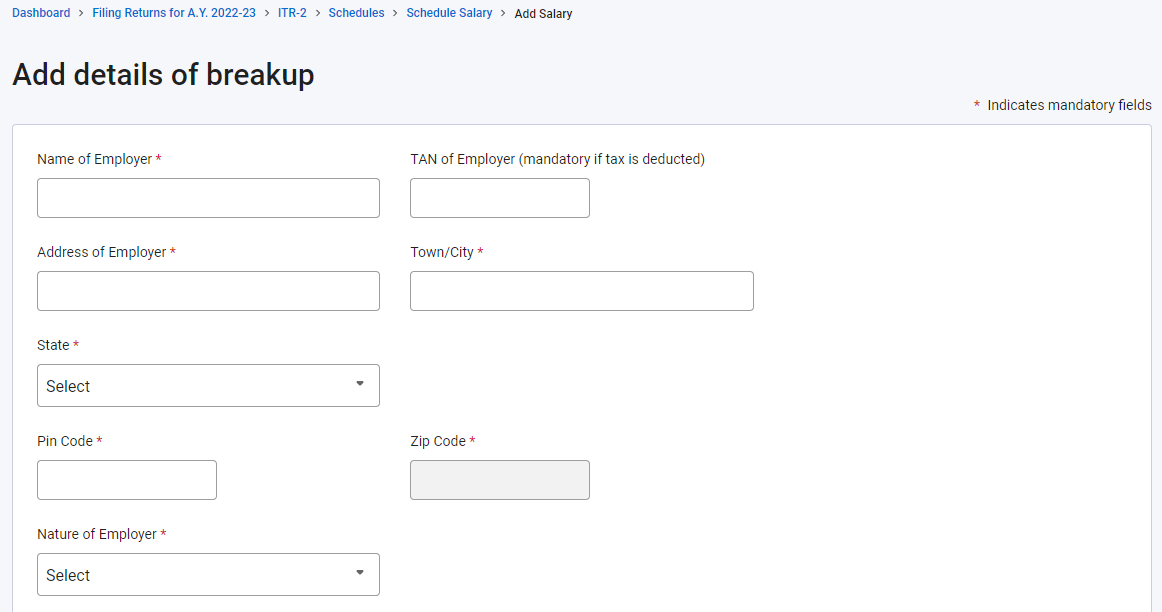

I left my job a few years ago and not currently employed. I withdrawn all my EPF balance last year (FY 2021-22). Since I had not completed 5 years of service, most of this amount is taxable under 'Salary' head. However I'm confused what I should fill-in for employer details.

The Form-26AS shows the money was paid by "REGIONAL PROVIDENT FUND COMMISSIONER IRO PUNE" with TAN "PNER00437D". Should this be mentioned as Employer Name and TAN? If yes, what should be filled-in for Address, and Nature of Employer?

CAclubindia

CAclubindia