Menu

Forum Search

Live updates and discussion budget 16

3833 views

105 replies

Excise duty on Tobacco products increased by 10-15%: FM

On 29 February 2016 at 12:52

Excise duty on Tobacco products increased by 10-15%: FM

On 29 February 2016 at 12:54

# Excise duty on most tobacco products raised by 10-15%.

On 29 February 2016 at 12:55

सेक्शन 87ए की छूट सीमा 2 लाख से बढ़कर 5 लाख हुई

On 29 February 2016 at 13:16

नई स्वास्थ्य रक्षा योजना शुरू होगी, प्रति परिवार 1 लाख का बीमा

On 29 February 2016 at 13:17

4 सरकारी जनरल बीमा कंपनियों के आईपीओ आएंगे

On 29 February 2016 at 13:17

रिटायरमेंट के समय एनपीए से 40 फीसदी निकासी पर टैक्स छूट

On 29 February 2016 at 13:17

what is current service tax inclusing Krishi kalyam cess?

is it 15% (14% ST + 0.5% Swatch Bharat Cess + 0.5% Krishi Kalyan Cess)

&

from when it wll be appliable?

On 29 February 2016 at 13:17

it's not lakh its thousand..![]()

On 29 February 2016 at 13:20

Krishi Kalyan cess from 1 st june

On 29 February 2016 at 13:24

| Originally posted by : Rajesh | ||

|

सेक्शन 87ए की छूट सीमा 2 लाख से बढ़कर 5 लाख हुई |  |

it's not lakh its thousand..

On 29 February 2016 at 13:36

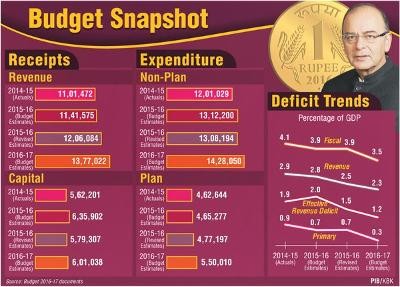

Union Budget 2016 Highlights.

1. Rs. 35984 crores allotted for agriculture sector.

2. Rs. 17000 crores for irrigation projects.

3. Two new Organic farming scheme for 5 lakh acres.

4. Rs. 19000 crores for Gram Sadak Yojana

5. Rs. 9 Lakh Crores Agriculture Credit Target.

6. Rs. 38500 crores for MANREGA, highest ever.

7. Rs. 2.87 Lakh crores to be spent on Villages in total.

8. Rs. 9000 crores for Swach Bharat Mission.

9. Rs. 97000 Crores for Roads.

10. Total Outlay on Roads and railway Rs. 2.18 Lk Crores.

11. Rs. 2.21 Lakh Crores on Infra Projects.

12. NHAI to raise Rs. 15000 crores via NHAI Bonds.

13. More benches for SEBI Appellate tribunal.

14. Registration of Company in One Day for Start-ups.

15. Rs. 25000 crores for Banks rehabilitation.

16. 100% FDI for food processing.

17. Non planned expenditure of Rs. 14.28 Lk Crores.

18. Planned expenditure increased by 15.3% .

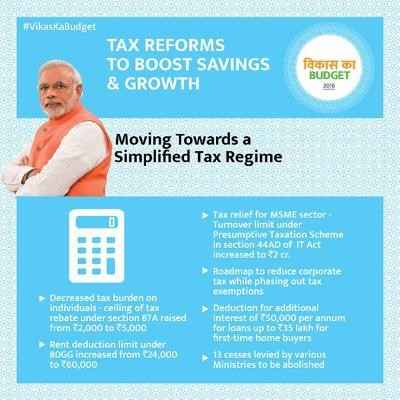

19. Relief Section 87A Rs. 2000 to Rs. 5000

20. Relief Sec 80GG Rs. 24000 to Rs. 60000

21. Section 44AD limits Rs. 1 crores to Rs. 2 crores. Rs. 50 Lakh for professional

22. Accelerated depreciation limited to 40%

23. New manufacturing companies will pay tax @ 25%.

24. LTCG on unlisted securities limited to 2 years.

25. 100% tax deduction for companies building houses upto 30 sq. mtrs.

26. Additional interest deduction for first house.

27. No service tax for building houses upto 60 sq mtrs.

28. 10% dividend tax for recipient over Rs. 10 lakh per annum.

29. TCS on purchase of asset over Rs. 2 Lakh in case and luxury cars.

30. VDS Scheme @ 30% + surcharge, Ist June to 30th September 2016.

31. Dispute resolution for appeal pending before Commissioner(Appeals).

32. Penalty for concealment of Income from 100-300% to 50-200%.

33. Rationalisation of TDS provisions.

34. 11 new benches for Income Tax Appellate tribunal.

35. No face to face scrutiny.

On 29 February 2016 at 13:39

CRISIL View: It's a rural- and poor-focussed, redistributive Budget, while adhering to fiscal prudence

On 29 February 2016 at 13:40

Summarize this with AI

Leave a Reply

Your are not logged in . Please login to post replies

Click here to Login / Register

Recent Threads

- International Tax clarification UK.

- E way bill expired penalty

- Best SME Focused AIF Funds in India for High Growt

- How does employee management software help in stat

- Clarification Required – Section 18 of Wage

- How to split freelance project income with a frien

- 194a for A y 2024-25

- Compensation & Benefits

- SAC code and GST rate transport services for anima

- Section 44AB is Gone — How Different is Tax

Related Threads

CAclubindia

CAclubindia