Notice u/s 139(9) for return filed in ITR-3

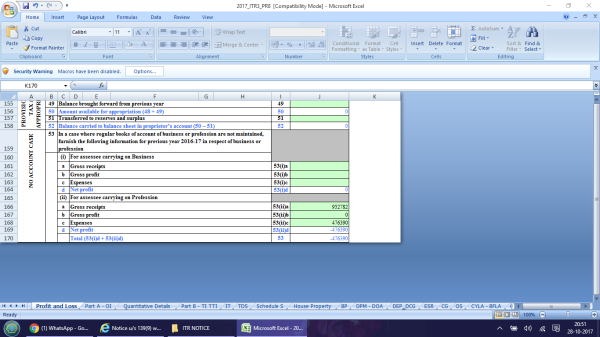

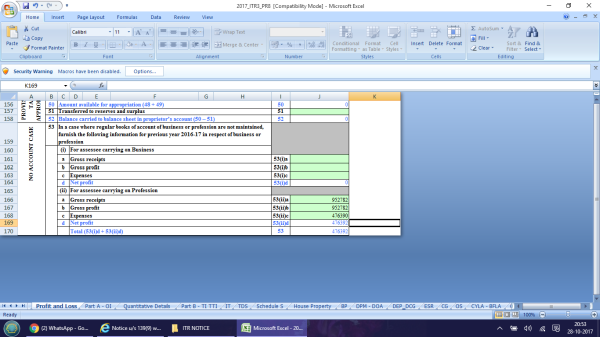

I have received a notice u/s 139(9) for my return filed in ITR-3 for AY 2017-18. Error code is 180, saying that "a) The Gross receipts is not mentioned in the Profit & Loss

A/c, OR b) The profit shown is less than 6% of the gross

receipts as prescribed u/s 44AD but has not mentioned the

maintenance of the books of accounts and audit report

u/s 44AB in Part A-General and the total income exceeds

the maximum amount not chargeable to income tax".

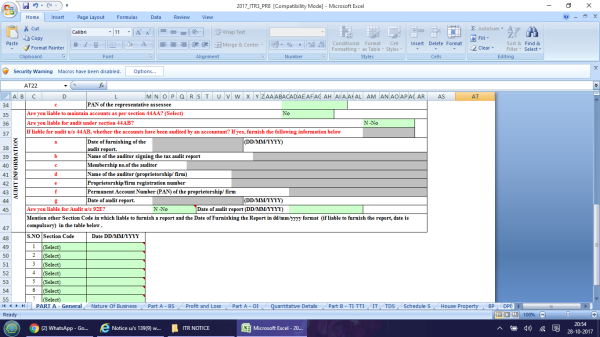

I filed my ITR u/s 44AD in ITR-3, so maintenance of the books of accounts(44AA) and audit report u/s 44AB were not required and these were selected as ‘NO’ in Part A-General. Business code mentioned was that for Trading.

Being compliant u/s 44AD Gross receipts (Rs 1035831) and net profit (Rs 318769) were provided under 53(i)a and 53(i)d respectively under NO ACCOUNT CASE in Part A-P & L. Gross receipt is well below the upper limit of 2 crore and profit shown is more than 30% as prescribed u/s 44AD.

In schedule BP, item A4 and A35i were used to convey it appropriately that business income needs to be considered u/s 44AD.

Last year, I submitted the return (in ITR-4) in exactly the same manner, which got duly processed.

Also, while trying to SUBMIT response to the notice in incometaxindiaefiling.gov.in, it says "No records found".

I would appreciate experts suggesting the resolution.

Thanks in advance!

Anil Kumar

CAclubindia

CAclubindia