Menu

Insurance on depoits bill in winter session

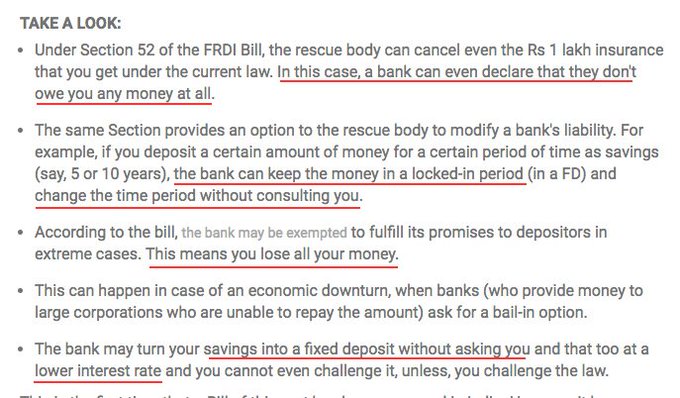

What is this Insurance on deposits bill to be laid in parliament in winter session?

Please explain.

Please explain.

Replies (1)

Recent Threads

- Eway bill generation for export material.

- International Tax clarification UK.

- E way bill expired penalty

- Best SME Focused AIF Funds in India for High Growt

- How does employee management software help in stat

- Clarification Required – Section 18 of Wage

- How to split freelance project income with a frien

- 194a for A y 2024-25

- Compensation & Benefits

- SAC code and GST rate transport services for anima

Related Threads

CAclubindia

CAclubindia