194S TDS is applicable on the payment for the transfer of Virtual Digital Assets (which include cryptocurrencies and non-fungible tokens).

Who will be the Deductor and Deductee?

| Deductor | Deductee |

| Any person who is responsible for paying to any resident any sum by way of consideration for the transfer of a virtual digital asset is required to deduct TDS u/s 194S. | Tax required to be deducted if the amount is paid or payable to a resident person if the recipient of the consideration is a non- resident, the tax may be deductible u/s 195. |

Rate of 194S TDS

- 1% TDS on the transfer of crypto assets.

- If no PAN then TDS at 20% as per Section 206AA

- For non-filing of return, TDS at 1% (for specified payer) or 5% (for non-specified payer) as per the Section 206AB.

Exemption from 194S TDS

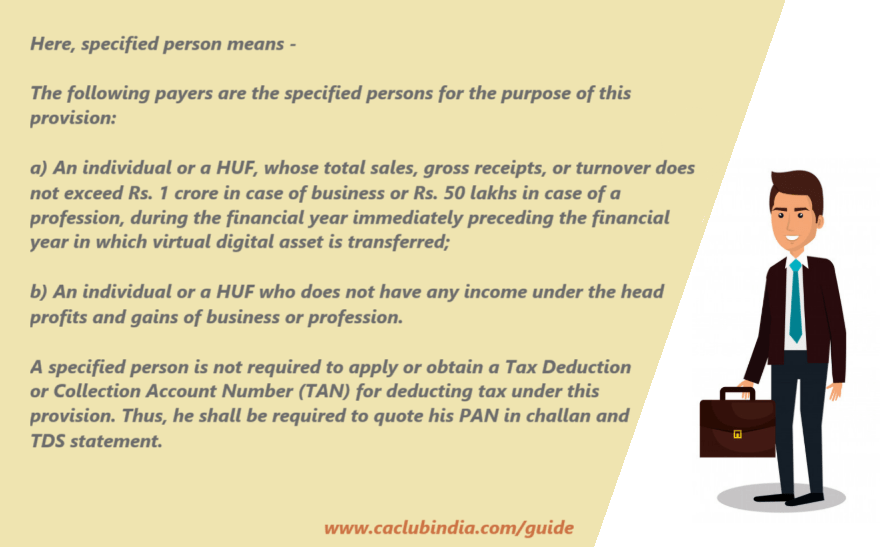

- If consideration is payable by any person (other than specified person) and its aggregate value does not exceed Rs. 10,000 during the financial year.

- If consideration is payable by any person (other than specified person) and its aggregate value does not exceed Rs. 50,000 during the financial year.

How to deposit of TDS?

- Specified Persons is required to deposit TDS via Form 26QE within 30 days of the month’s end.

- Others can deposit via Challan ITNS 281 within 7 days of the month’s end (March TDS by April 30).

| Category | Filing of TDS Statement | TDS Certificate |

| Specified Persons | File Form 26QE | Issue Form 16E within 15 days of filing Form 26QE. |

| Others | File Form 26Q quarterly | Issue Form 16A within 15 days of filing Form 26Q. |

Consequences on Failure to Deduct/Deposit TDS

Interest

- For non-deduction: 1% per month from due date till deduction.

- For non-deposit: 1.5% per month from deduction date till deposit.

Penalties and Prosecution

- Penalty u/s 271C or 221.

- Prosecution u/s 276B for non-deposit, unless reasonable cause is proven.

Failure to Furnish TDS Statement:

- Fee: Rs.200/day under Section 234E (capped at TDS amount).

- Penalty: Rs.10,000 to Rs.100,000 under Section 271H, or Rs.500/day under Section 272A.

Failure to Issue TDS Certificate:

Penalty applicable to Rs.500/day u/s 272A during default period.

Click Here To Know – Cryptocurrency Taxation in India