Form 15H is self-declaration forms which can be submitted by resident individuals to their banks or financial institutions to request exemption from TDS on interest income earned from fixed deposits, recurring deposits, and other investments.

Now, senior citizen can submit 15H Form if he/she is earning ₹12L FD interest for FY 2025-26.

Who is Eligible for Form 15H Submission?

Only resident senior citizens (aged 60 years or more) can submit Form 15H.

Deadline for Form 15H Submission

The form must be submitted by 1st week of April to avoid TDS deductions.

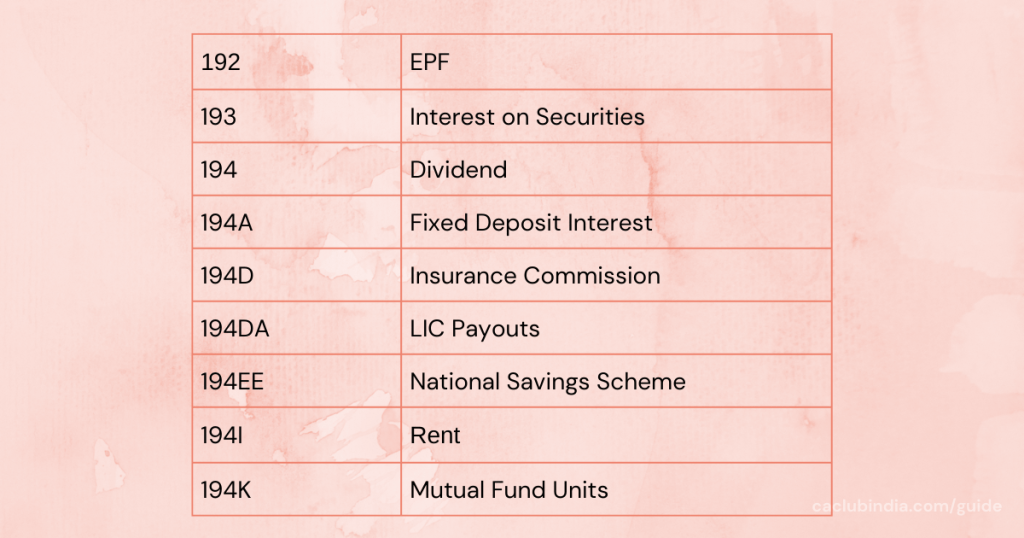

Applicable Income Sources

Form 15H can be submitted for income earned under the following sections:

How to Save TDS on ₹12 Lakh FD Interest?

Interest Calculation on FD for FY 2025-26

Suppose a Senior Citizen Deposit Amount: ₹1,45,00,000

Interest Rate: 7.5% (compounded quarterly as per SBI)

Interest Earned: ₹ 11,28,382

TDS Exemption on FD Interest

- As per Section 194A, TDS is deducted if the amount exceeds threshold limits.

- For Senior Citizen threshold limits is 1,00,000/-

- If Form 15H is submitted, the bank will not deduct TDS of ₹1,12,838 (10% of ₹11,28,382).

Exemption of ₹12 Lakh Interest Income

As per Notification Number G.S.R.375(E) dated 22 May 2019, banks/financial institutions accepts Form 15H even if the senior citizen’s total income exceeds the usual threshold for submission, provided their final tax liability is nil after claiming the rebate under Section 87A.

Total Income for FY 2025-26: ₹11,28,382

Calculation

Tax on ₹11,28,382 (as per slab rates)

Rebate u/s 87A: ₹60,000 (available for income up to ₹12,00,000)

Final Tax Liability: Nil

Since the final tax liability is zero, Form 15H can be submitted to prevent TDS deduction.

Thus, a senior citizen earning up to ₹12,00,000 from FD interest can submit Form 15H and avoid TDS, ensuring tax-free income.