Menu

Tds late payment

Dear Seniors,

My doubts is...

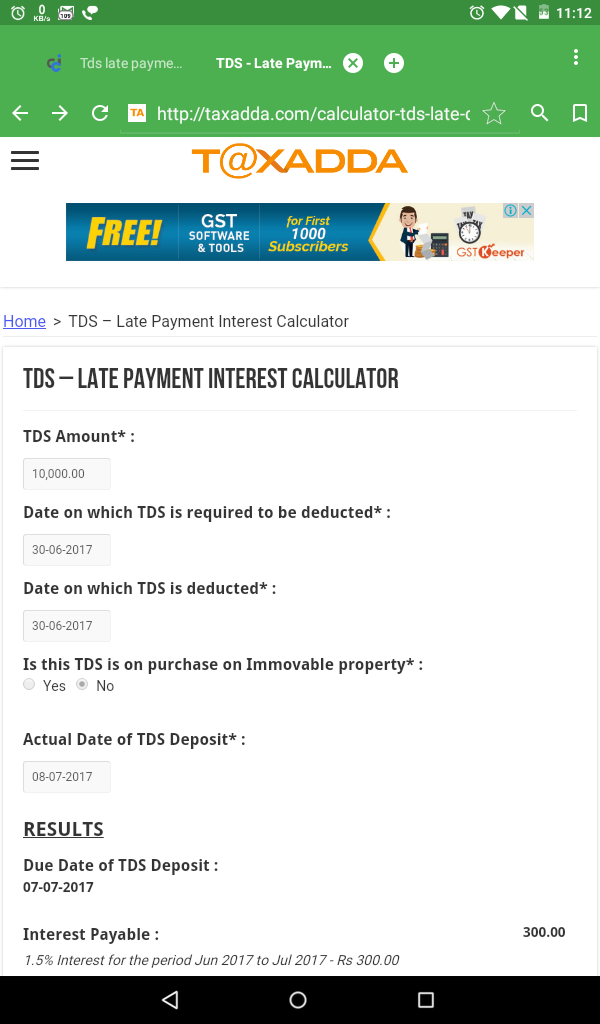

1) Is we have to pay the interest on TDS if its one day delay payment (next day morning of due date)?

2) I tried for the TDS payment through SBI online by 7.7.17 evening, which transaction was unsuccessful...? what is the solution for this.

Replies (9)

Recent Threads

- Understanding section 269st

- CASH AS GIFT OR FD AS GIFT

- NPS Pre Maturity full exit taxation rules

- Planning to ceased a Business

- Taxation for sale and purchase of REIT shares

- PAN - AADHAR LINK

- RECONCILIATION OF GSTR 2B Vs BOOKS WITH VBA

- Regarding cancellation of GST Number

- GST on business receipts pre -registration

- A Restaurant registered under the Composition Sche

Related Threads

CAclubindia

CAclubindia