can nil income assessee have to pay 1000 penalty

Menu

Forum Search

Return filed after 31 July

Sec 234F is applicable if it's nil or taxable filing.

sandeep porwal

*इस वर्ष का आयकर रिटर्न A.Y. 2018-19 जमा करने की अंतिम तिथि 31 जुलाई 2018 है (Individual HUF Person)*

*इस वर्ष आयकर कानून में भी GST जैसी पेनल्टी का प्रावधान जोड़ दिया गया है धारा 234F के तहत अतः इसकी जानकारी हमारे लिए अति आवश्यक है कि आयकर रिटर्न लेट फ़ाइल करने पर कब और कितनी पेनल्टी लगेगी।*

*जिसकी जानकारी इस प्रकार है*

*(1) Income 250000 अंतिम तिथि 31 जुलाई 2018 पेनल्टी 0*

*(2) Income 250000 से 500000 तक*

*अंतिम तिथि 31 जुलाई 2018*

*31 जुलाई 2018 के बाद पेनल्टी 1000*

*दिसम्बर 2018 के बाद पेनल्टी 5000*

*(3) Income 500000 से अधिक*

*अंतिम तिथि 31 जुलाई 2018*

*31 जुलाई 2018 के बाद पेनल्टी 1000*

*दिसम्बर 2018 के बाद पेनल्टी 10000*

*नोट:*

*(1)अपना आयकर रिटर्न A.Y. 2018 -19 का 31 जुलाई 2018 से पूर्व जमा कराए*

*(2) 31 जुलाई 2018 के बाद बिना पेनल्टी जमा किये आपका रिटर्न फ़ाइल ही नही होगा।*

*(3) A.Y. 2018-19 का आयकर रिटर्न 31 मार्च 2019 के बाद आप पेनल्टी के साथ भी फ़ाइल नही कर पाएंगे*

Hallo Sandeep Porwal, pl. give the definition in English also.

Respected P M RAJA Sir,

I have regularly read your comments and many times I have found your answers and comments incorrect, so plz kindly give the correct answer or write comment that "Wait for experts answer"

Here are many experts giving answer from their years of experiance and knowledge. I also request the experts that if you have found any reply or comments incorrect on this valuale platform, kindly do correct the comment and reply with your good knowledge.

Sorry if you heart from my comment.

Thanks

| Originally posted by : Raj Chitroda | ||

|

Respected P M RAJA Sir, - Okay... If incorrect then I'll change or Learn.... so plz kindly give the correct answer or write comment that "Wait for experts answer" - Why I write the Comment. If You are found incorrect or You have answer then Post the forum which is posted Here are many experts giving answer from their years of experiance and knowledge. - YES. Bcoz, They are experts and Give Answer also Discuss the Matter. I also request the experts that if you have found any reply or comments incorrect on this valuale platform, kindly do correct the comment and reply with your good knowledge. - Why You give request... Give answers or Discusion to the Forum... |

|

Dear Mr. Raj Chitroda.,

Thank You for Feed Back...

If You are found any mistakes from My replies and Discussions then You / Any of the members can Ban the replies. And Have Knowledge about that topics then Give solutions...

Also I'm Learning knowledge from CCI...

In case You have any Idea or Knowledge go to Reply the query and If You don't have Just see or read replies from Others if it's wrong or Right....!

Are you found mistakes then Notify the same forum or Prepare a new forum and Post the above comment or Complaint to CCI Admin...

| Originally posted by : RAJA P M | ||

|

Originally posted by : Raj Chitroda Respected P M RAJA Sir, I have regularly read your comments and many times I have found your answers and comments incorrect, - Okay... If incorrect then I'll change or Learn.... so plz kindly give the correct answer or write comment that "Wait for experts answer" - Why I write the Comment. If You are found incorrect or You have answer then Post the forum which is posted Here are many experts giving answer from their years of experiance and knowledge. - YES. Bcoz, They are experts and Give Answer also Discuss the Matter. I also request the experts that if you have found any reply or comments incorrect on this valuale platform, kindly do correct the comment and reply with your good knowledge. - Why You give request... Give answers or Discusion to the Forum... Sorry if you heart from my comment. - No... It's not a Heartiest Comment. It's just a BLETHER Thanks Dear Mr. Raj Chitroda., Thank You for Feed Back... If You are found any mistakes from My replies and Discussions then You / Any of the members can Ban the replies. And Have Knowledge about that topics then Give solutions... Also I'm Learning knowledge from CCI... In case You have any Idea or Knowledge go to Reply the query and If You don't have Just see or read replies from Others if it's wrong or Right....! Are you found mistakes then Notify the same forum or Prepare a new forum and Post the above comment or Complaint to CCI Admin... |

|

"Great minds discuss the IDEAS"

