Hello,

I have a small problem that my self assessment tax payment not counted in "As Computed under section 143(1)" instead it is reflected in "Unmatched Tax Payment Claims".

Actually during the ITR preparation, the ITR form calculated that "Amount Payable" = Rs. 1500.

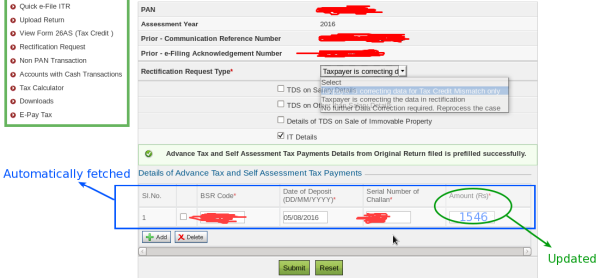

Hence I paid this amount as Self Assessment tax as Basic tax Rs. 1500 + Edu cess 46 = Total 1546.

and updated the ITR form so in IT section 18A with corresponding detail with Amount = Rs. 1500, then on recalculation in ITR tool, I got "Amount Payable" and "Refund" are Rs. 0.

And then I had filed the ITR.

Now I got 143(1) intimation from CPC that the self assessment tax that I paid is not actually counted in the system calculation, so there is a demand to pay for the same amount.

And also in that intimation, there is "Unmatched Tax Payment Claims - Advance tax and Self Assessment" with the amount that I paid as self assessment tax (ie. Amount Claimed = 1500).

I have verified that the Major head (21), Minor head (300), PAN card, BSR code, challan no., date of deposit and amount are all found correct. Even Form26AS shows the same.

Please let me know what is incorrect in this ITR form preparation or Self assessment payment. And how shall I proceed further to react to this 143(1) intimation.

PS. I think the issue is that I mistakenly filled the amount in IT section 18A. I should have entered the actualy total paid amount instead of just Basic tax amount. Please clarify.

Thanks

CAclubindia

CAclubindia