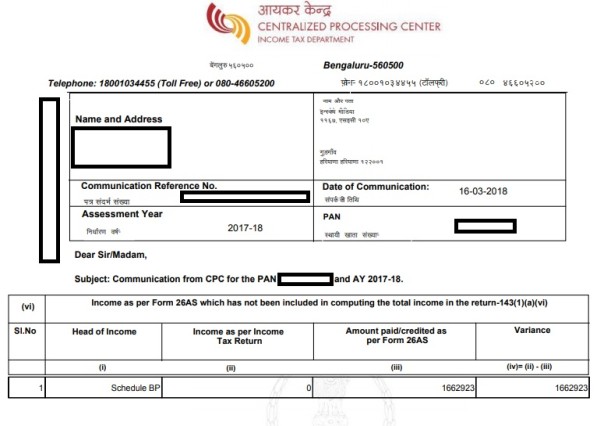

I've received Notice of adjustment(s) u/s 143(1)(a) for my Partnership firm's ITR-4 for assessment year 2017-2018. The noticed says that "Income Tax as per return is 0" while amount credited as per form 26as is 16,62,923. The difference is being taken as 16,62,923.

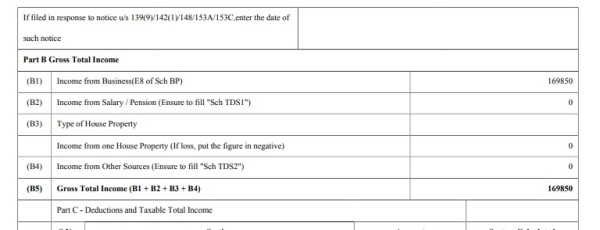

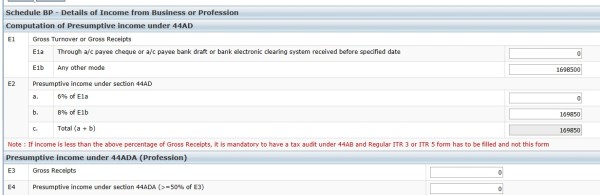

I've checked the filed ITR-4, it is under section 44ad. It mentions gross receipts of 1698500 (which is more than the 26as) and presumptive income as 169850 which is 10% of gross receipts (over 8%). The tax has been calculated as Rs 50,955 and there is a due refund.

So why is it saaying that the income tax as per return is 0. What should I do? I asked my CA who filed the return and he has no idea what this is.

Please help, what should be my course of action?

CAclubindia

CAclubindia