Article Assistant

184 Points

Joined October 2011

hi chetan,

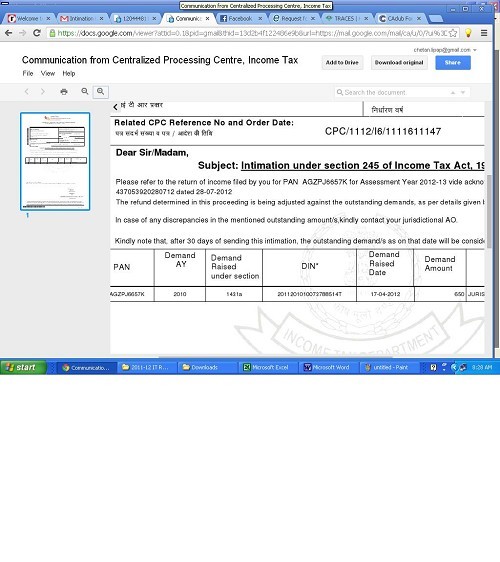

there are many cases when the intimation is send through post, if filled manually, so in your case the Local AO had sent you the intimation letter but may be misplaced, and also you cannot even find the cause of demand, they have given you time limit of 30 days so act as soon as possible.

*So in view of the above intimation from department we have jotted down some important points to be noted which can assist you in knowing about your demand and help you in solving the problem:

-

As the return for the relevant AY has been transferred to Local Assessing Officer, rectification cannot be processed online.

-

If you want to do a rectification against the outstanding demand you would have to contact your Local AO in your jurisdiction. You can check your jurisdiction online from the income tax department website i.e. www.incometaxindiaefiling.gov.in and click on “Know Your Jurisdiction”.

-

Please carry the necessary supporting documents including the intimation u/s 245 the rectification i.e. ITR Form, ITR Acknowledgement, Tax Computation, Details of Income and Tax Investments made, Form 26AS, etc.

-

A timeline of 30 days is given from the department. If no respond is made within this time limit, the refund for AY 12-13 will be considered for adjustment against outstanding demand.

-

If the outstanding demand amount for previous years are greater than the tax refund for FY 11-12 (AY 12-13), the balance demand will still reflect as outstanding demand for the relevant year. The refund for future years may further be adjusted with the balance outstanding amount.

*source:Taxmantra

CAclubindia

CAclubindia