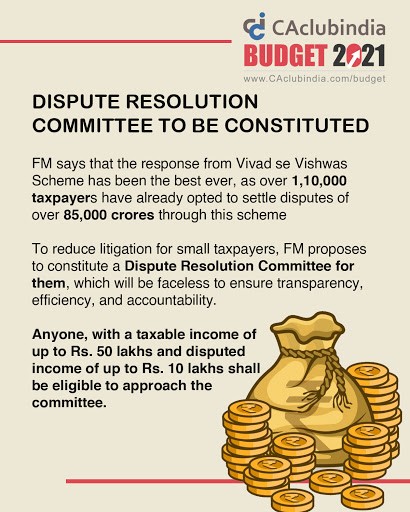

Furthermore, to reduce litigation for small taxpayers, FM proposes to constitute a Dispute Resolution Committee for them, which will be faceless to ensure transparency, efficiency, and accountability. Anyone, with a taxable income of up to Rs. 50 lakhs and disputed income of up to Rs. 10 lakhs shall be eligible to approach the committee #Budget2021

Menu

Live Updates and discussion on Union Budget 2021

Recent Threads

- Waste Management services

- Seeking Clarity: New Transport Allowance Limits (D

- Query regarding Consolidated Gift Deed for Bank Tr

- TDS u/s194IB - Joint Ownership

- Free GST Reconciliation Tool in Google Sheets R

- NRI return after due date refund case

- TDS u/s 194J - training honorarium

- WHERE TO REGISTER UNDER PTRC AND PTEC ACTS ?

- Key Corporate Compliance Requirements for Private

- Gst Non Filling Return Notice

Related Threads

CAclubindia

CAclubindia