The implementation of the Goods and Services Tax (GST) in India has significantly changed the way businesses operate, and freelancers are no exception. As the gig economy expands and more individuals turn to freelancing across fields like content creation, graphic design, software development, digital marketing, and consulting, understanding the implications of GST becomes crucial.

A freelancer is a person who provides his professional services on contract basis. Under GST, freelancers are treated as service providers. If a freelancer provides services across states or earns above a certain income threshold, GST compliance becomes mandatory. Freelancers, like any other service provider, need to register for GST if their annual turnover exceeds ₹20 lakhs (₹10 lakhs for special category states).

Rules for GST are same for individual freelancers as well as partnership firms, LLP, Companies etc. These same rules apply to self-employed professionals whether providing services to a single client or to multiple clients.

Registration of GST for Freelancers

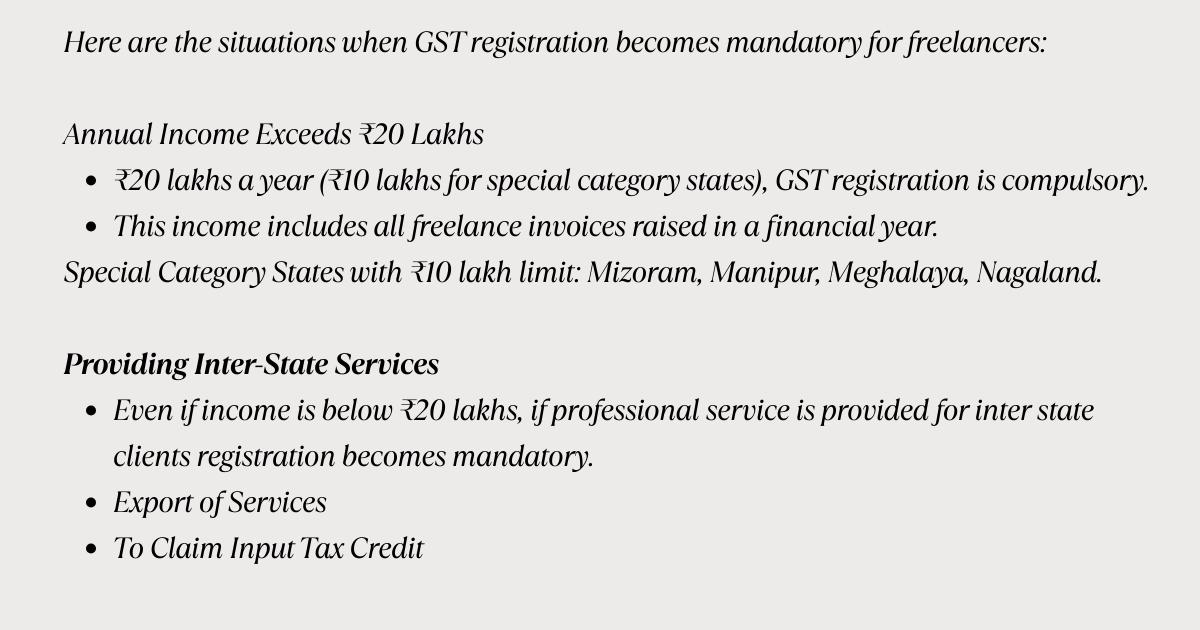

GST registration for freelancers is mandatory under certain conditions, primarily based on their annual turnover. Freelancers must register for GST if their annual turnover exceeds ₹20 lakh. Turnover includes intra state, inter state and export of services.

Special States

List of Special Category States under GST (as per current provisions):

Initially, 11 states were classified as special category states, but currently, only these 4 are treated as special states for GST purposes:

- Arunachal Pradesh

- Manipur

- Meghalaya

- Mizoram

Note: The following states were earlier special states but have been removed from that category for GST threshold limits:

- Assam

- Himachal Pradesh

- Sikkim

- Tripura

- Uttarakhand

- Nagaland

They now follow the standard threshold of ₹20 lakhs for service providers.

Compulsory Registration for Freelancers

Following Freelancers should compulsorily register under GST:

- A person whose Turnover exceeds 20 Lakhs for normal states and 10 Lakhs for Special State Category.

- A freelancer who provides services inter state.

- A freelancer who exports his services

- A freelancer in Online Information and Database Access and Retrieval services (‘OIDAR’).

Freelancing for International Clients (Export of Services)

Working with clients outside India, shall qualify as an export of services. Exports are zero-rated under GST.

Freelancers can choose to:

- Export under LUT (Letter of Undertaking) without charging GST and claim Input Tax Credit refund, or

- Pay IGST, export the service, and claim a refund of the IGST paid.

