|

Section No. |

Particulars |

|||||||||||||||||||||||

|

Proviso to S. 32(1)(iii) |

Unclaimed balance 50% of additional depreciation u/ 32(1)(iia) be allowed in the subsequent year |

|||||||||||||||||||||||

|

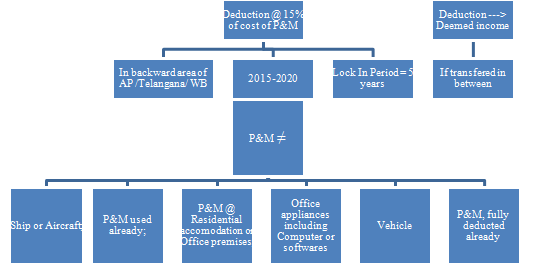

Sec 32AD |

|

|||||||||||||||||||||||

|

Proviso to Sec 32(1)(iia) |

Rate of additional depreciation to assessees fulfilling conditions in Sec 32AD = 35% |

|||||||||||||||||||||||

|

Sec 35(2AB) + 35(2AA) |

Procedural areas |

|||||||||||||||||||||||

|

36(1)(iii) |

Interest in respect of loan for acquisition of asset to be capitalised, in all cases |

|

|

|||||||||||||||||||||

|

|

|

|

|

|

|

|

| |

|

|

|||||||||||||||

|

|

|

|

|

|

Even if not for extension of business |

|

||||||||||||||||||

|

36(1)(vii) |

Even if not recognised as income in the books, if an item is admitted as income as per ICDS |

|

||||||||||||||||||||||

|

|

it becomes qualified to be allowed as deduction when it becomes irrecoverable later. |

|

||||||||||||||||||||||

|

36(1)(xvii) |

Deduction in respect of Cooperative society, which produces sugarcane |

|

|

|||||||||||||||||||||

|

|

|

|

||||||||||||||||||||||

|

|

||||||||||||||||||||||||

|

|

||||||||||||||||||||||||

|

Price paid for sugarcane as fixed by government =< Deduction |

|

|

|

|||||||||||||||||||||

|

Circulars |

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

03/2015

|

Only that portion of expense, which was chargeable to tax be disallowed u/s. 40(a)(i) for non-deduction of TDS |

|

||||||||||||||||||||||

|

|

||||||||||||||||||||||||

|

43/2014 |

Rate of depreciation w.r.t. windmills or other renewable energy device |

|

|

|||||||||||||||||||||

|

|

|

|||||||||||||||||||||||

|

Abbreviations |

||||||||||||||||||||||||

|

P&M |

Plant and Machinery |

|||||||||||||||||||||||

|

=< |

Less than or equal to |

|||||||||||||||||||||||

Menu

Summary of Important Amendments by FA 2015 in Chapter IV-D

Replies (2)

Recent Threads

- Waste Management services

- Seeking Clarity: New Transport Allowance Limits (D

- Query regarding Consolidated Gift Deed for Bank Tr

- TDS u/s194IB - Joint Ownership

- Free GST Reconciliation Tool in Google Sheets R

- NRI return after due date refund case

- TDS u/s 194J - training honorarium

- WHERE TO REGISTER UNDER PTRC AND PTEC ACTS ?

- Key Corporate Compliance Requirements for Private

- Gst Non Filling Return Notice

Related Threads

CAclubindia

CAclubindia