Creator: TheProTalks

2325 Points

Joined January 2016

The answer to this question will have two parts,

For 1st part: Can this be done, setting off Interest expense on Debentures issued and Interest Income on Loan issued to Mr. A. Yes it can be done and compliance part will not be hurt any of the below mentioned sections

- Section 186 Loan by Company mentions that Interest rate cannot be below a prescribed Govt, rate on equivalent tenure securities, it doesn't say about setting off is allowed or not

- Section 179 (3) also doesn't says on any prohibitoion to set off

- Similarly Section 71 read with rules framed under Companies (Share Capital and Debentures) Rules, 2014 also does not prohibit to set off

For 2nd part: Can this be shown in books of accounts/Financial statements including Notes to accounts?

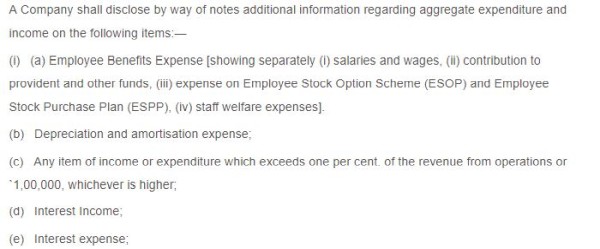

No, as true and fair approach is to be followed and as per the extract to notes to accounts given below, both should be shown separately

CAclubindia

CAclubindia