SEO Sai Gr. Hosp.

210688 Points

Joined July 2016

how to-get-benefit-from-reverse-mortgage

What is the reverse mortgage scheme?

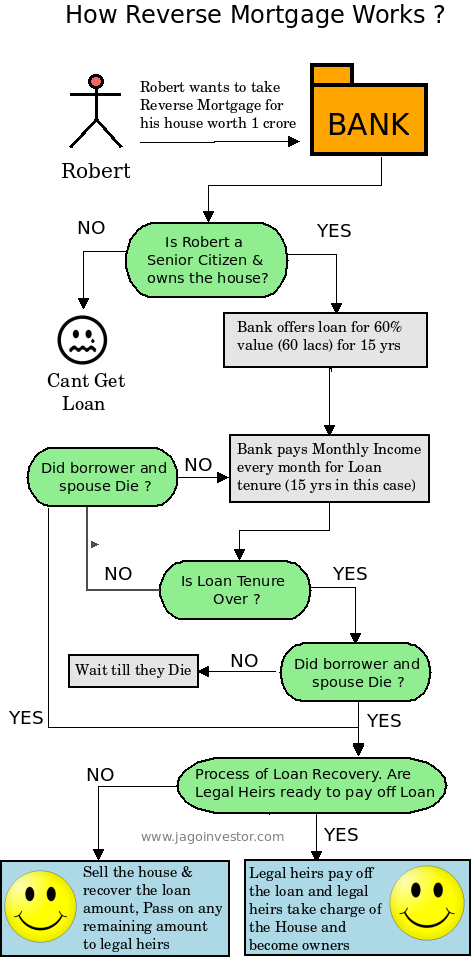

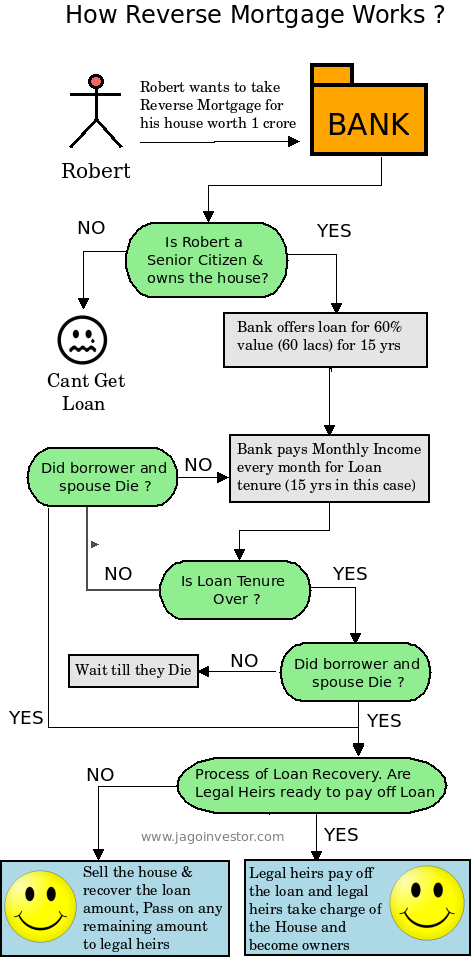

This scheme is exact ‘reverse’ of plain home loan scheme. In case of a home loan one takes a lump sum loan and repays it in instalments in future. Under the reverse mortgage scheme, you get instalments and the loan is repayable in lump sum in future.

Here, the payment stream comes to the borrower for a fixed period of time in the form of monthly, quarterly or yearly payments.

What is Reverse Mortgage ?

Reverse Mortgage is the exact opposite of a Home Loan. Anyone, who has a fully owned House can get a loan. The way, this works, is that his loan money will be divided in chunks (EMI’s) over many years and given to him every month. This can easily act as Monthly income. At the end of the loan tenure, the Bank stops paying the monthly income. If one of the spouses dies, the other can still continue living in the house. If both die, the bank gives their heirs two options – settle the overall outstanding loan and retain the house or, the bank will sell the house, use the proceeds to settle the outstanding loan and give the rest to the heirs. For people who don’t know – “Mortgage” means “Loan”

CAclubindia

CAclubindia