Dear Sir

Pls let me know that I have a Partnership firm with Software company

as 100% EOU registered from SEZ

i am filing return since last 13 year under 44AD

but during discussion with CA i am confused and having query

I may file return under 44AD if my turnover is under 2 Crore (which is 1.3 crore)

which ITR form i should use? ITR4 or ITR5

do we have to show case complete P&L & Balance sheet ?

or only the minimum info

I am maintaining books of account for my purpose bot not yet declared

and after deducting depreciation of 2.5Lac book profit is 6.5%

We are registered and filing GST return timely too.

I need your input if possible for same it would be great if you may guide us?

Menu

Forum Search

Software development by partnership firm is business? or profession ? under 44ad ?

Bcoz, Your income is purely professional income as "Technical Services" then how to you declare u/s 44ad...?

But, Better to Consult nearest CA.

you can file your return as ITR 3 giving complete balancesheet and statement of profit or you can declare 50% or more profit than your gross receipts under ITR 4

| Originally posted by : Meet Abhani | ||

|

Professionals – who are carrying on the profession of engineering/ technical consultancy falls under section 44 ADA.you can file your return as ITR 3 giving complete balancesheet and statement of profit or you can declare 50% or more profit than your gross receipts under ITR 4 |  |

NO , the original poster is asking about whether his bussiness entity being a partnership firm doing " software development " as major bussiness activity is eligible for filing ITR under section 44AD ... First thing , as a partnership firm is a "artificial entity " and posses no instric skill of a " profession " in itself ..is not eligible for 44ADA as 44ADA specifically refers to " professions " and "profession" in itself is an activity done by individuals/humans .....

Next the question is " whether the bussiness activity of " software development " is eligble for 44AD ??? " ..YES a partnership firm devoping softwares is eligible for section 44AD as the activity of " software development " is a manufacturing activity resulting in intangible goods ..and when a thing can falls under the category of GOODS then selling of such GOODS will definitely be an activity of bussiness eligible for section 44AD...below are few case laws excerpts in support of this view : -

(1) CIT v Oracle Software India Ltd 2010 ELT 161 [SC]

"It has been upheld that transforming blank CD into software loaded disc is manufacture and hence possess the essential characteristics of goods."

(2) Tata Consultancy Services vs. State of A.P [(2004) 271 ITR 401 SC]

“ The landmark judgment of TCS held that, software,whether customized or not shall be categorized as “goods”, only if it has the following characteristics:

(a) Utility .

(b) Capable of being bought and sold; and

(c) Capable of being transmitted, transferred, delivered, stored and possessed.

A software programme consists of various commands, which enable the computer to perform a designated task. The copyright in that programme may remain with the originator of the programme. But when the copies are made and sold in the market, it becomes goods, and hence liable to VAT.

The software is an indispensable part of media and it is not possible to separate the two. It is important to note that, the consideration that the buyer pays is for the software and not for the hardware in which the software is embedded. Thus sale of computer software is clearly sale of goods within the meaning of Sales Tax Act. Further, it is to be noted that branded or packaged software, which is capable of abstraction, consumption, use, transmission, transfer or delivery, it would be treated as goods, when such software is marketed or sold. Thus, once the software is classified as goods, it is liable to the goods taxes of customs, excise duty and VAT.

”

(3) Infosys Technologies Ltd. vs. Commissioner of Commercial Taxes, Chennai [2009 (233) ELT 56 (Mad)]

“The landmark judgment of TCS case was upheld and it observed that whether the software is customized or non-customized, the same will be considered as goods and liable to sales tax. Hence it is immaterial whether the software is canned or un-canned, it would still be liable to sales tax/VAT.”

The Income of any person making use of this Section would be assumed to be 50% of the Total Gross Receipts for the year. The following are considered as professionals who can make use of this Section:-

LegalMedicalEngineeringArchitectural ProfessionProfession of AccountancyTechnical ConsultancyInterior Decoration

This scheme is applicable only to a resident assessee who is an Individual, HUF or Partnership but not a Limited Liability Partnership firm.

it includes partnership firm. PARTNERSHIP FIRM CAN ALSO CARRY ON PROFESSION. CA FIRMS, ADVOCATES ARE BEST EXAMPLES.

| Originally posted by : Meet Abhani | ||

|

please refer this also. a plain text of section 44ada.The Income of any person making use of this Section would be assumed to be 50% of the Total Gross Receipts for the year. The following are considered as professionals who can make use of this Section:-LegalMedicalEngineeringArchitectural ProfessionProfession of AccountancyTechnical ConsultancyInterior DecorationThis scheme is applicable only to a resident assessee who is an Individual, HUF or Partnership but not a Limited Liability Partnership firm.it includes partnership firm. PARTNERSHIP FIRM CAN ALSO CARRY ON PROFESSION. CA FIRMS, ADVOCATES ARE BEST EXAMPLES. |  |

