GSTR-1 due date for December 2024 is approaching but the GST portal has experienced scheduled downtime starting from 12:00 AM on 9th January 2025, which have been impacting taxpayers who are trying to file their returns.

Below is an explanation of the situation, including updates on the extension of GSTR-1 filing deadline for December 2024.

Scheduled Maintenance Details

Initial Announcement

The portal was scheduled to reopen at 6:00 AM on January 10, 2025.

Revised Timings

Reopening time was successively revised to:

- 9:00 AM

- 12:00 PM

- 03:00 PM

- 06:00 PM

When the taxpayers trying to access the GST portal, showing following notice:

“Scheduled Downtime! We are enhancing the services on the site. The services will not be available from 10th Jan’25 12:00 AM to 10th Jan’25 06:00 PM. Kindly come back later! In case of any queries, please call us at 1800-103-4786. We appreciate your cooperation and patience.”

GSTR-1 Filing Extended Deadline

Due to the downtime, the due date is extended.

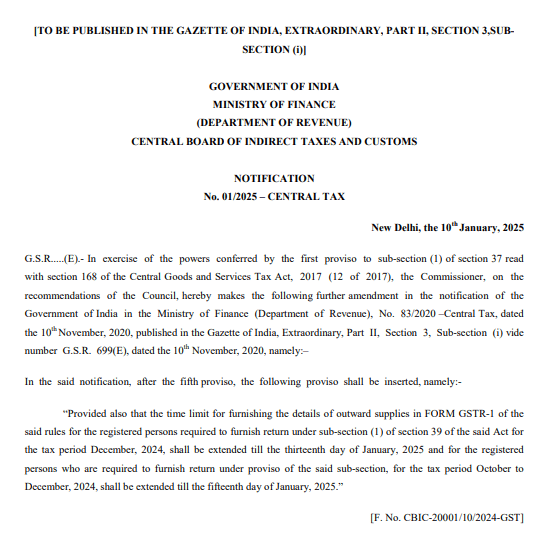

CBIC sent an incident report to consider extension in filing date.

The notification extends the deadlines for filing GSTR-1 for certain taxpayers:

- For Monthly filers: Due date extended to 13th January 2025.

- For Quarterly filers : Due date extended to 15th January 2025.

This extension aims to provide additional time for furnishing details of outward supplies.

Related Articles

GSTR-8 Filing Extended: Extra Time for E-Commerce Operators

GSTR-7 Deadline Extended: Relief for TDS Deductors

GSTR-6 Filing Deadline Extended: Relief for ISDs

GSTR 5: Deadline Extended to 15th Jan For Dec 24 Return.

GSTR-3B Due Date: State-Wise Extended Deadlines for Dec 2024