Small Trusts and Institutions are non-profit organisations—charitable trusts, religious trusts, educational societies, and NGOs—operating with limited assets, income, or beneficiaries. While they are generally exempt from strict regulatory compliance, they must still register under applicable laws, such as the Income Tax Act, the Trusts Act, or the Societies Registration Act.

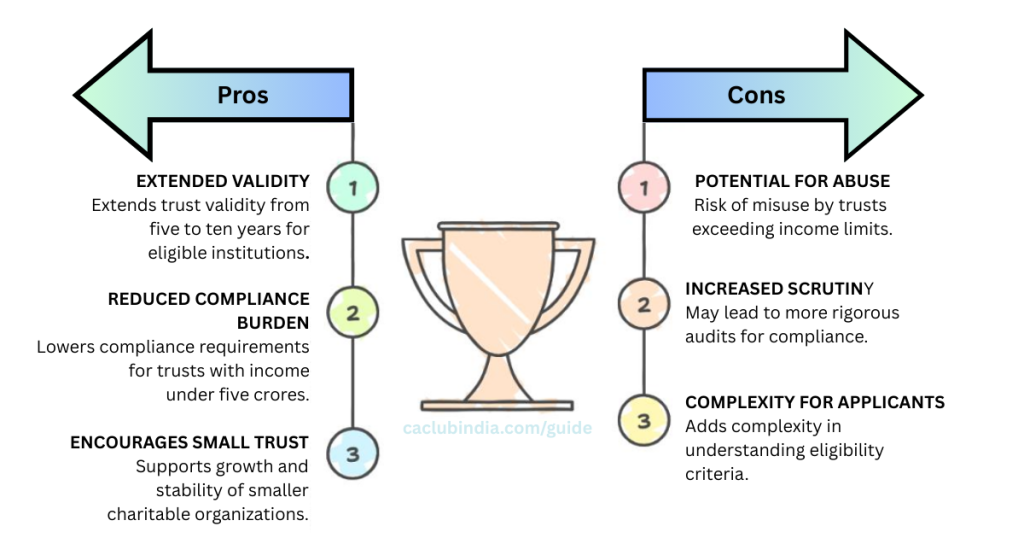

The Finance Bill 2025 proposes extending the registration validity period for trusts and institutions from five to ten years, provided their total income (before exemptions under Sections 11 and 12) remains below Rs. 5 crores in each of the two preceding financial years. This change is expected to ease compliance burdens for smaller charitable organisations. However, certain ambiguities in the proposal need clarification to ensure its practical effectiveness.

It is worth recalling that the Hon’ble Finance Minister Nirmala Sitharaman in the previous year had highlighted that the Finance (No. 2) Bill, 2024, initiated steps to streamline the tax framework for charitable organisations. One of the key reforms introduced was the consolidation of the dual tax exemption systems—Section 10(23C) and Section 12A—into a unified structure.

The Proposed Amendment

In Section 12AB(1), the following proviso shall be inserted:

‘Provided that where an application is made under sub-clauses (i) to (v) of the said clause, and the total income of such trust or institution, without giving effect to the provisions of sections 11 and 12, does not exceed rupees five crores during each of the two previous years, preceding the previous year in which such application is made, the provisions of this subsection shall have effect as if for the words “five years”, the words “ten years” has been substituted.’

The proposed amendment extends the registration validity period from five to ten years for eligible trusts and institutions. To qualify, an organisation’s gross income (before exemptions under Sections 11 and 12) must not exceed Rs.5 crore in both of the two financial years immediately preceding the application year.

Trust Application Extension

Is the benefit applicable to all eligible entities with income below Rs. 5 crore?

The enhanced 10-year registration benefit is specifically available to trusts and institutions applying under sub-clauses (i) to (v) of Section 12A(1)(ac). This includes cases of:

- Re-registration of existing entities,

- Renewal of registration, or

- Conversion from provisional to permanent registration.

Exclusion: The benefit does not apply to first-time applicants under sub-clause (vi), whether applying before or after commencing operations. Thus, newly established trusts or institutions seeking initial registration remain subject to the standard validity period.

