Introduction

1. What is Insurance & why we need Insurance is normally misunderstood by Us.

2. Most of the time, when we ask any investor about his investment portfolio, he/she invariably lands up saying that we have investments in some sort of insurance policy in LIC, ULIPs, Endowment Policy, Money Back Policy etc. In fact, over the last 50 years or so, LIC has taught Us everything other than insurance.

3. We all understand insurance as Tax Saving Instrument, Investment Tool but do we understand Insurance as Insurance?. You must be surprised by our sentence, but that is the hard core fact of life.

What is Insurance?

1.

It is a contract between the insured and the insurance company whereby the insured financial risk is covered by the insurance company.

2. The risk can be of your vehicle, property, legal etc. So effectively, you pass on the risk to the insurance company and they charge you a nominal sum of money for taking that risk which is called Insurance Premium.

Why Insurance?

1.

It is said that Rama, Krishna, Bhishma and Buddha, knew the time when they would leave this world. To put simply, each of them come to live with their disciples with a mission or set of responsibility to fulfill.

2. Does any one of us know when something will go wrong with us and whether that times our responsibilities to fulfill?

3. Does any one of us know when we something will go wrong with us and whether that time our responsibilities would be over or not?

4. We all know that in life unexpected is always expected. Our life is full of uncertainties with lot of goals, short term goals, long term goals, and known goals – unknown goals. We are all born with some responsibilities to fulfill…..but we do not know how much time we will get to fulfill those responsibilities.

5.

What if anything goes wrong to us, who will provide financial security to the family. Who will fulfill all the dreams that you would have thought for. This is where insurance can help you.

6. Insurance is one of the greatest inventions in the field of personal financial products. But it becomes fatal to financial life and costly once you end purchasing a wrong insurance solution.

What Happens in Real Life?

The answer to this lies in 2 questions “why did I buy this insurance” and “what product I bought”.

Typically you buy insurance product as investment and not insurance. That is why we say that Us have actually not understood insurance in the right sense.

First of all less than 5% of the Indian have insurance policy and add to this, out of those who are insured, the average life insurance cover is less than Rs. 90000/-.

We all understand insurance as an investment and land up buying EXPENSIVE Product. We all buy Endowment Money Back. ULIPs etc. Now when you buy an expensive product, you will actually be the loser and the manufacturer and the middlemen will be the winner. Is it not? All one need is to have a simple Term Insurance Policy / Term Life Insurance Plan.

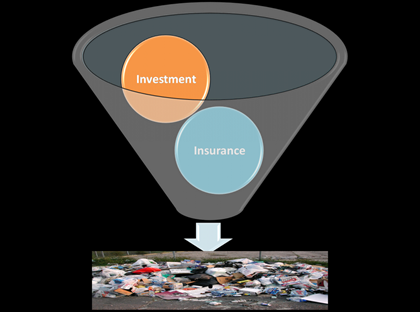

1. Mixing Insurance & Investment

Mixing insurance and investment is something we should totally avoid.

When your insurance agent chase you, does he sell you insurance products? Or does he offer you investment opportunities and tax- saving schemes? In 99 of the 100 cases, agents don’t sell pure insurance.

2. The insurance agents are driven by the first year commission that they get and they are hardly bothered whether or not it is really right for you or not. In fact, that is the reason, why most of the investors we meet, say that they don’t see their agents after first premium.

3. They make heavy commission by selling the product. Now we don’t have to explain that the commission that they make is actually deducted out of your investment and it could be as high as 70% of your premium.

· Insurance is an Expense

Let’s try to answer the question through a analogy.

Do you know that the world’s tallest building Burj Khalifa at Dubai, which is 828 meters high and has a foundation of 320 meters below the earth level made out of concrete and stainless steel.

· This means that to see a masterpiece you need to invest in its foundation. And we all know foundation has no visibility but it is a major part of cost. So any expense which gives a foothold and act as a security towards unforeseen circumstances is worth spending.

·

Similarly is life insurance. We all must buy a simple insurance even before we start thinking of investing for future. Understanding insurance as an investment or mixing insurance & investment is not a wise decision.

CAclubindia

CAclubindia