"Small minds discuss the EVENTS"

Read more at: https://www.caclubindia.com/profile.asp?member_id=89130

Sir This is just for information.. dont misunderstood me..

| Originally posted by : Raj Chitroda | ||

|

Sir This is just for information.. dont misunderstood me.. |  |

No need information for Individual Experimentals... Also it's myself... Go to Yourself and Prepare Yourself...

Once again I say, If You found mistakes then go to reply the same FORUM with correct solution with Your knowledge...

Don't be act as Small Minds...

Dear Sir..I know myself sir I know a few experts can give 100% reply but many time i seen that you reply either totally incorrect or not reach nearby 25%..so i commented dear sir be cool..this is plateform for sharing knowledge..if someone dont know the proper reply..then they should not comment or reply on this platform...

bahave professionally

otherwise u will boycott

this platform for solving the query not for arguements

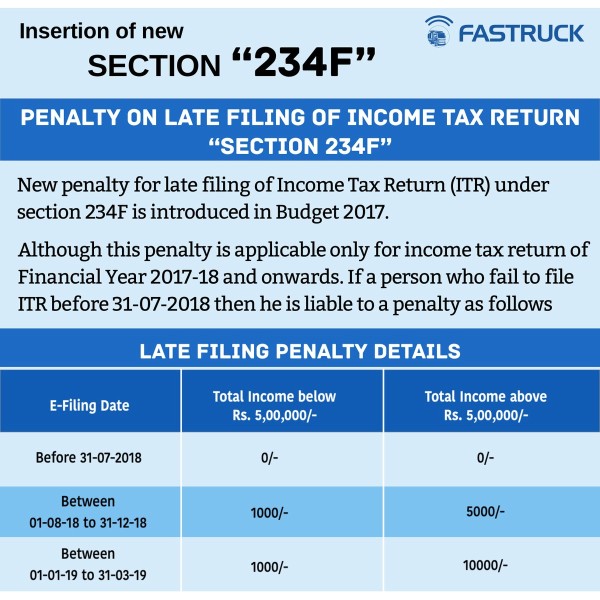

Insertion of new section 234F.

76. After section 234E of the Income-tax Act, the following section shall be inserted with effect from the 1st day of April, 2018, namely:—

"234F. Fees for default in furnishing return of income.—(1) Without prejudice to the provisions of this Act, where a person required to furnish a return of income under section 139, fails to do so within the time prescribed in sub-section (1) of said section, he shall pay, by way of fee, a sum of,—

| (a) | five thousand rupees, if the return is furnished on or before the 31st day of December of the assessment year; | |

| (b) | ten thousand rupees in any other case: |

Provided that if the total income of the person does not exceed five lakh rupees, the fee payable under this section shall not exceed one thousand rupees.

(2) The provisions of this section shall apply in respect of return of income required to be furnished for the assessment year commencing on or after the 1st day of April, 2018.".

| Originally posted by : Raj Chitroda | ||

|

Dear Sir..I know myself sir I know a few experts can give 100% reply but many time i seen that you reply either totally incorrect or not reach nearby 25%..so i commented dear sir be cool..this is plateform for sharing knowledge..if someone dont know the proper reply..then they should not comment or reply on this platform... |  |

Bro.,

i know my replies okay...

In case i replied incorrect @ 100%... But., where?

You will come to the wrong replied forum and remain or correct that forum you know...

If you dont have details where i replied wrong then pls be calm or quit here...

Leave a Reply

Your are not logged in . Please login to post replies

Click here to Login / Register

Recent Threads

- Planning of Ceased a Business i.e Closure of Compa

- Property value in 26QB

- Form 26QB Multiple Buyer/Multiple seller

- Company Formation for clothing business

- TDS on purchase 194Q

- Compensation for urban land acquisition

- Understanding section 269st

- CASH AS GIFT OR FD AS GIFT

- NPS Pre Maturity full exit taxation rules

- Planning to ceased a Business

Related Threads

CAclubindia

CAclubindia