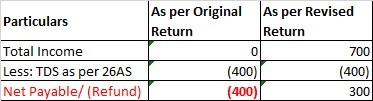

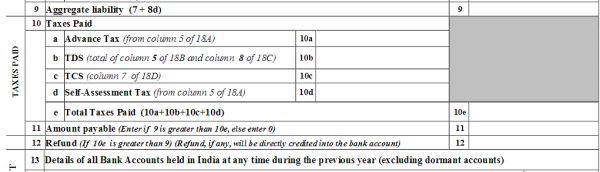

if in original return refund has been claimed and received in assessee,' account and there is some other amount to b reported in revised return on the basis of which there is tax liability than is there liability to pay refund received earlier in original return ,? how to show it in revised return?

Menu

How to show refund to be deposit in revised return

Replies (11)

Recent Threads

- International Tax clarification UK.

- E way bill expired penalty

- Best SME Focused AIF Funds in India for High Growt

- How does employee management software help in stat

- Clarification Required – Section 18 of Wage

- How to split freelance project income with a frien

- 194a for A y 2024-25

- Compensation & Benefits

- SAC code and GST rate transport services for anima

- Section 44AB is Gone — How Different is Tax

Related Threads

CAclubindia

CAclubindia