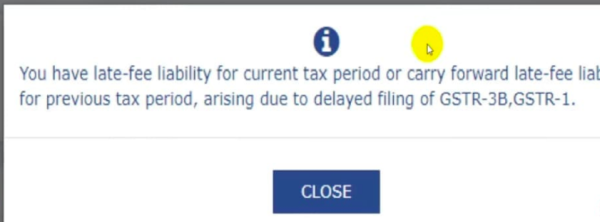

The due date to file GSTR1 was 11/02/19 and i filed it on 12/01/19 i.e. 1 day late. I am filing GSTR 3b on 12/02/19. Should i pay any late fee on GSTR1??

Menu

Late fee for gstr 1

Replies (7)

Recent Threads

- Company Formation for clothing business

- TDS on purchase 194Q

- Compensation for urban land acquisition

- Understanding section 269st

- CASH AS GIFT OR FD AS GIFT

- NPS Pre Maturity full exit taxation rules

- Planning to ceased a Business

- Taxation for sale and purchase of REIT shares

- PAN - AADHAR LINK

- RECONCILIATION OF GSTR 2B Vs BOOKS WITH VBA

Related Threads

allow to file GSTR1 after the due date.(latest development of GST portal)

allow to file GSTR1 after the due date.(latest development of GST portal)

CAclubindia

CAclubindia