Menu

Penalties and FINE

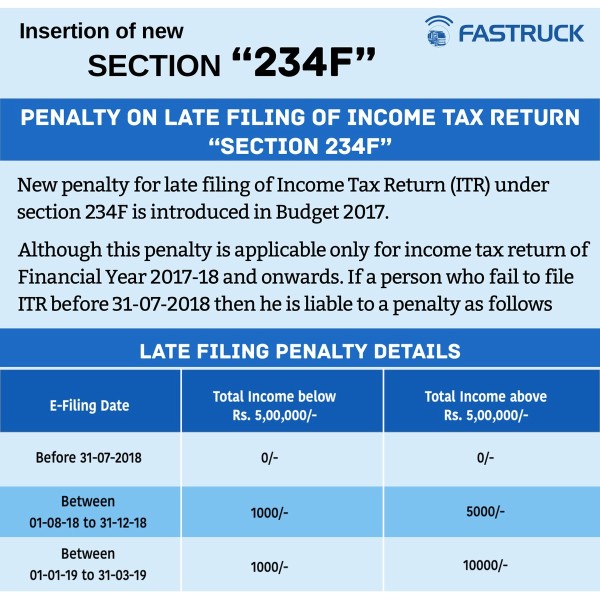

Is fine will be imposed If we file direct tax return with income below taxable after 31 st july?

Replies (5)

Recent Threads

- Planning of Ceased a Business i.e Closure of Compa

- Property value in 26QB

- Form 26QB Multiple Buyer/Multiple seller

- Company Formation for clothing business

- TDS on purchase 194Q

- Compensation for urban land acquisition

- Understanding section 269st

- CASH AS GIFT OR FD AS GIFT

- NPS Pre Maturity full exit taxation rules

- Planning to ceased a Business

Related Threads

CAclubindia

CAclubindia