Section 185 of Companies Act 2013 prohibits companies from giving loans. According to Section 184(1) of the Act, a company may not directly or indirectly make an advance loan, make an advance loan that is expressed by a book debt, give a guarantee or security in conjunction with any borrowed money –

- To its Director

- To its holding company’s Director

- To Director’s Relatives

- To the business partner, if the Director is a partner

- To the partnership firm in which the company’s Director or holding company is Partner.

Exceptions of Section 185: Providing Loans To its Directors

1.Companies that provide business loans to its Managing Directors or full time Directors are required to do so with the following terms:

- Conditions of service provided to all of their workers, or

- In accordance with a plan approved by special resolution.

2.Companies offering loans , guarantees and securities in the regular course of business charge interest that is at least as high as the current yield on government securities with terms of one year, three years, five years or ten years.

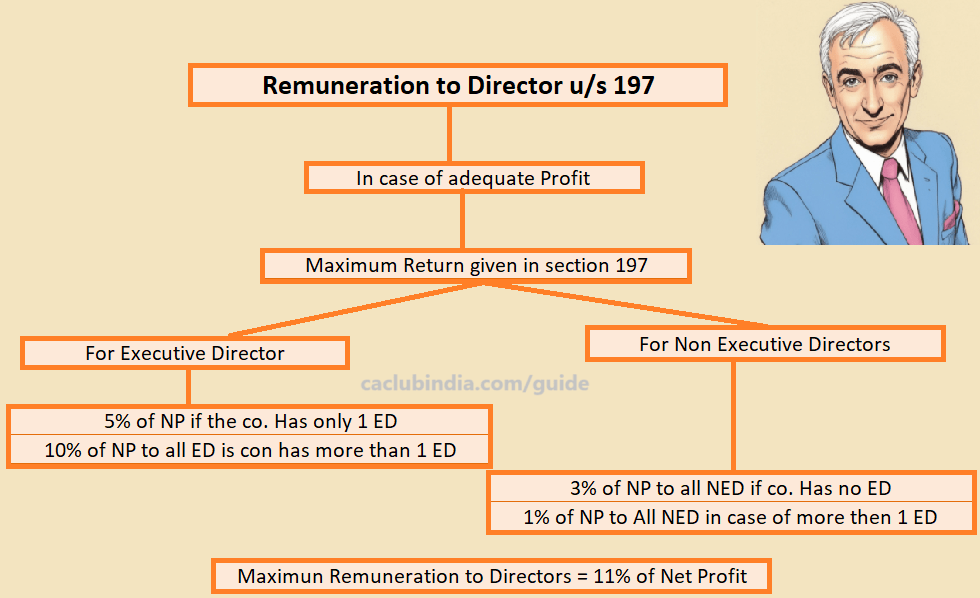

Remuneration to Director u/s 197

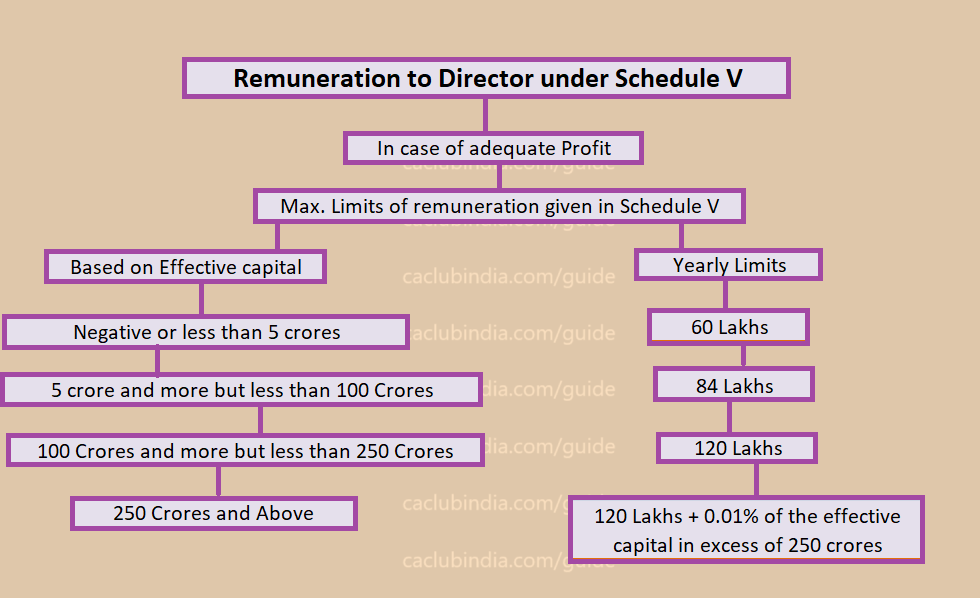

Remuneration to Director under Schedule V

Penalty Provisions

Penalties may attract if a company contravenes the provisions of Section 185 of Companies Act 2013 regarding loans, guarantees, or securities to directors or related parties:

- Company: Fine of Rs 5 lakhs to Rs 25 lakhs.

- Director/Recipient: Fine of Rs 5 lakhs to Rs 25 lakhs or imprisonment up to 6 months, or both.

Click here to know more about Remuneration of Directors.