Accounts Professional

356 Points

Joined January 2010

Yes, That's good job, but must be cleared that 'what do you means GIFT?'

The gift falls in any of the following five categories:-

• The gift does not fall in the exempted category. The five categories are as under:

• Any sum of money (gift in cash or by cheque or draft).

•Immovable property without consideration

• Immovable property for a consideration which is less than the stamp duty value

• Movable property without consideration

• Movable property for a consideration which is less than fair market value.

While calculating the above monetary limit of Rs. 50,000 in any of the five categories, any sum of money or property received from the following shall not be considered—

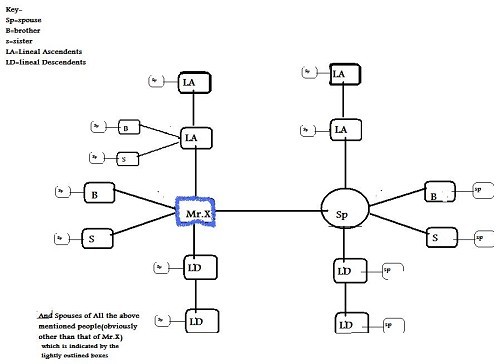

• Money/property received from a relative.

• Money/property received on the occasion of the marriage of the individual.

• Money/property received by way of will/inheritance.

• Money/property received in contemplation of death of the payer.

• Money/property received from a local authority.

• Money/property received from any fund, foundation, university, other educational institution, hospital, medical institution, any trust or institution referred to in section 10(23C ).

• Money received from a charitable institute registered under section 12AA

CAclubindia

CAclubindia