Dear Experts.,

All of You good evening and Very thankful for Taxation Related Supporting to All...

Recently changed the GST filing options especially GSTR 1....!

The GSTR 1 filing is monthly return to Turn Over Above Rs. 1.5 crores dealers.

They ll be file monthly for GSTR 1.

But,

The same GSTR 1 return is Quarterly basis to Turn Over Less then Rs. 1.5 crores dealers...!!!

In 22nd GST council meeting 6th October 2017 - point no .5 they declared as following

"5. To facilitate the ease of payment and return filing for small and medium businesses with annual aggregate turnover up to Rs. 1.5 crores, it has been decided that such taxpayers shall be required to file quarterly returns in FORM GSTR-1,2 & 3 and pay taxes only on a quarterly basis, starting from the third quarter of this financial year i.e. October-December, 2017"

After 35 days they ll meet once again as "23rd GST council Meeting" on 10th November 2017 and declared as following

(a)Taxpayers with annual aggregate turnover upto Rs. 1.5 crore need to file GSTR-1 on quarterly basis as per following frequency: Periods "Jul- Sep - 31st Dec 2017" "Oct- Dec- 15th Feb 2018" "Jan- Mar 30th April 2018"

Here a "BIG COMEDY" the JULY-2017 GSTR 1 Filed By many more Taxpayers...

No more clarity for filing GSTR 1 for the Quarter of "JULY - SEPTEMBER".

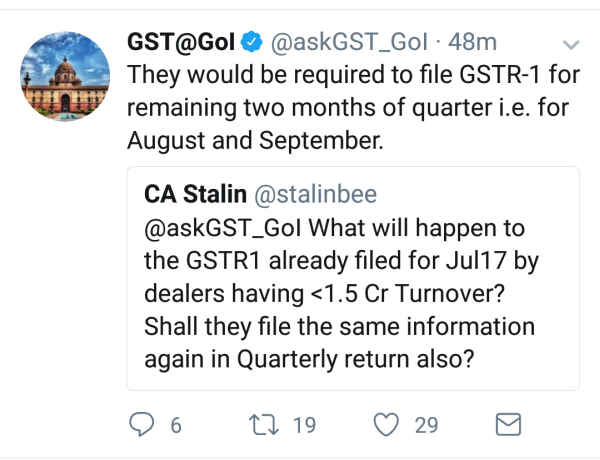

I also ask it to CBEC help desk, in Twitter @ askGST_GoI & @ askGSTech. No replies there. Bcoz, they are not aware...

Also they are not ready to construct first monthly (Jul-Sep) and next Quarterly.

Bcoz, It's risky and they can't try to confirm. So they ll simply said file Quarterly.

Then What is the Solution for already filed GSTR 1 for July...

How to file GSTR 1 for "July-September"...?

Already filed July returns then ll be file It's include or Exclude...

Please give your Valuable Comments & Suggesstions with reasonable...!!!

Thanks & Regards

RAJA P M

CAclubindia

CAclubindia