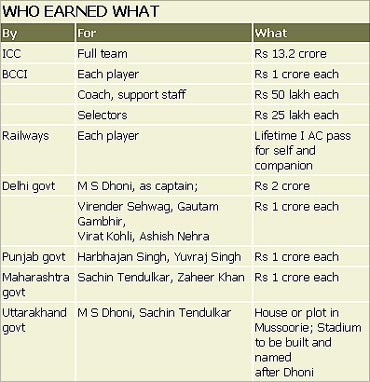

The dictionary defines tax breaks as: “Tax break is a slang term referring to any item which reduces tax, including any tax exemption, tax deduction, or tax credit. Tax break is also a pejorative term used in the United States to refer to purportedly favourable tax treatment of any class of persons, as in ‘individuals get a tax break for xxx’.” A tax break is generally considered antisocial in certain societies, while it finds great support in others. A tax break is normally given on the criteria of profession, age, gender and merit. The tax break for the Indian cricket team falls in the third category: merit. Historically, such breaks have been frowned upon but times are changing. The debate has surfaced after the World Cup rewards for the winning team from the The Board of Control for Cricket in India and others. Sports enthusiasts like me believe that tax breaks are necessary to promote excellence in sports, like many other countries. Also, promoting sports has a big influence on increasing tourism income, jobs and the overall well-being of society. There are definite arguments in favour of a tax break for cricketers: Cricketers have a somewhat short career, sometimes one or two Test or one-day international matches in their whole lifetime. Also, when a cricketer is most productive, the competition may be even severe. For example, when Padmakar Shivalkar was in form, the Prasanna-Bedi-Venkataraghavan trio was also at the peak and Shivalkar’s career was very short, especially in the international arena. When a cricketer’s career ends, not everybody gets an opportunity to become a commentator, umpire or coach. Many cricketers neglect their education in the service of the nation or for sports. So there is a case to protect their income. Many national and international awards are tax-free. Therefore, there is a case for tax exemption on the rewards that the cricketers have got. Tax exemptions may encourage many high-earning cricketers to allocate more money for charity. Of course, there need not be totally indiscriminate tax breaks. It may follow certain guidelines : A tax break should be available only for outstanding achievements: A World or Asia Cup win, in all categories of play —Test, one-day international and T-20. Certain categories of income should be tax-fee after retirement. As the table shows, almost everybody who was responsible for the World Cup win got something. Self-imposed or voluntary tax breaks can also be considered. If the tax is 30 per cent, the player can pay only 15 per cent and the balance can go to acharitable institution of his choice. Finally, tax breaks can be extended to other games with similar achievements. That will certainly dampen the present opposition to the tax break for the Indian team. www.business-standard.com

Menu

Should The Indian Team Get A Tax Break?

Replies (1)

Recent Threads

- Free GST Reconciliation Tool in Google Sheets R

- NRI return after due date refund case

- TDS u/s 194J - training honorarium

- WHERE TO REGISTER UNDER PTRC AND PTEC ACTS ?

- Key Corporate Compliance Requirements for Private

- Gst Non Filling Return Notice

- GSTR 2B ( MULTIPLE MONTHS )

- Eway bill generation for export material.

- International Tax clarification UK.

- E way bill expired penalty

Related Threads

CAclubindia

CAclubindia