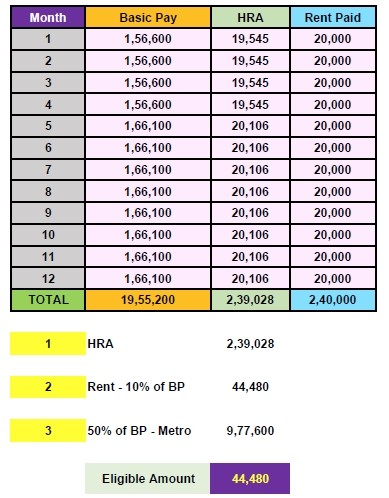

I had produced a rent receipt of Rs. 20000 per month for consideration of exemption of HRA for the calculation of Income tax.

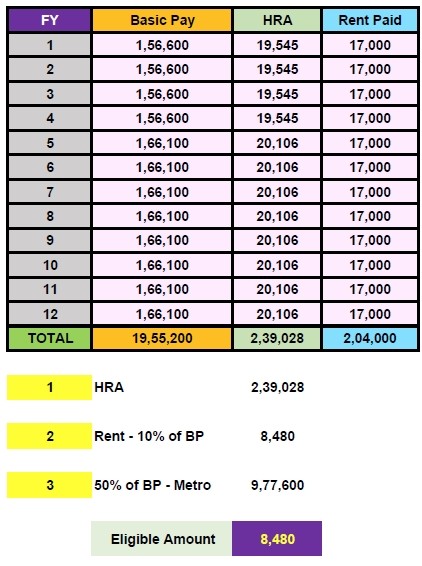

My employer has considered only 17000 as monthly rent. Hence, the amount indicated for the purpose of exemption of Income Tax is only 8400 against 44,480. Form 16 for the financial year provided by the employer also shows 8,480 against actual eligible exemption amount of 44,480.

Can I get the amount refunded while e-filing Income Tax Return? How will the disparity between Form 26AS and Form 16 be rectified in such a case for the financial year?

CAclubindia

CAclubindia