|

Coverage: |

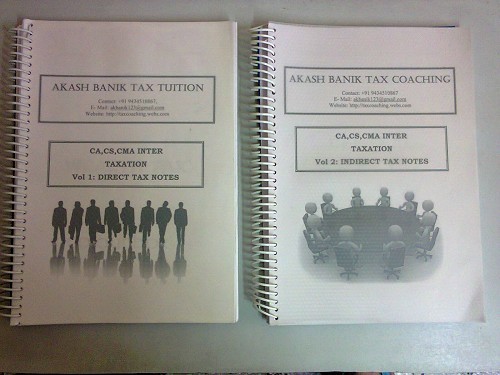

1. Basic Concepts of Indirect Taxation: a. Introduction. b. Central Excise Duty [Basic, Goods, Manufacture, Manufacturer, Collection of duty, Classification, Valuation – Rule 4A & Rule 4, SSI] c. Customs [Basic, Classification, Valuation] d. Central Sales Tax e. VAT 2. Basic Concept of Service tax 3. Point of Taxation 4. Valuation of taxable services 5. Exemption and abatements 6. Service Tax procedure 7. Cenvat Credit |

| Printed Mat? |

Yes. |

| Summarized / Detail? |

As per requirement of topic, discussion is made till the topic become digestible. |

| Coverage Type? |

Pure Concept and Testing of understanding via case studies + Theory Question cum answer + Important Practical Problems + Diagrams. |

| Nature of Mat? |

Handbook. |

|

Fees: |

Rs. 250/- [ Upto 31th July, 2014] Rs. 300/- [From 1st August to 15th August,2014] Rs. 400/- [16th August onwards, 2014] |

| No. of classes |

6 (Six). |

| Timing of class |

Morning / Day / Afternoon/ Evening |

|

Teacher Profile: |

Teacher: Akash Banik (CA Final). Contact: +91 9434510867 (Call + SMS + Watsapp) E Mail: akbanik123 @ gmail.com Face to Face. City: Kolkata (North) |

| Address |

P 42, Motijheel Avenue. Dumdum, Kolkata – 700074 West Bengal. |

CAclubindia

CAclubindia