Hello,

I am posting the Notice which my wife has received from IT department.

My wife is a housewife and does not have any income.

I have made some investments in shares and mutual funds in her name from my source of income.

Whatever investments in Shares and Mutual Funds are they have never yield any returns and as there is no taxable income from any source so she has never filed any IT returns.

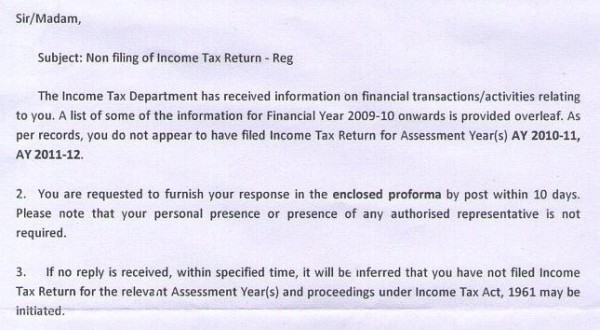

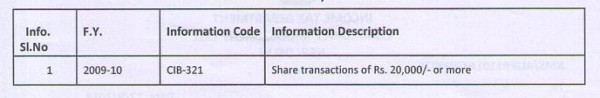

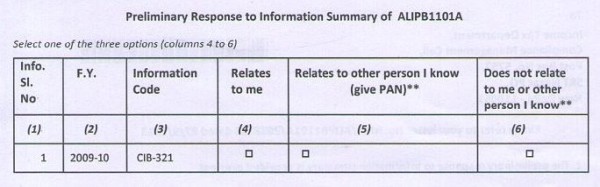

Now she has received a notice from IT Department (CIB - 321) stating that since there were transaction of shares for more than 20,000 in 2009-2010 and no income tax return has been filled for AY 2010-11, 2011-12, 2012-13.

Please advise - Is it a requirement for any individual to file IT return if he/she is making any investment in shares/mutual fund for more than 20,000/- in any given year?

The letter is dated 27th Sept and was received by us on 8th Oct. They have asked the reply within 10 days by post. Do not understand if the 10 days time given by them is from the date the letter was written by them, or 10 days time start from the time letter received by us? Please advise?

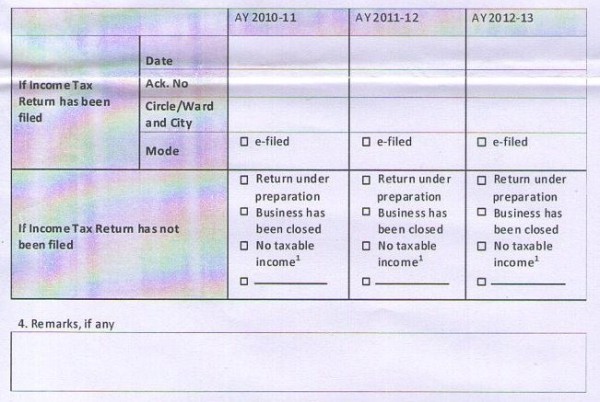

I am of the opinion that since she did not have any taxable income therefore no income tax returns were filed. And I am thinking of checking the check box for "No Taxable Income". Will this be a Prudent reply?

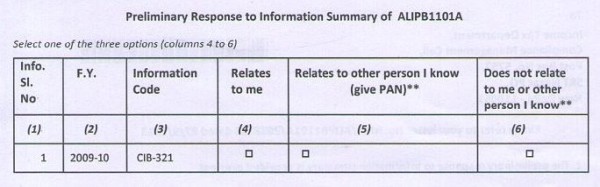

I am confused as what should be the answer here...... 4, 5 or 6.

.

As for me I am in Merchant Navy and I am maintaining NRI status. I receive my salary in NRI account from where I transfer money to my wife and children’s accounts.

As the salary which I receive is non taxable and other than that I don't have any source of income in India I also do not file any income tax returns.

Valuable feedback from experts on above scenario will be highly appreciated.

Thanks.

CAclubindia

CAclubindia