The Reserve Bank of India’s Liberalized Remittance Scheme (LRS) permits resident individuals to transfer funds overseas for various authorized purposes, including education, medical costs, travel, foreign investments, and gifting.

As per the Liberalized Remittance Scheme, all resident individuals, including minors, can remit up to USD 250,000 per financial year (April to March) for any allowable current or capital account transactions, or a combination of both.

Additionally, resident individuals can access foreign exchange services for the purposes outlined in Para 1 of Schedule III of the FEM (CAT) Amendment Rules 2015, dated May 26, 2015, within the USD 250,000 limit.

Introduction

The Liberalized Remittance Scheme (LRS) was introduced in India on February 4, 2004, allowing residents to remit money abroad for various purposes, including education, travel, medical treatment, and investments.

These changes are made in response to evolving macroeconomic conditions, regulatory considerations, and the need to facilitate greater foreign exchange management while ensuring compliance with the country’s financial regulations.

Key Changes to the TCS Thresholds

The Liberalized Remittance Scheme (LRS) in India has experienced considerable changes as outlined in the Budget 2025. As of February 2025, the key changes to the Tax Collected at Source (TCS) thresholds under the Liberalized Remittance Scheme (LRS) are as follows:

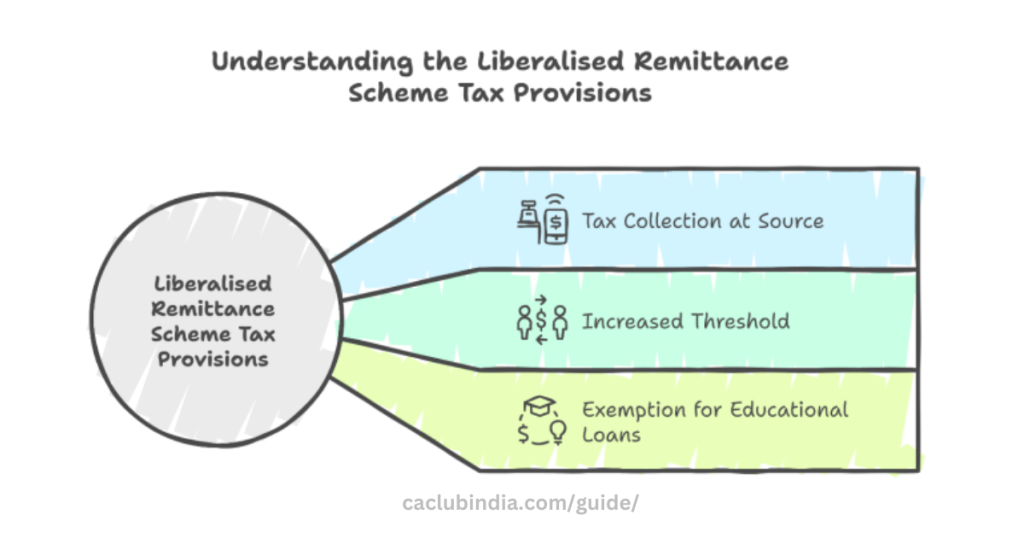

Threshold for TCS Applicability

Previous law

For remittances up to ₹7 lakh per individual per financial year, no TCS is applicable, regardless of the purpose or mode of payment.

Proposed law

The TCS threshold for remittances under the LRS has been increased to ₹10 lakh. As a result, individuals will only face TCS deductions if their total remittances surpass ₹10 lakh in a financial year, offering relief for smaller transactions intended for education, travel, medical costs, and investments.

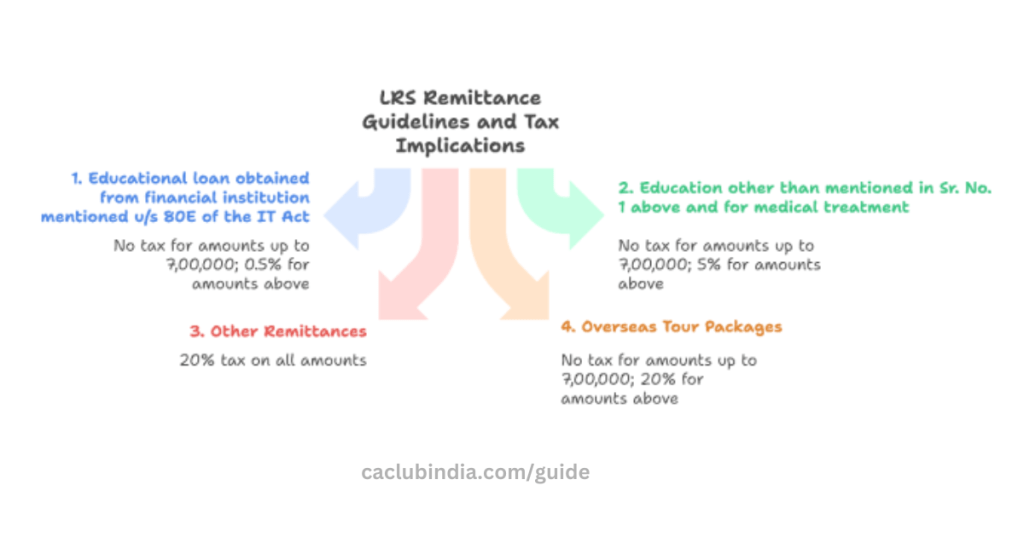

TCS Rates for Exceeding Amounts

The TCS rates for remittances that go beyond the updated threshold of ₹10 lakh will continue to stay the same:

- 5% for education and medical purposes.

- 20% for foreign investments and overseas travel

Removal of TCS on Education Loans

A significant change is the elimination of TCS on remittances intended for educational purposes when financed through loans from designated financial institutions. This adjustment is anticipated to alleviate the financial strain on students and their families.

The applicable TCS rates for LRS are given below:

These changes aim to streamline tax compliance and lessen the financial burden on individuals sending remittances for different reasons. By increasing the exemption threshold, the government seeks to make it easier for people to transfer money overseas without facing immediate tax deductions

Key Highlights of the Union Budget 2025-26: Click Here