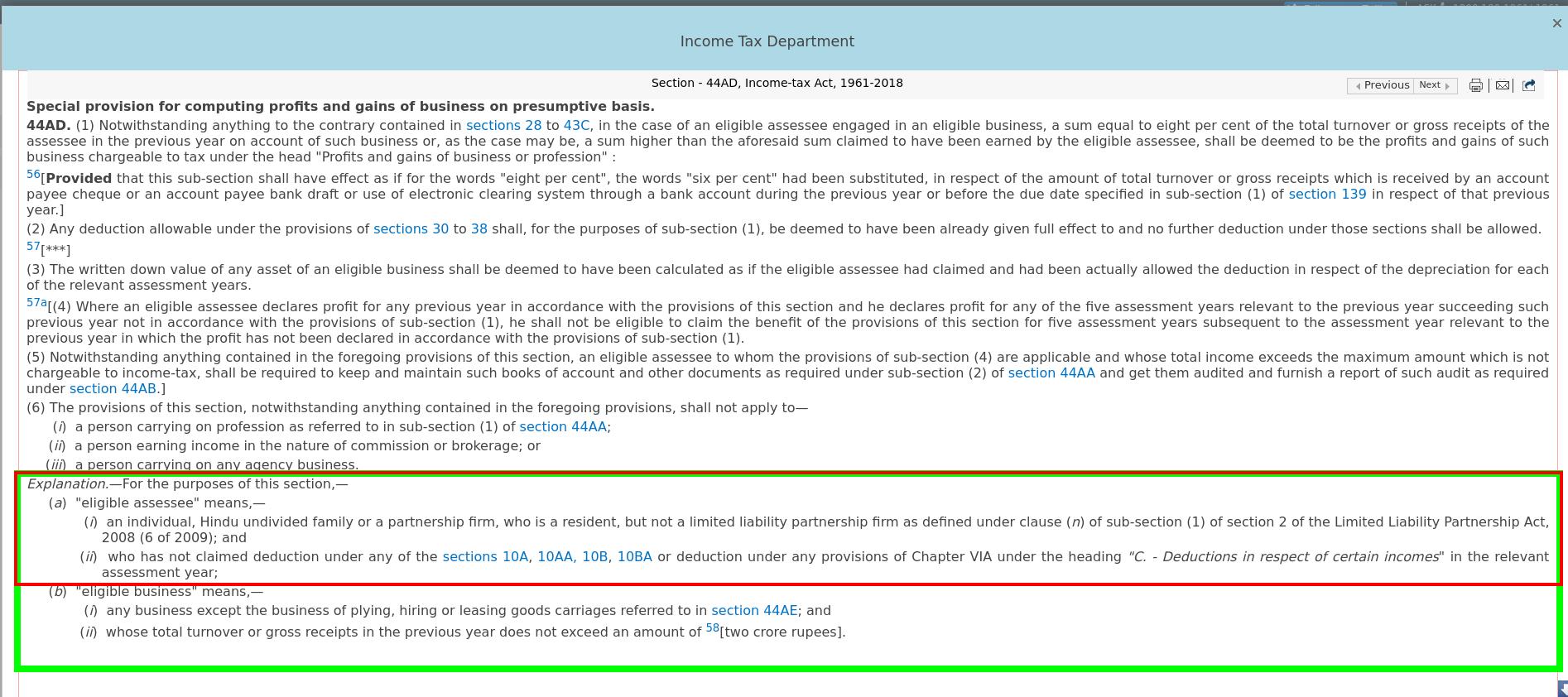

Hmmmm...Below is a screen shot direct from the ITD website...No where partnership firm mentioned there...or am I missing something ?

please refer this link.

| Originally posted by : Meet Abhani | ||

|

https://googleweblight.com/i?u=https://www.charteredclub.com/section-44ad/&hl=en-INplease refer this link. |  |

The screen shot that I posted is direct from ITD website ... the weblink you gave no where specifies HUF/Partnetship firm as "eligible assesse " under 44ADA .... can you reproduce that part of web article where it specifies " partnership firm " eligible under 44ADA ?

& in Bare Act there is no specific mentioning about this AS it is AN OBVIOUS INTERPRETATION . please refer all other articles also. they too will agree with my stand.

| Originally posted by : Meet Abhani | ||

|

please refer it again. they have pecifically mentioned PARTNERSHIP FIRM EXCLUDING LLP.& in Bare Act there is no specific mentioning about this AS it is AN OBVIOUS INTERPRETATION . please refer all other articles also. they too will agree with my stand. |  |

In ITD website they " specifically " defined the entity/persons for 44AD but no such thing given for 44ADA ...

44AD >

Genevie Mendonsa

My company is also in a similar situation. I receive orders from abroad, subcontract them and sell custom developed software to these clients. Ours is a partnership firm with turnover under 2cr. please suggest if we can go with 44AD

Is there any TDS receipt and if so in which section?

From last year onwards, TDS section is mainly relevant for 44ADA vs 44AD distinction

Arvind Kumar

Under Section 44AD of the Income Tax Act in India, the classification of income as a business or profession is important for determining the applicability of presumptive taxation. For a partnership firm engaged in software development, whether this activity is considered a business or a profession can depend on the nature of the services provided. Generally, software development, particularly for a custom software development company in India, is treated as a business activity rather than a profession. However, it's advisable to consult with a tax professional for specific guidance related to your situation.

A partnership firm can file under section 44 ADA as only LLP is specifically excluded. If a client is eligible to use section 44 ADA, then they cannot use section 44 AD. Since this is software develpoment , Section 44 ADA should be availed.

Kamal Deep Pareek

Software development is generally treated as a profession, not business, and hence is not eligible under Section 44AD. Instead, it may fall under Section 44ADA if provided by an individual or partnership firm (not LLP). However, since your firm is a 100% EOU registered with SEZ, and you’re a partnership firm, presumptive taxation under 44AD is not applicable. You should file ITR-5, not ITR-4. Also, since you're maintaining books, it's better to disclose full profit and loss and balance sheet. Consult your CA for accurate classification, as wrong filing may lead to scrutiny or penalty.

Leave a Reply

Your are not logged in . Please login to post replies

Click here to Login / Register

Recent Threads

- GSTR 2B ( MULTIPLE MONTHS )

- Eway bill generation for export material.

- International Tax clarification UK.

- E way bill expired penalty

- Best SME Focused AIF Funds in India for High Growt

- How does employee management software help in stat

- Clarification Required – Section 18 of Wage

- How to split freelance project income with a frien

- 194a for A y 2024-25

- Compensation & Benefits

Related Threads

CAclubindia

CAclubindia