Short-Term Capital Gain are the profits which arises when you sell a capital asset (such as stocks, mutual funds, or property) within a short holding period at a profit.

Short Term Capital Gain Tax Rate

Under Old Tax Regime

In old tax regime, if overall income after all deduction and exemption is up to ₹5 lakh then rebate u/s 87A is available amounting ₹12,500. This rebate is also available for STCG.

If income is only from STCG then,

| Sold | Tax Rate |

| 23.07.24 Onwards | 20% |

| Up to 22.07.24 | 15% |

Under New Tax Regime

In new tax regime overall income after all deduction and exemption is up to 7,00,000 then Rebate u/s 87A is available amounting ₹25,000.

But this rebate is not available for STCG for any special rate incomes.

If income is only from STCG then,

| Sold | Tax Rate |

| 23.07.24 Onwards | 20% |

| Up to 22.07.24 | 15% |

Note:

If you have any other income such as salary, business or other, then it will be taxable as per the slab rates.

How much short-term capital gain is tax-free?

- In Old Regime – up to ₹2,50,000 is Tax Free.

- In New Regime – up to ₹3,00,000 is Tax Free. It will increase to ₹4 lakh in 2025-26.

For example, if your STCG is ₹3 lakh under new regime and your total income is under the exemption limit then no tax is applicable.

Note:

This limit is the over all income limit including salary, business, capital gain etc.

Short Term Capital Gain Tax on Shares

This occurs when any share purchased as delivery and sold after 1 day and before 12 months.

Short-Term Capital Asset classification

| Type of Asset | Holding Period |

| Listed Equity Shares | Less than 12 months |

| Unlisted Equity Shares | Less than 24 months |

Here,

Listed securities are short-term if held for less than 12 months, while unlisted equity shares are considered as short-term if held for less than 24 months.

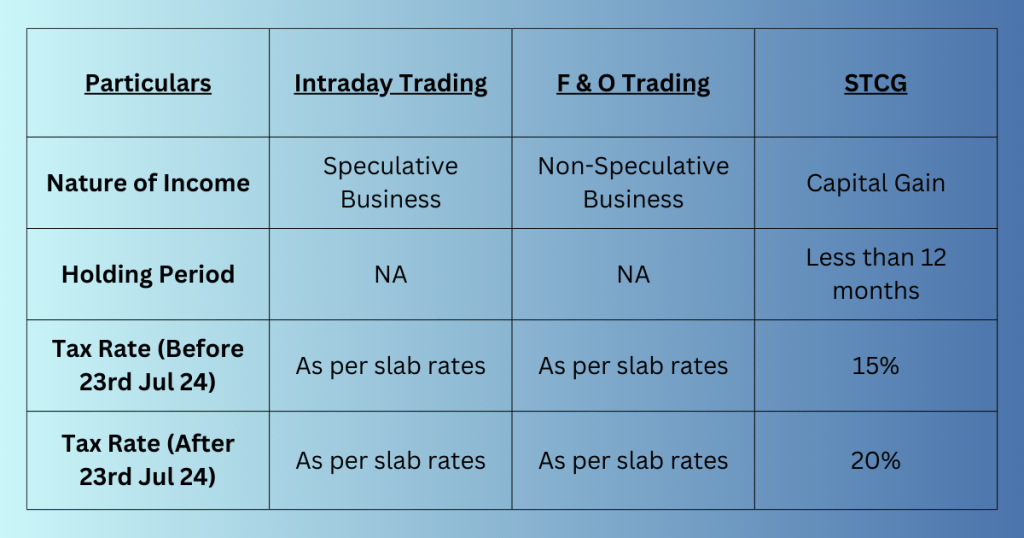

Rates as per Type Of Income from Shares

Which ITR Form to Choose?

| ITR Form | Applicable |

| ITR-2 | If income is only from STCG, salary or other source. |

| ITR-3 | If there is business income including STCG. |

FAQs

Losses from STCG can be set off against both STCG and LTCG, and any unadjusted losses can be carried forward for up to 8 years.

No, if your total income (including STCG) is below the basic exemption limit, no tax is payable.

No, the 87A rebate is not available on STCG.