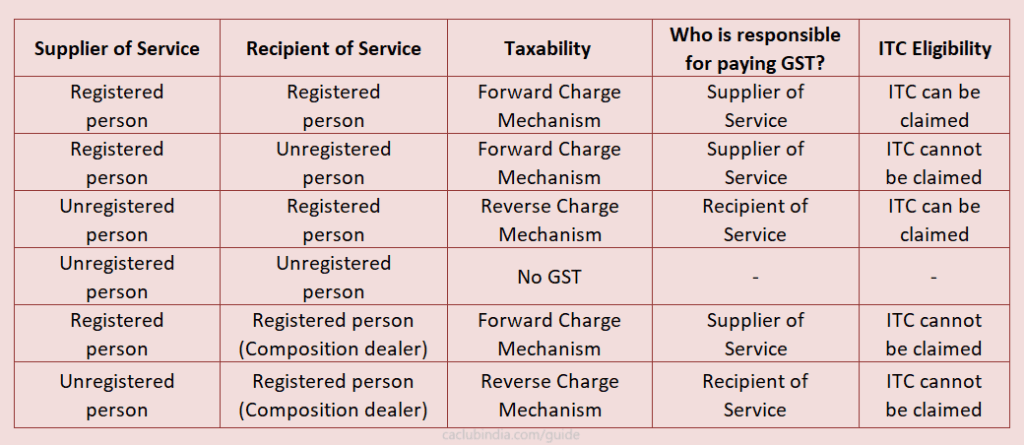

Previously, renting commercial property by a registered person to a registered/unregistered person was liable to GST under the forward charge mechanism and renting commercial property by an unregistered person to a registered/unregistered person was not liable to GST.

As per Notification No. 09/2024-Integrated Tax (Rate) dated 8th October 2024, RCM shall be applicable to services by way of renting any property other than a residential dwelling provided by any unregistered person to any registered person.

This notification come into force from October 10, 2024.

Various scenarios in the case of renting commercial property

Renting of commercial property has come under the purview of the GST Act. Exemptions under GST are only available for properties that are used exclusively for residential purposes.

The main purpose of this amendment is to stop revenue loss and improve tax collection, particularly concerning unregistered service suppliers.

Impact on Landlords and Tenant

For Registered Landlords

If the landlord is registered under GST, they charge GST at 18% on the rent to the tenant, and the tenant pays the GST along with the rent.

For Unregistered Landlords

If the landlord is not registered under GST, the RCM applies, and the tenant (if registered) is responsible for paying the GST directly to the government.

This impacts small landlords who do not meet the GST registration threshold but rent out commercial properties to registered businesses.

ITC (Input Tax Credit) for Tenants

Tenants paying GST under RCM can avail of Input Tax Credit (ITC) on the GST paid under RCM, provided they are using the property for business purposes.

This reduces the effective cost of renting for businesses since they can set off the GST paid under RCM against their GST liability on other supplies.

Cash Flow Impact on Tenants

RCM may affect the tenant’s cash flow, as they need to pay the GST on the rent directly to the government rather than just paying it as part of the rent to the landlord.

However, tenants who are eligible for ITC can offset this GST liability against their output tax liability, so the overall tax burden remains neutral.

Accounting and Compliance Burden

For Tenants

Tenants need to be aware of their responsibility to pay GST under RCM. They must ensure they correctly account for the GST liability, pay it to the government, and claim ITC, which adds to the administrative and compliance burden.

For Landlords

While unregistered landlords are not directly impacted by RCM in terms of GST compliance, their tenants may prefer dealing with registered landlords to simplify their tax processes.

Exemptions and Thresholds

The RCM does not apply to small landlords whose aggregate turnover is below the GST registration threshold (Rs.20 lakhs for most states, Rs.10 lakhs for some special category states).

Additionally, if the tenant is unregistered under GST, RCM does not apply, and no GST is payable on the rent.

Impact on Commercial Real Estate Sector

| For Small Property Owners | For Large Businesses |

| Small landlords who rent out commercial properties to registered businesses may face reduced demand if tenants prefer renting from GST-registered landlords to avoid the complexity of RCM. | Larger businesses renting commercial properties may prefer to deal with registered landlords, which could shift market dynamics in the commercial real estate sector. |

Tax Rate on Commercial Rent

GST on commercial rent is currently taxed at 18% under the services category. This applies whether GST is paid by the landlord or under RCM by the tenant.

Even when RCM applies, the applicable tax rate remains the same.

Points To Remember

- It applies only to immovable property.

- RCM applies when a registered person takes a commercial property as rent from an unregistered landlord.

- The tenant must pay GST under RCM at rate of 18%.

- RCM does not apply to residential dwellings, even if it used for commercial purposes.

- If both landlord and tenant are unregistered, then no GST is applicable.

- GST is payable under forward charge if landlord is registered.

- The registered tenant can claim ITC if the property is used for taxable business purposes.

Conclusion

The application of RCM on commercial rent has broad implications for tenants, landlords, and the overall real estate sector. While it shifts the tax burden from landlords to tenants, it ensures that GST is collected on rental transactions, even when landlords are unregistered.

For tenants, especially businesses, RCM means added responsibilities in terms of compliance and cash flow management, but the availability of ITC can help offset the GST paid under RCM.

The RCM on commercial rent also influences leasing decisions, favoring registered landlords, while contributing to better tax compliance across the commercial property market.

FAQs

GST is calculated at 18% (9% CGST & 9% SGST) in case of intra-state supply and 18% IGST in case of inter-state supply of services. GST shall be calculated on the taxable value.

GST shall be exempted in the case of religious trusts or registered charitable trusts where it is meant for the public.

The threshold limit for GST registration for providing services only is Rs. 20 lakhs.

Hence, if the rental income from commercial properties is greater than Rs. 20 lakhs, then GST registration is mandatory.

(Note: Rs. 10 lakhs limit is available only for special category states)

If all the conditions are satisfied under section 16 of the CGST Act, 2017, such as disclosing the tax paid in the returns, ensuring GST has been paid etc., then one can avail ITC on such GST paid on rent.

There is no TDS deduction under the CGST Act. However, there is a TDS deduction under the Income Tax Act at 10%.