To qualify, payments must be received in foreign currency, and client must be located outside India.

Letter of Undertaking (LUT)

It is a declaration that a registered person (like a freelancer or exporter) submits to the GST department to export services or goods without paying IGST (Integrated GST).

Freelancer working with international clients, and the services provided are treated as export of services under GST.

By default, exports are zero-rated.

However, if LUT is not filed with the GST department , then it is required to charge IGST on export invoices, pay it to the government, and then apply for a refund—which is a longer process.

Filing an LUT helps to skip the payment step entirely.

Benefits of Filing LUT for Freelancers

- No need to pay IGST on export invoices

- Easier cash flow—no blocked capital waiting for refunds

- Access zero-rated export status

- Faster and more efficient international invoicing

GST Rates Applicable to Freelancers

Most freelancing services fall under SAC (Services Accounting Code) 9983 or 9984, attracting a GST rate of 18%. This includes:

- IT services

- Digital marketing

- Content creation

- Graphic design

- Online education

- Consultancy, etc.

Documents Required for GST Registration for Freelancers

PAN Card

- Mandatory for registration.

- Should be in the name of the applicant (freelancer).

Aadhaar Card

- Used for identity verification.

- Aadhar-based e-KYC is part of the application process.

Photograph

- Recent passport-size photograph of the applicant.

- Required if registering as a proprietorship

Business Address Proof

Any one of the following:

- Utility bill (electricity bill, water bill, gas bill) – not older than 2 months

- Rent agreement (if you’re renting the place)

- Ownership document (if you own the premises)

- NOC from owner (if you’re working from someone else’s premises)

If a freelancer is working from home, they can still register using residential address.

Bank Account Proof

Any one of the following:

- Cancelled cheque

- Bank statement

- Passbook copy (with your name and account number)

Digital Signature Certificate (DSC) (Optional)

- Not mandatory for proprietorships or individual freelancers.

- Required only for companies or LLPs.

Declaration or Authorization Letter

If applying through a CA or authorized person.

Other Points to Note

- Registration is done online on the GST portal.

- You’ll receive an Application Reference Number (ARN) after submission.

- Once documents are verified, the GSTIN (GST Identification Number) is issued within 7–10 working days.

Reverse Charge Mechanism (RCM) and Freelancers

If a freelancer purchases services from a foreign supplier (e.g., Google Ads, foreign software tools), GST may be payable under the Reverse Charge Mechanism (RCM).

- Under RCM, the recipient (freelancer) pays GST directly to the government.

- Input Tax Credit can be claimed on such payments if the expense is business-related.

Invoicing and Record-Keeping Requirements

Freelancers registered under GST must issue GST-compliant invoices, which include:

- Name, address, and GSTIN of the freelancer

- Name and address of the client

- Invoice number and date

- SAC code and description of services

- Value of services

- Applicable GST rate and tax amount (CGST/SGST/IGST)

- Signature (digital or manual)

Proper records must be maintained for at least 6 years from the due date of filing annual returns.

GST Returns to Be Filed by Freelancers

Freelancers must regularly file GST returns. The frequency and form depend on the type of registration:

| Return Type | Form | Frequency | Purpose |

| Outward Supply Details | GSTR-1 | Monthly/Quarterly | Reporting sales |

| Summary Return | GSTR-3B | Monthly | Tax payment & ITC claim |

| Annual Return | GSTR-9 | Yearly | Summary of annual transactions (if applicable) |

Note: If turnover is below ₹2 crores, filing GSTR-9 is optional for individual service providers.

Benefits of GST for Freelancers

- Legal recognition and trustworthiness

- Input Tax Credit to lower cost of operations

- Seamless transactions with large or international clients

- Zero-rated export status improves profit margin

- Eligibility for e-commerce platforms or global marketplaces

Click Here To Know About – GST Registration: Major Changes in 2025

FAQs

Yes, but only under certain conditions.

For service providers (including freelancers):

1. Flat 6% tax on turnover = 3% CGST + 3% SGST

2. Cannot collect GST from clients

3. Cannot claim Input Tax Credit (ITC)

Yes, freelancers can claim Input Tax Credit if they are: Registered under Regular GST (not Composition Scheme)

A freelancer who has taken normal GST registration, is eligible to claim ITC on all business-related purchases.

Yes, freelancers need to register for GST only if certain conditions apply.

For Service providing Freelancers are exempt to register if the turnover does not exceed Rs 20 Lakhs in normal state and 10 Lakhs in special state.

OIDAR services refer to services provided to non-taxable persons (like individual consumers) who are located in India, via the internet or an electronic network, and where the delivery of the service is essentially automated, without the need for human intervention.