Income Tax Introduction

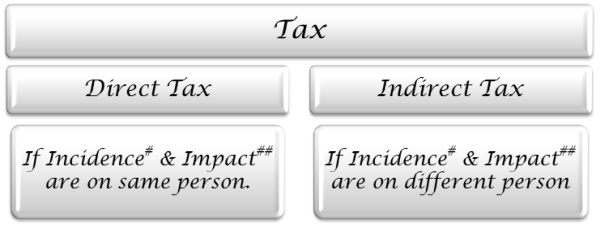

Tax is a compulsory payment made to government for services it provides us.

# Incidence: - Liability to pay Tax, ## Impact; - One who pays Tax

|

Authority

|

Direct Tax

|

Indirect Tax

|

||

|

Central Government

|

a.

|

Income Tax

|

a.

|

Excise Duty

|

|

b.

|

Wealth Tax

|

b.

|

Service Tax

|

|

|

State Government

|

a.

|

Income Tax on Agriculture

|

a.

|

Excise Duty on Liquor

|

|

b

|

Professional Tax

|

b.

|

Luxury Tax

|

|

|

Local Authority

|

a.

|

Municipal Tax

|

|

|

∂ Income-tax Act, 1961, extends to the whole of India; it came into force on the 1st day of April, 1962.

∂ Income is a return on investment monetary/ nonmonetary or significant/insignificant.

∂ Assessment [Sec 2(3)]

A Process of computing taxable income of assessee, Calculating tax on such taxable income, Imposing tax liability on assessee.

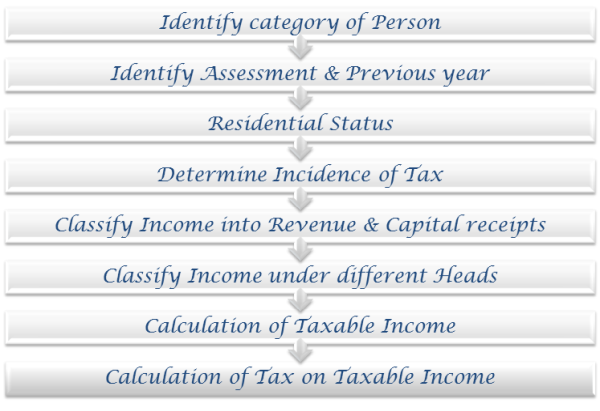

∂ Steps of Assessment

∂ Identify category of Person

The definition is inclusive i.e. a person includes,

(i) Individual- The term ‘individual’ means only a natural person, i.e., a human being. It includes both males and females. It also includes a minor or a person of unsound mind. But the assessment in such a case may be made under section 161(1) on the guardian or manager of the minor or lunatic. In the case of deceased person, assessment would be made on the legal representative.

(ii) HUF - "Hindu undivided family" has been defined under the Hindu Law as a family, which consists of all males lineally descended from a common ancestor and includes their wives and unmarried daughters.

A Hindu is born into a HUF. A male member continues to remain a member of the family until there is a partition of the family. After the partition, he becomes a member of another smaller family. A female member ceases to be a member of the HUF in which she was born, when she gets married. Thereafter, she becomes a member of the HUF of her husband.

Members of the HUF are called co-parceners. The head of the family (kartha) are called co-parceners.

(iii) Company- The expression ‘Company’ means:

(a) Any Indian company as defined in section 2(26); or

(b) Any corporate incorporated by or under the laws of a country outside India, i.e., any foreign company

(c) Any institution, association or body which is assessable or was assessed as a company for any assessment year under the Indian Income-tax Act, 1922 or for any assessment year commencing on or before 1.4.1970 under the present Act

(d) Any institution, association or body, whether incorporated or not and whether Indian or non-Indian, which is declared by a general or special order of the CBDT to be a company for such assessment years as may be specified in the CBDT’s order

(iv) Firm- A partnership is the relation between persons who have agreed to share the profits of business carried on by all or any of them acting for all. The persons who have entered into partnership with one another are called individually ‘partners’ and collectively a ‘firm’.

(v) Association of Persons (AOP)- When persons combine together for promotion of joint enterprise they are assessable as an AOP. In order to constitute an association, persons must join in a common purpose; common action and their object must be to produce income.

Body of Individuals (BOI)– It denotes the status of persons like executors or trustees who merely receive the income jointly and who may be assessable in like manner and to the same extent as the beneficiaries individually. Thus co-executors or co-trustees are assessable as a BOI.

(vi) Local Authority- The term means a municipal committee, district board, and body of port commissioners or other authority legally entitled to or entrusted by the Government with the control or management of a municipal or local fund.

