NPS Vatsalya Scheme allows parents or guardians to open a National Pension System (NPS) account for their children, ensuring long-term savings and financial security.

NPS is regulated and administered by the Pension Fund Regulatory and Development Authority.

This Scheme was launched on 18.09.2024.

Eligibility

Parents and Guardians can open the accounts on behalf of below 18 years child.

Minimum Contribution Limit

- Rs.1,000 per year.

- No upper limit on contributions.

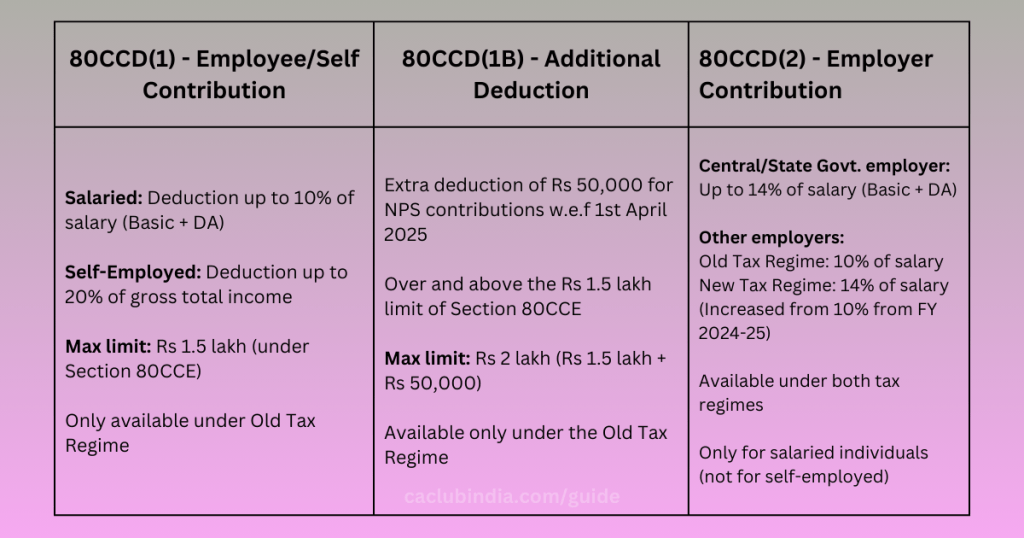

NPS Tax Benefits

Contributions made to NPS Vatsalya accounts qualify for the deduction.

Detailed Breakdown of Deductions:

Scope of Section 80CCD

Scope of section 80CCD is proposed to be extended:

- Deduction shall now be allowed to the parent/guardian under the old taxation regime for amount deposited in the account of any minor child (up to 2 children) under the NPS-Vatsalya also.

- Proposed deduction shall be allowed u/s 80CCD(1B).

- Overall cap of Rs. 50,000 under the said sub-section (cumulatively for self and such minor child (up to 2 children) shall continue as earlier.

Transition to Regular NPS Account

- When Child will become 18 years of age, the NPS Vatsalya Scheme will be converted to a regular NPS Account.

- The child gains full control over their retirement savings.

- They can continue contributions independently.

KYC Required Once the Child Becomes 18 Years

Fresh KYC of the minor required within 3 months from the date of attainting 18 years.

Document Required

- Date of birth of the Minor (Birth Certificate, School leaving certificate/ Highschool certificate, PAN and Passport).

- KYC of the Guardian shall be carried out by submitting Identity and Address Proof (Aadhaar, Driving License, Passport, Voter ID card, NREGA Job Card, National Population Register)

- If the guardian is NRI then the NRE/NRO Bank Account (solo or joint) of the minor is required.

Withdrawal Conditions

Before 18 years of Age

- Guardians can withdraw partial amount up to 25% of contribution after the lock-in-period of 3 years.

- Withdrawal may be for education, specified illness and disability.

- Maximum 3 times withdrawal can be done till the child attains 18 years of age.

After 18 years of Age

- Accumulated Corpus is equal to or greater than 2.5 Lakh – At least 80% of balance to be utilized for purchase of annuity which will provide regular income after retirement and remaining 20% can be withdrawn as a in lump sum.

- Accumulated Corpus is less than 2.5 Lakh – Option to withdraw entire balance as lump sum.

In Case of Death of Minor or Guardian

Death of Minor

Entire accumulated corpus returned to the guardian.

Death of Guardian

Another guardian to be registered through fresh KYC.

In case of both the parents, the legally appointed guardian can continue the account with or without making contributions to the account.

Once the child attains the age 18 years, the subscriber has an option to continue or exit from the scheme.

FAQs

This Scheme was notified by the Pension Fund Regulatory and Development Authority and allows parents and guardians to maintain NPS account for their minor children.

Section 80CCD allows for a deduction to income for the contributions made to the National Pension Scheme either by an employer and an employee or by any assessee. The withdrawal of the contributions is taxable subject to certain conditions.

Partial withdrawal upto 25% of contribution, in accordance with the Scheme is allowed exemption u/s 10(12BA) by Finance Bill 2025.

When the contribution is finally withdrawn, the amount on which deduction is allowed earlier, will be charged to tax.