Sometimes, a policyholder buys an LIC policy but for some reasons the benefits remain unpaid due to non-payment of premiums, death, or other reasons.

If there is no nominee or having a nominee or policyholder doesn’t claim the money, then it stays with LIC which is called an unclaimed amount or deposit.

The policy includes maturity proceeds, survival benefits, or death claims that were not settled. Nominees or policyholders can later claim this amount by providing necessary documents and following LIC’s claim process.

How to Check for Unclaimed Amounts?

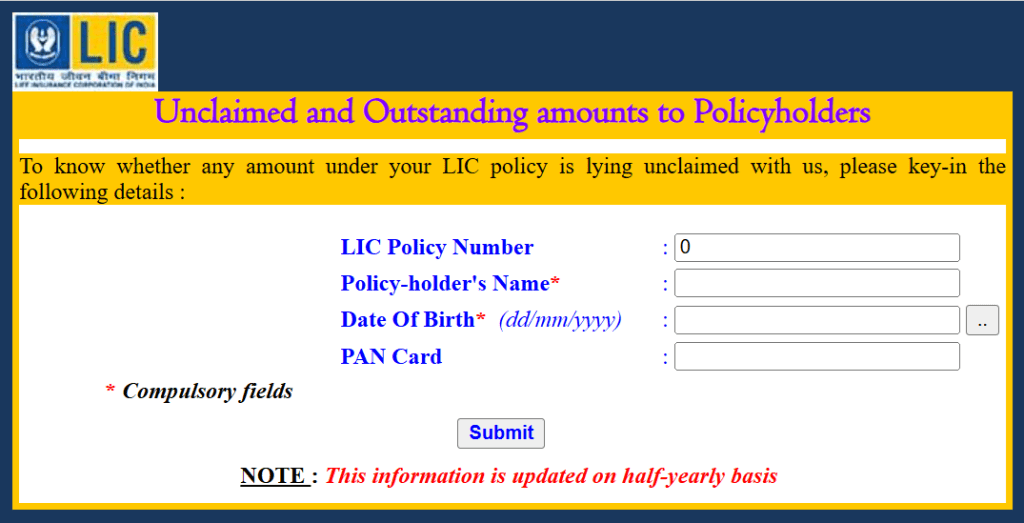

LIC provides an online portal to check unclaimed amounts:

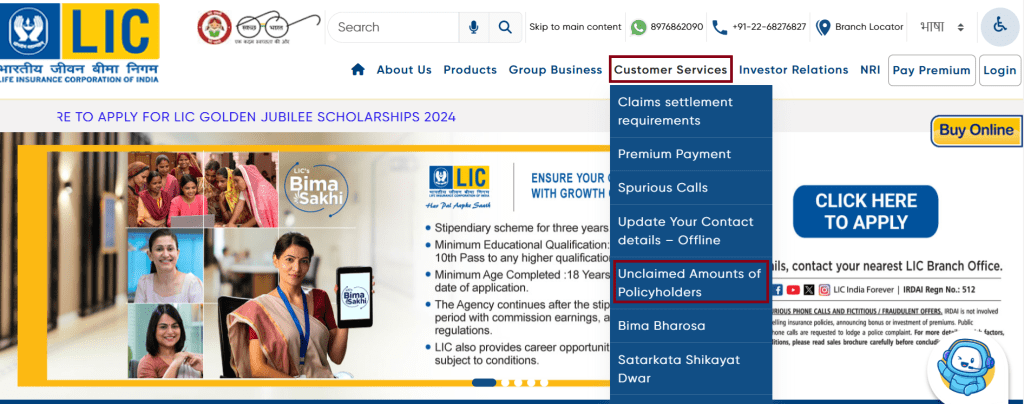

- Visit the LIC official website.

- On the portal navigate to Customer Services and then click on Unclaimed Amounts of Policyholders

- Enter the Policy Number, Policy Holder’s Name, Date of Birth, PAN Card details to search for unclaimed funds.

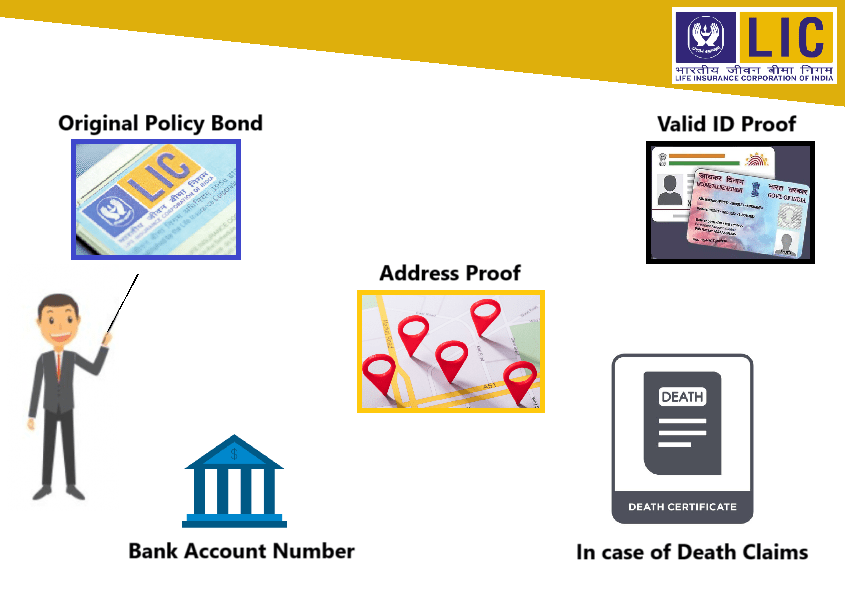

Note : You Must have these following documents to support your claim:

How to Submit a Claim Request?

- Visit the LIC branch with the documents.

- Fill out the required claim forms (available at the branch or online).

- Submit the forms along with the documents.

- LIC will verify the details and process the claim.

- Upon successful verification, the unclaimed amount will be credited to your bank account.

FAQs

Visit the nearest LIC branch with the required documents to file a claim.

There is no specific time limit, but it’s advisable to claim as soon as possible.

You can check for unclaimed amounts online, but the actual claim process is completed offline at LIC branches.

It takes few weeks, depending on the completeness of your documents and verification.