(vii) Artificial Persons- This category could cover every artificial juridical person not falling under other heads. An idol or deity would be assessable in the status of an artificial juridical person

∂ Identify Assessment & Previous year

Assessment Year [Sec 2(9)]– It’s a period of 12 months commencing from 1st April of each year & ending on 31st March of following year. It’s a period during which assessee income of previous year is assessed.

Previous Year [Sec 3] - It’s a period of 12 months commencing from 1st April of each year & ending on 31st March of following year immediately preceding assessment year. It’s a period during which income is earned by assessee.

Income earned in one year will be assessed in immediate next year.

The following are situation where income of previous year is assessed in same previous year

(a) Income of Non Resident from shipping.

(b) Income of a person leaving India permanently or for a long period.

(c) Income of bodies formed for short period.

(d) Income of a person trying to alienate his asset with a view of avoiding tax.

(e) Income from discontinued business.

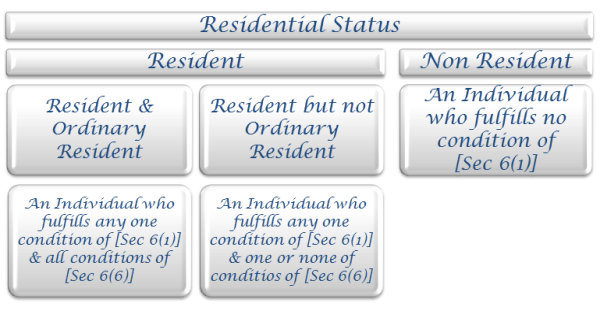

∂ Residential Status

(a) Condition of [Sec 6(1)]

i. An individual must be in India for atleast 182 days during previous year.

Or

ii. An individual must be in India for at least 365 days during 4 years.

And

Atleast 60 days during previous years.

The following are exemption for condition of [Sec 6(1)] ii

a. An Indian citizen leaving India for employment.

b. An Indian citizen leaving India as a crew member.

c. A person of Indian origin @ coming on a visit.

@ A personis deemed to beof Indian origin if he or either of his parents or any of his grandparents was born in Undivided India.

(b) Conditions of [Sec 6(6)]

i. An Individual must be a resident in India for atleast 2 out of 10 previous years immediately preceding previous years.

And

ii. An Individual must be in India for atleast 730 days during 7 previous years preceding previous year.

∂ Determine Incidence of Tax

Identifying the incomes which can be considered for computing Taxable Income

|

Types of Income

|

Resident

|

Non Resident

|

||

|

Ordinary

|

Not Ordinary

|

|||

|

1.

|

Indian Income

|

Yes

|

Yes

|

Yes

|

|

2.

|

Foreign Income

|

|

|

|

|

a.

|

Business/Profession situated overseas but controlled from India

|

Yes

|

Yes

|

No

|

|

b.

|

Business/Profession situated overseas but controlled from outside India

|

Yes

|

No

|

No

|

|

c.

|

Other Income

|

Yes

|

No

|

No

|

∂ Classify Income into Revenue & Capital receipts

Revenue receipts are receipts from a source; Capital receipts are receipts in lieu of source.

Golden Rule

“All Revenue receipts are taxable unless specifically exempt; All Capital receipts are exempt unless specifically taxable”

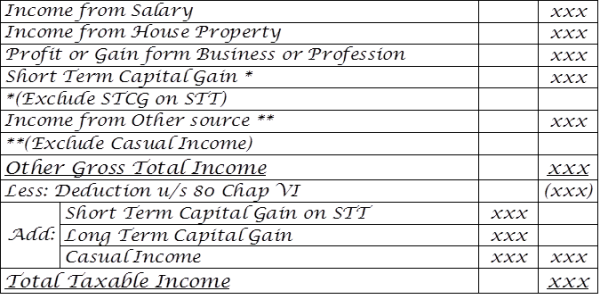

∂ Classify Income under different Heads

(a) Income from Salary

(b) Income from House Property

(c) Profit or Gain form Business or Profession

(d) Capital Gain

(e) Income from Other source

∂ Calculation of Taxable Income

# Total Taxable Income subject to Clubbing of Income & Carry forward of Losses; Total Taxable Income must be rounded off to nearest multiple of Ten.

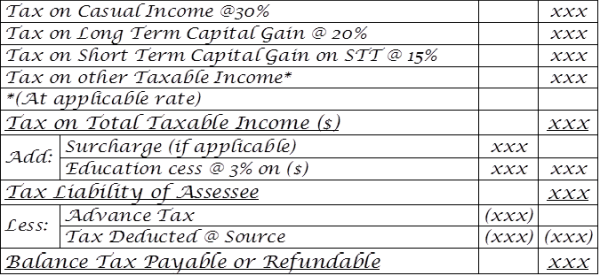

∂ Calculation of Tax on Taxable Income

CAclubindia

CAclubindia