Fake GST registrations are being used to fraudulently pass on input tax credit to unscrupulous recipients by issuing invoices without any underlying supply of goods or services.

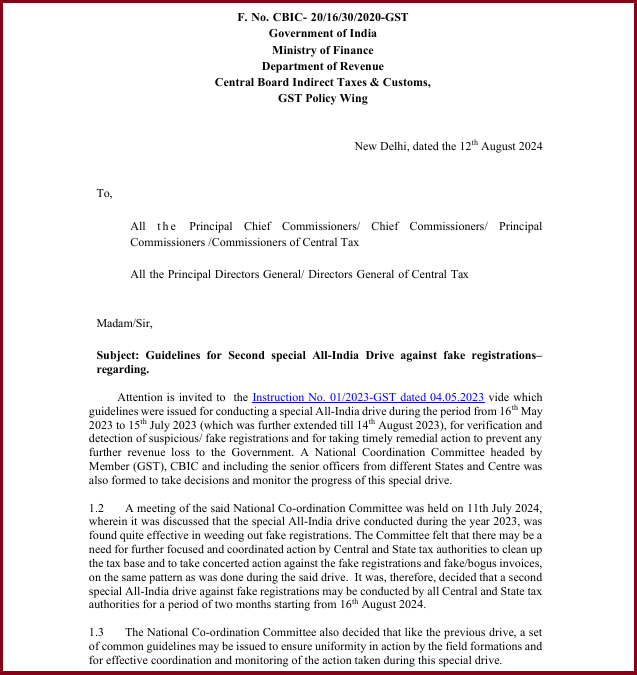

For this CBIC will start a special drive against fake GST registrations from August 16 to October 15.

Tax officers will begin a two-month special drive to remove the fraudulent entries from the tax system.

First drive results in detecting fake GST registrations

A similar drive was done in the previous year from May 16, 2023 to July 15, 2023 which suspected GST evasion of over Rs 24,000 crore and detection of nearly 22,000 fake registrations.

Reasons to conduct second all-India drive against fake GST registrations

The main reasons are:

- Some taxpayers make forged documents such as electricity bills, property tax receipts, and rent agreements etc. to use as proof of principal place of business to obtain GST registration.

- Misuse the identity of other person to obtain fake/bogus registration under GST.

Documents to keep ready for GST officers

GSTIN on sign board

Every registered person must display his/her Goods and Services Tax Identification Number on sign board at principal place of business.

KYC and financial records for verification

- Original PAN and Aadhar of owner.

- GST registration certificate.

- Filed ITR copy for financial verification.

- Bank statements of firms.

Return records

All the filed copy of GST returns and sale purchase records must be kept for verification.

Documents of principal place of business

- Rent agreement if it a rented premises.

- Latest electricity bill or any other ownership proof for owned premises.

Penalties or actions on fake GST registrations

Under GST, the penalties include:

- For incorrect Invoicing penalty upto Rs. 25,000.

- Penalty as per sections 73 or 74, with 100% tax due in fraud cases or 10% in non-fraud cases, both with a minimum of Rs. 10,000 for opting composition scheme even though ineligible.

- Penalty of 100% of the tax due or Rs. 10,000, whichever is higher, if:

- not issuing an Invoice

- excess GST is not paid to the government.

- committing Fraud or high-value cases may also lead to jail.

Penalties on the amount of ITC availed by the taxpayer with the help of fake invoices

| Imprisonment can be faced | ITC availed |

| Up to 5 years along with a fine | Exceeds Rs. 5 Crore |

| Up to 3 years and a fine | Exceeds Rs. 2 Crore but not above Rs. 5 Crore Exceeds Rs. 1 Crore but doesn’t exceed Rs. 5 Crore |

| Up to 6 months with a fine | Commits in any of the offenses mentioned above |

FAQs

Frauds in GST involve fake invoices, claiming false ITC, under reporting sales, registering with forged documents, or charging incorrect GST rates to evade taxes.

The CBIC launch this special drive to combat the issue of fake GST registrations, which leads to significant tax evasion and undermines the integrity of the tax system.

Tax officers may include field visits, audits, and cross-verification with other records.