My grammar is 💯 good I

7296 Points

Joined March 2019

It cannot be a collateral because Collateral is usually an equity instrument or an asset. It will be recognised under separate head like:

| Non-cash collateral given |

Dr. |

| Assets/ Equity Instruments/ other assets given |

Cr. |

| (being risk & rewards still with the company) |

|

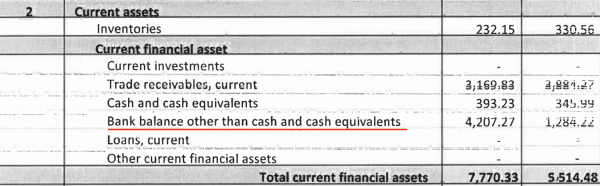

Sometimes, the client deposit a lump sum amount with the trading/clearing member in respect of the margin instead of paying/receiving margin on daily basis. In such case, the amount of margin paid/received from/into such accounts should be debited/credited to the ‘Deposit for Margin Account’. At the end of the year the balance in this account would be shown as deposit under ‘Current Assets’.

So, margin money is not the underlined one.

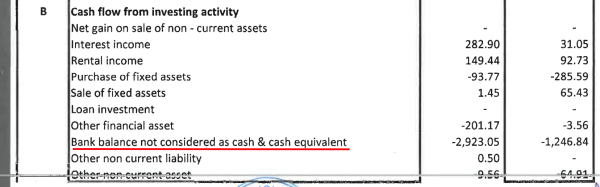

Finally, all non current assets fall under investing activities. So, it must be a long term bank fixed deposit. Look at the annual reports of banks, you might get an insight into what items are considered under this heading in notes.

CAclubindia

CAclubindia