Sub-clauses (i) to (v) of Section 12A(1)(ac) are given below-

| (ac) notwithstanding anything contained in clauses (a) to (ab), the person in receipt of the income has made an application in the prescribed form and manner to the Principal Commissioner or Commissioner, for registration of the trust or institution,— (i) where the trust or institution is registered under section 12A [as it stood immediately before its amendment by the Finance (No. 2) Act, 1996 (33 of 1996)] or under section 12AA, [as it stood immediately before its amendment by the Finance Act, 2020] within three months from the date on which this clause has come into force; (ii) where the trust or institution is registered under section 12AB and the period of the said registration is due to expire, at least six months prior to expiry of the said period; (iii) where the trust or institution has been provisionally registered under section 12AB, at least six months prior to expiry of period of the provisional registration or within six months of commencement of its activities, whichever is earlier; (iv) where registration of the trust or institution has become inoperative due to the first proviso to sub-section (7) of section 11, at least six months prior to the commencement of the assessment year from which the said registration is sought to be made operative; (v) where the trust or institution has adopted or undertaken modifications of the objects which do not conform to the conditions of registration, within a period of thirty days from the date of the said adoption or modification; Exclusion- (vi) in any other case, at least one month prior to the commencement of the previous year relevant to the assessment year from which the said registration is sought, and such trust or institution is registered under section 12AB;] |

The exclusion of Section 12A(1)(ac)(vi) means new applicants must initially obtain a three-year provisional registration if applying before commencing operations.

However, they can convert this to a full ten-year registration within six months of starting activities, provided they qualify as small charities (income below ₹5 crore).

Thus, while first-time applicants don’t get immediate ten-year validity, a pathway exists for them to secure longer-term registration after launching operations.

Two types of registration for new charities

Uncertainty Regarding Registration Tenure Upon Income Exceeding ₹5 Crore

The current provisions lack explicit guidance on whether the ten-year registration remains valid if an organisation’s income surpasses ₹5 crore during the registration period. While the ₹5 crore threshold determines initial eligibility for extended validity, the rules do not specify whether crossing this limit subsequently affects the registration’s duration or requires immediate revalidation. This ambiguity necessitates clarification to ensure consistent implementation.

Applicability to Existing Five-Year Registrations

The revised provisions fail to offer immediate relief to already-registered small charities, as the extended ten-year validity applies only during renewal applications. This means existing organisations must complete their current fiveyear term before benefiting from the longer registration period, assuming they continue to meet the income criteria.

A more impactful approach would have been granting automatic ten-year extensions to all eligible charities (with sub-₹5 crore income) currently within their registration period. Such a measure would have better served the amendment’s objective of reducing compliance burdens for small nonprofits.

Applicability of the Amendment to Section 80G Approvals

The current amendment specifically addresses registration validity under Sections 11 and 12, but does not automatically extend the approval period for Section 80G tax benefits. The tenure for Section 80G certifications remains governed by its existing provisions, which typically require separate renewal processes.

Effective date of the Amendment

The amendments will take effect from 1st April 2025, but their scope remains unclear – whether they apply only to registration certificates issued after this date or to all applications submitted post-implementation. This ambiguity creates uncertainty for trusts with pending applications or nearing renewal during the transition period.

FAQs

1. Assets below ₹5 crore (up from ₹2 crore).

2. Annual income under ₹50 lakh (previously ₹20 lakh).

3. Must operate for charitable, religious, educational, or social welfare purposes.

Yes, but it must notify authorities and comply with stricter audit/reporting rules.

Trusts: Registered under the Indian Trusts Act, 1882.

Societies: Formed under the Societies Registration Act, 1860.

Section 8 Companies: Non-profit companies under the Companies Act, 2013.

Reduced Compliance: Smaller entities get exemptions (e.g., relaxed audits, simpler reporting).

Encouragement for Grassroots Work: Lower barriers for local, community driven organizations.

Preventing Misuse: Stricter random checks under the 2025 rules to curb fraud.