Dear All,

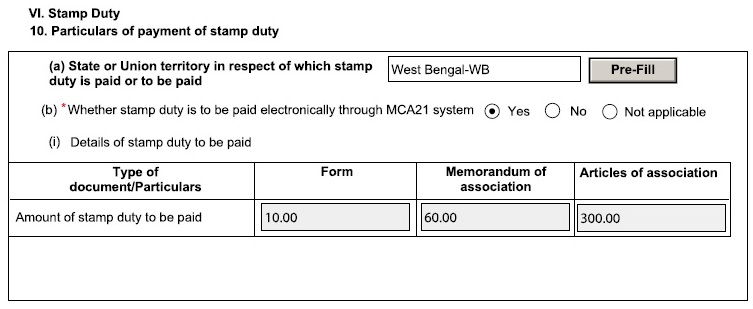

My company was incorporated one month ago. As we know share certificates is to be issued within 60 days from the date of incorporation to the Equity shareholders or subscribers of MOA and AOA. In my new company, Director1 and Director2 are the two equity shareholders 75000 and 25000 respectively total 1 lakh Share Capital of INR 1 each. The following stamp duty paid during filing of incorporation form spice32.

My question is

Q1) Is above stamp duty payment means the STAMP DUTY of the Share Capital is paid during incorporation of the company.

Q2) If not paid, how to pay STAMP DUTY? Where should I visit?

Registered office of the company is at BURDWAN, WEST BENGAL.

KINDLY HELP

CAclubindia

CAclubindia