Section 80GG deduction is available under Chapter VI-A which provides tax relief to individuals who incur expenses on rent for their accommodation but do not receive House Rent Allowance.

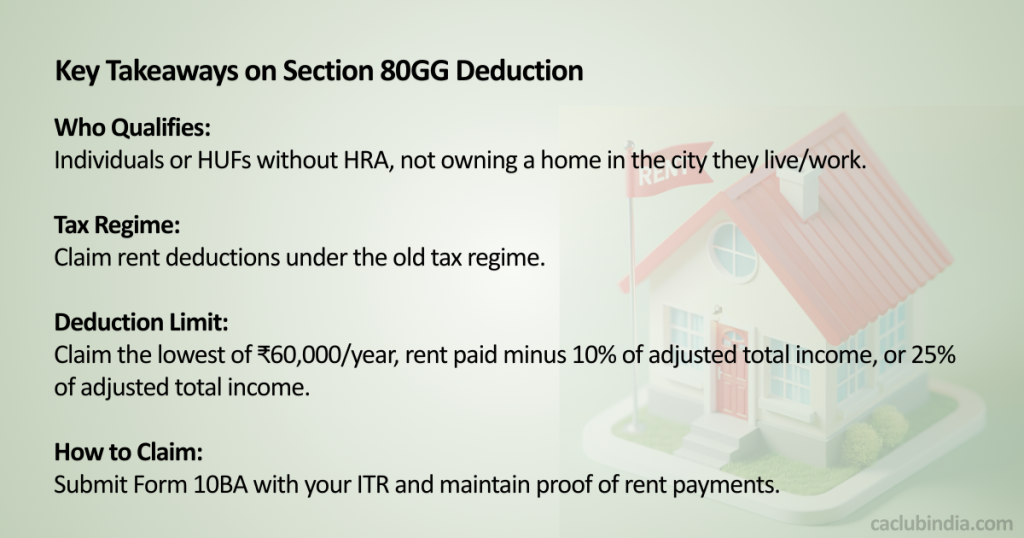

Who can claim deduction u/s 80GG?

Section 80GG deduction is eligible for:

- Individual – Salaried or Self Employed.

- HUF

Note – Business (other than individual) cannot claim this deduction.

Eligible Payment

- The taxpayer must pay rent for a residential accommodation.

- The taxpayer should be paying rent for furnished or unfurnished residential accommodation occupied by them.

- If rent paid exceeds Rs. 1 lakh per year, the taxpayer needs to present the PAN card of the owner of the house to claim the deduction.

Conditions Applicable

- The deduction is available only to the taxpayer who is not receiving House Rent Allowance (HRA) from their employer or a self employed person.

- The taxpayer, their spouse, their minor child or HUF should not own any residential property at the place where the taxpayer resides and performs their duties of the office.

- The taxpayer must file Form 10BA to declare that they satisfy the conditions for claiming the deduction as they are not receiving HRA.

Note – If you own any residential property at any place for which your income from house property is calculated under applicable sections (as a self occupied property), no deduction u/s 80GG will be allowed.

Amount of Deduction Allowed

Least of the following amounts are allowed for deduction:

- ₹5,000 per month or ₹60,000 per year.

- 25% of Adjusted Gross Total Income i.e., 25% of total income excluding LTCG and STCG u/s 111A.

- Excess of rent paid over 10% of Adjusted Gross Total Income.

What is Adjusted Gross Total Income?

It means gross total income excluding capital gains, short-term capital gains under section 111A, and income referred to in sections 115A or 115D, and deductions under section 80C to 80U).

Old Tax Regime Requirement for Section 80GG

The deduction is only available under the old tax regime not under the new tax regime.

What is Form 10BA?

Form 10BA is a declaration that has to be filed by an individual who want to claim deduction under Section 80GG.

It is a declaration that you are not claiming the benefits of a self occupied property in any other location or the same location as you are employed.

What are the details required to be filled in 10BA?

The details to be filled in 10BA are:

- Name and PAN details of assessee

- Full address

- Rent Payment mode

- Duration of the residence in months

- Rent amount

- Address of the property owner

- A declaration that no house property is owned by the assessee himself or in the name of spouse/minor or by HUF of which he is member.

How to Compute the amount deductible u/s 80GG?

Ajay lives in a rented house of Delhi and pays rent of Rs. 10,000.

His gross total income is Rs. 8,42,000.

He is entitle to deduction u/s 80D and 80C of Rs. 10,000 and Rs. 12,000 respectively.

He is the owner of a factory building which is at Mumbai and let out.

Solution :

| Particulars | Amount |

| Gross Total Income | 8,42,000 |

| Less : Deduction | |

| U/s 80D | (10,000) |

| U/s 80C | (12,000) |

| Adjusted Gross Total Income | 8,20,000 |

| Less : Deduction u/s 80GG | |

| Least of the following | |

| ₹5,000 per month or ₹60,000 per year. | |

| 25% of Adjusted Gross Total Income [8,20,000*25% = 2,05,000] | |

| Excess of rent paid over 10% of Adjusted Gross Total Income [(10,000*12)-(8,20,000*10%) = 38000] | 38,000 |

| Total Income | 7,82,000 |

Key Condition on Residing in Rented Property

- Individuals are eligible to claim this deduction if they pay rent to their parents.

- Such individuals should sign a rental agreement with their parents and give rent to them.

- The rental amount paid to their parents will be taxable when they file their income tax return.

Common Mistakes to Avoid

- Ensure that you have calculate the deduction accurately.

- Do not claim HRA and 80GG Together as you can only claim one, not both.

- Keep all the documents (receipts, agreements, bank statements) in case the IT Department asks for verification.

80C Deduction: Benefits and Limitations Available For FY 24-25 Click Here

80TTA Deduction: How To Save Tax on Interest Income FY 24-25 Click Here

FAQs

No, you cannot claim under section 80GG if you are receiving HRA and if it shown under Form 16.

Form 10BA can be received directly from the HR department of their organization or can be downloaded online from the official website of the Income Tax department.

Yes, you can claim deductions under Section 80EE and Section 80GG, if the conditions are met:

1.Living in rented premises and paying rent for it.

2.Do not receive any House Rent Allowance from your employer.

3.Taken a loan for the purchase of your first residential house property.

4.Not occupying the purchased residential house.